Region:Middle East

Author(s):Dev

Product Code:KRAB1926

Pages:87

Published On:January 2026

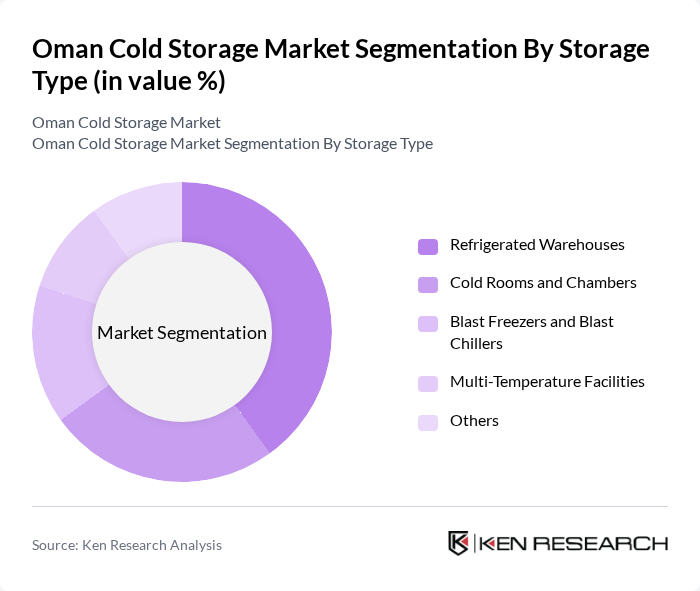

By Storage Type:The storage type segmentation includes various subsegments such as Refrigerated Warehouses, Cold Rooms and Chambers, Blast Freezers and Blast Chillers, Multi-Temperature Facilities, and Others. Refrigerated Warehouses represent the core of formal cold storage capacity in Oman and the GCC, as they are extensively used for storing a wide range of perishable goods including fruits, vegetables, meat, seafood, and dairy products, and for supporting import, re?export, and domestic distribution. The growing demand for efficient storage solutions from modern retail, foodservice, and FMCG sectors, along with increased attention to food safety and shelf?life extension, has led to higher investment in large, multi?user refrigerated warehouses, making them a critical component of the cold storage market.

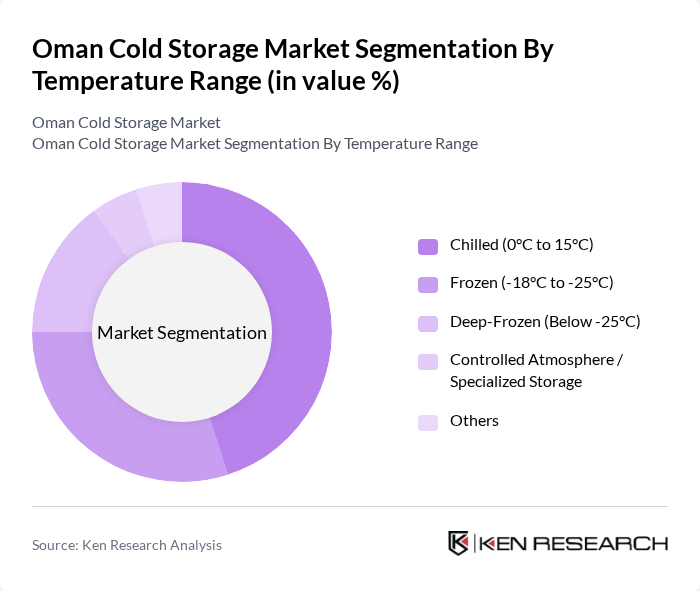

By Temperature Range:The temperature range segmentation includes Chilled (0°C to 15°C), Frozen (-18°C to -25°C), Deep-Frozen (Below -25°C), Controlled Atmosphere / Specialized Storage, and Others. The Chilled segment is leading the market due to the increasing demand for fresh produce, dairy, and other short?shelf?life products that require controlled temperatures above freezing to maintain quality and nutritional value. The trend towards healthier eating habits, growth of organized grocery retail and foodservice, and the rising share of fresh and ready?to?cook items are driving the need for chilled storage solutions, while specialized and controlled?atmosphere facilities are gaining relevance for high?value commodities and pharmaceuticals, making temperature?specific infrastructure a key feature of the cold storage market.

The Oman Cold Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Cold Storage & Logistics, Al Jazeera Cold Storage, Muscat Cold Store, Gulf Cold Stores & Ice Plant, Al Khamis Cold Stores, Oman Food Investment Holding Company, Al Madina Logistics Services, Khimji Ramdas Logistics, A’Saffa Foods, Salalah Port Services (Cold Storage Facilities), Sohar Port and Freezone (Cold Storage Facilities), Al Fair Supermarkets (In-house Cold Storage), Lulu Group International – Oman Operations (Cold Chain), National Foodstuff Company (NFPC Oman), and other emerging local cold storage operators contribute to innovation, geographic expansion, and service delivery in this space.

The Oman cold storage market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of IoT and AI technologies is expected to enhance operational efficiency and inventory management, while the shift towards sustainable practices will likely reshape facility designs. As e-commerce food delivery services expand, the demand for reliable cold storage solutions will increase, creating new avenues for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Storage Type | Refrigerated Warehouses Cold Rooms and Chambers Blast Freezers and Blast Chillers Multi-Temperature Facilities Others |

| By Temperature Range | Chilled (0°C to 15°C) Frozen (-18°C to -25°C) Deep-Frozen (Below -25°C) Controlled Atmosphere / Specialized Storage Others |

| By Service Type | Cold Storage Services Temperature-Controlled Transportation Value-Added Services (Sorting, Packaging, Labelling) Inventory Management and 3PL Services Others |

| By Application | Fruits and Vegetables Dairy Products Meat and Seafood Bakery, Confectionery and Processed Food Pharmaceuticals and Healthcare Products Others |

| By End-User | Food Retailers (Supermarkets, Hypermarkets) Food Manufacturers and Processors Distributors and Wholesalers Restaurants, Hotels and Catering (HoReCa) Pharmaceutical and Healthcare Companies Others |

| By Ownership / Entity | Logistics-Owned Facilities Third-Party Logistics (3PL) Providers Manufacturer / Retailer-Owned Facilities Joint Ventures and Public-Private Partnerships Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Cold Storage Facilities | 60 | Farm Managers, Cold Chain Operators |

| Pharmaceutical Cold Chain Management | 50 | Logistics Coordinators, Quality Assurance Managers |

| Retail Cold Storage Solutions | 55 | Supply Chain Managers, Store Operations Directors |

| Food Processing Cold Storage | 45 | Production Managers, Facility Supervisors |

| Logistics and Distribution Cold Storage | 50 | Warehouse Managers, Distribution Center Supervisors |

The Oman Cold Storage Market is valued at approximately USD 180 million, reflecting its significant role within the broader cold chain and dairy market in Oman, which is estimated at around USD 1.2 billion.