Region:Asia

Author(s):Shubham

Product Code:KRAA8498

Pages:97

Published On:November 2025

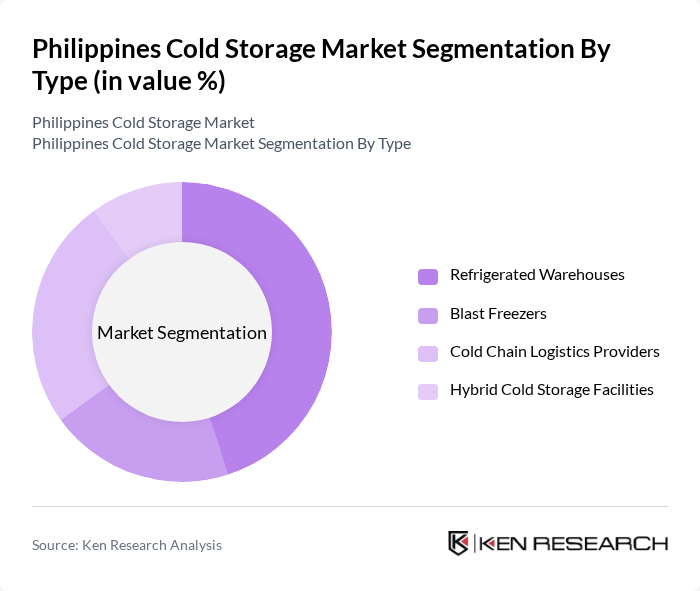

By Type:The cold storage market can be segmented into four main types: Refrigerated Warehouses, Blast Freezers, Cold Chain Logistics Providers, and Hybrid Cold Storage Facilities. Among these, Refrigerated Warehouses dominate the market due to their extensive use in storing perishable goods, driven by the growing food and beverage industry. The demand for efficient storage solutions has led to an increase in the establishment of these facilities, which are essential for maintaining the quality and safety of food products. Hybrid facilities are also expanding, supported by government initiatives to build energy-efficient, renewable-powered cold storage in agricultural regions.

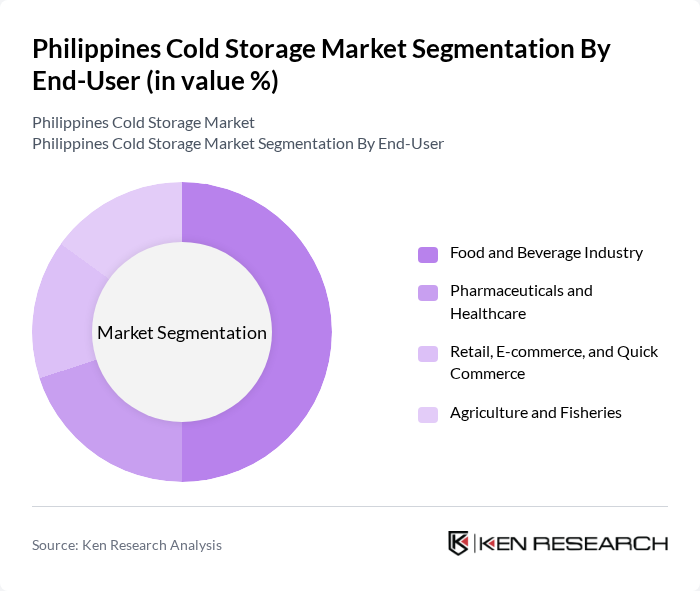

By End-User:The end-user segmentation includes the Food and Beverage Industry, Pharmaceuticals and Healthcare, Retail, E-commerce, and Quick Commerce, and Agriculture and Fisheries. The Food and Beverage Industry is the leading segment, driven by the increasing demand for fresh and frozen products. The rise of e-commerce has also contributed to the growth of cold storage facilities, as online grocery shopping necessitates efficient storage and distribution of perishable goods. Pharmaceuticals and healthcare are expanding rapidly due to increased demand for vaccine and biopharmaceutical storage.

The Philippines Cold Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jentec Storage Inc., Glacier Megafridge Inc., Royal Cargo Inc., Big Blue Logistics Corporation, Mets Logistics, Inc., Royal Cold Storage (I Squared Capital), Cold Chain Solutions, Inc., Prime Cold Storage, Manila Cold Storage, Aboitiz InfraCapital, San Miguel Foods, Universal Robina Corporation, Del Monte Philippines, Inc., Purefoods Hormel Company, Inc., Cargill Philippines, Inc., AgriNurture, Inc., Fresh Express Delivery Inc., Philippine Cold Storage Corporation, Food Terminal, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold storage market in the Philippines appears promising, driven by technological advancements and increasing consumer demand for quality food products. As the government continues to invest in infrastructure improvements, particularly in rural areas, the market is expected to see enhanced operational efficiencies. Additionally, the integration of IoT technologies for real-time monitoring will likely become standard, further optimizing storage conditions and reducing waste, thus supporting sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Warehouses Blast Freezers Cold Chain Logistics Providers Hybrid Cold Storage Facilities |

| By End-User | Food and Beverage Industry Pharmaceuticals and Healthcare Retail, E-commerce, and Quick Commerce Agriculture and Fisheries |

| By Product Type | Meat and Seafood Dairy Products Fruits and Vegetables Ready-to-Eat Meals and Processed Foods |

| By Storage Capacity | Small Scale (Less than 5,000 tons) Medium Scale (5,000–20,000 tons) Large Scale (More than 20,000 tons) Mega Facilities (More than 50,000 tons) |

| By Technology | Conventional Refrigeration Advanced Refrigeration Technologies (e.g., ammonia-based, CO? systems) Automated Cold Storage Systems (ASRS, WMS, IoT-enabled) Energy-Efficient and Sustainable Solutions |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Incentives Grants for Infrastructure Development Compliance with International Food Safety Standards |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Storage | 100 | Operations Managers, Supply Chain Directors |

| Pharmaceutical Cold Chain Management | 60 | Quality Assurance Managers, Logistics Coordinators |

| Retail Cold Storage Solutions | 50 | Store Managers, Inventory Control Specialists |

| Cold Storage Technology Providers | 40 | Product Development Managers, Sales Executives |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

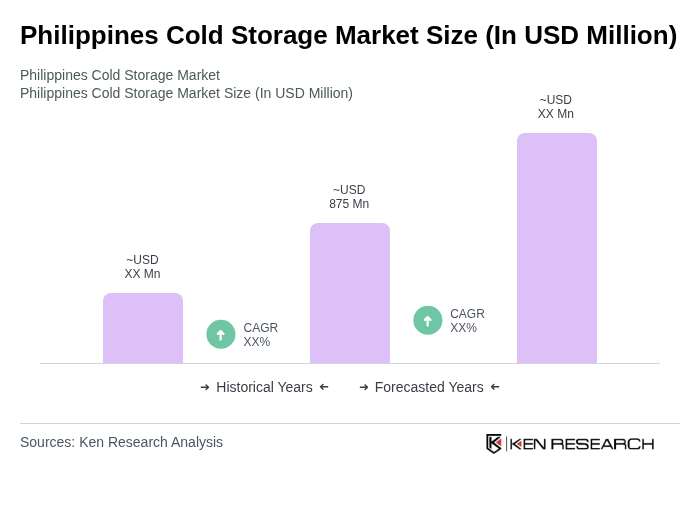

The Philippines Cold Storage Market is valued at approximately USD 875 million, driven by the increasing demand for efficient food storage solutions, the expansion of the food and beverage sector, and the growth of e-commerce and online grocery shopping.