Region:Middle East

Author(s):Shubham

Product Code:KRAD0808

Pages:99

Published On:August 2025

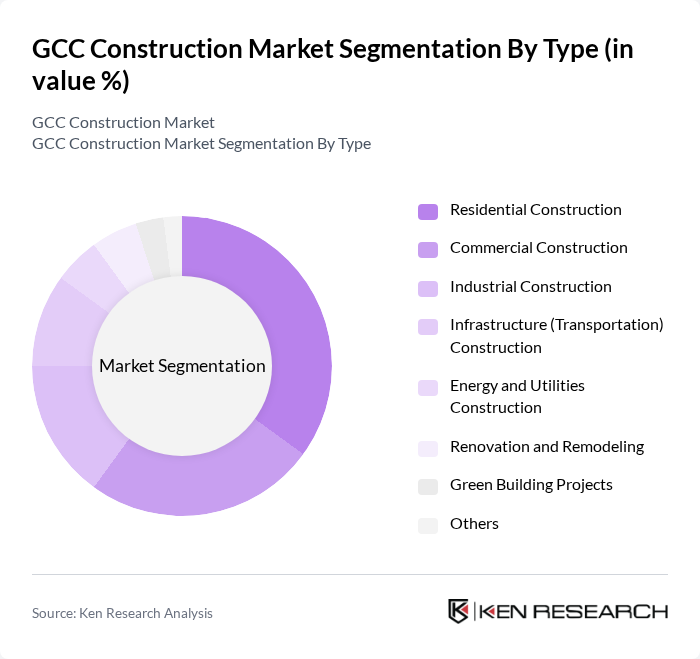

By Type:The construction market is segmented into Residential Construction, Commercial Construction, Industrial Construction, Infrastructure (Transportation) Construction, Energy and Utilities Construction, Renovation and Remodeling, Green Building Projects, and Others.Residential Constructionremains the leading segment, propelled by population growth, urban migration, and strong demand for affordable and luxury housing.Green Building Projectsare gaining momentum, reflecting increased regulatory support and consumer preference for sustainable living environments. The adoption of modular construction, digital project management, and energy-efficient materials is transforming traditional practices across all segments .

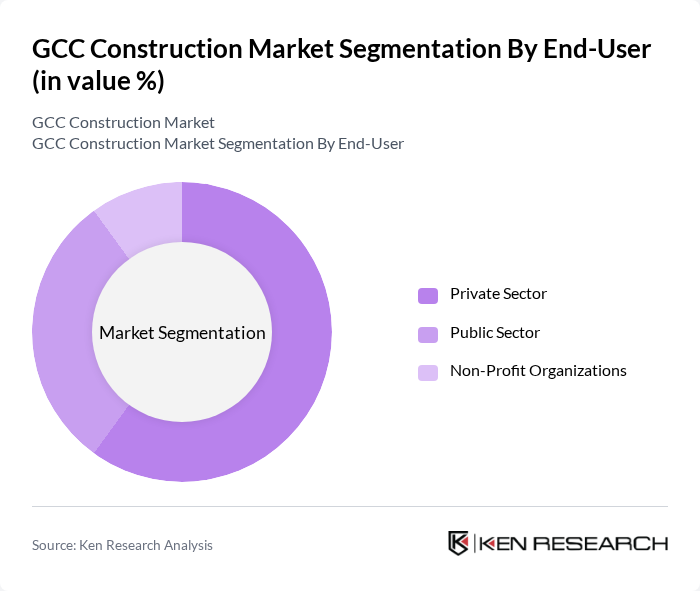

By End-User:The market is segmented by end-users into Private Sector, Public Sector, and Non-Profit Organizations. ThePrivate Sectoris the dominant end-user, driven by rising private investments in residential, commercial, and mixed-use developments. ThePublic Sectorcontinues to play a pivotal role through large-scale infrastructure and utility projects, whileNon-Profit Organizationsfocus on community and social infrastructure. The increasing role of public-private partnerships (PPPs) is further shaping end-user dynamics .

The GCC Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arabtec Holding PJSC, ACCIONA, Saudi Binladin Group, El Seif Engineering Contracting Company, Al Habtoor Group, Strabag SE, China State Construction Engineering Corporation, Larsen & Toubro Limited, National Projects & Construction LLC, KEO International Consultants, Hill International, Turner Construction Company, Al-Futtaim Group, Bouygues Construction, Vinci Construction, Nesma & Partners Contracting Co. Ltd., ALEC Engineering and Contracting LLC, Khansaheb Civil Engineering LLC, Almabani General Contractors, ASGC Construction, and Albawani Group contribute to innovation, geographic expansion, and service delivery in this space .

The GCC construction market is poised for significant transformation, driven by technological advancements and a focus on sustainability. As governments prioritize green building practices, the adoption of eco-friendly materials and energy-efficient designs will become standard. Additionally, the integration of digital tools in project management will enhance efficiency and reduce costs. With ongoing investments in infrastructure and a commitment to economic diversification, the region is expected to witness a robust construction landscape that supports long-term growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Construction Commercial Construction Industrial Construction Infrastructure (Transportation) Construction Energy and Utilities Construction Renovation and Remodeling Green Building Projects Others |

| By End-User | Private Sector Public Sector Non-Profit Organizations |

| By Application | Residential Buildings Commercial Spaces Infrastructure Development Industrial Facilities Energy and Utility Facilities |

| By Investment Source | Government Funding Private Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| By Construction Method | Traditional Construction Modular Construction Design-Build |

| By Policy Support | Subsidies for Green Initiatives Tax Incentives for Developers Regulatory Support for Innovation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Supervisors |

| Commercial Building Developments | 80 | Architects, Construction Executives |

| Infrastructure Projects (Roads, Bridges) | 60 | Civil Engineers, Government Officials |

| Construction Material Suppliers | 50 | Sales Managers, Product Line Directors |

| Construction Equipment Rental Services | 40 | Operations Managers, Fleet Supervisors |

The GCC Construction Market is valued at approximately USD 147 billion, driven by rapid urbanization, government infrastructure investments, and a growing population. This valuation reflects a comprehensive analysis over the past five years, highlighting the sector's robust growth potential.