Region:Global

Author(s):Rebecca

Product Code:KRAB4752

Pages:89

Published On:October 2025

By Type:The market is segmented into various types of training programs that cater to different learning needs and preferences. Technical training is driving significant market growth as it enables organizations to increase efficiency and adapt to technological changes. The subsegments include Online Training, In-Person Workshops, Blended Learning Programs, Technical Training, Leadership & Management Development, Compliance Training, Soft Skills Training, Sales & Customer Service Training, and Others. Each of these subsegments plays a crucial role in addressing specific skill gaps and enhancing workforce capabilities, with instructor-led training emerging as the most lucrative segment.

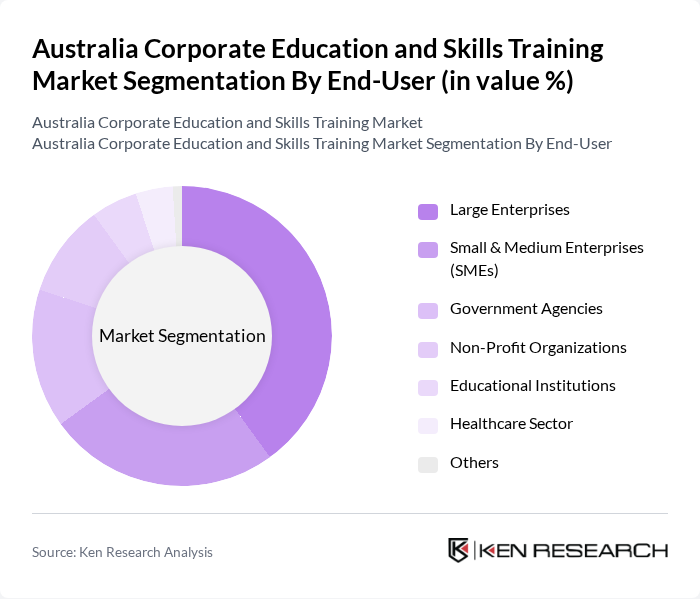

By End-User:The end-user segmentation includes Large Enterprises, Small & Medium Enterprises (SMEs), Government Agencies, Non-Profit Organizations, Educational Institutions, Healthcare Sector, and Others. Each end-user category has distinct training needs, with large enterprises often investing heavily in comprehensive training programs to maintain a competitive edge, while SMEs may focus on cost-effective solutions. Customer management training services are experiencing particularly strong growth at 7.2%, while on-site deployment models also show robust expansion at 7.2%.

The Australia Corporate Education and Skills Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as TAFE Queensland, Upskilled, Open Colleges, Australian Institute of Management (AIM), Learning Tree International, Navitas, Pearson Australia, SEEK Learning, RMIT Online, Coursera Australia, The Dream Collective, DDLS Australia, Academy of Information Technology, Australian College of Applied Psychology, and The University of Sydney contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and skills training market in Australia appears promising, driven by ongoing technological advancements and a strong emphasis on workforce development. As organizations increasingly adopt blended learning models, the integration of digital and in-person training will become more prevalent. Additionally, the focus on soft skills training is expected to grow, addressing the evolving needs of employers seeking well-rounded employees capable of navigating complex work environments effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Training In-Person Workshops Blended Learning Programs Technical Training Leadership & Management Development Compliance Training Soft Skills Training Sales & Customer Service Training Others |

| By End-User | Large Enterprises Small & Medium Enterprises (SMEs) Government Agencies Non-Profit Organizations Educational Institutions Healthcare Sector Others |

| By Delivery Mode | Virtual Classrooms On-Site Training Mobile Learning E-Learning Platforms Blended Learning Others |

| By Industry Focus | Information Technology (IT & ITES) Finance and Banking (BFSI) Manufacturing Retail & FMCG Healthcare & Life Sciences Hospitality & Tourism Telecom Others |

| By Training Duration | Short Courses (1-3 days) Medium Courses (1-4 weeks) Long Courses (1-6 months) Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Industry-Specific Certifications Micro-Credentials Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Freemium/Trial Access Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 100 | Training Managers, Learning and Development Directors |

| Skills Development Initiatives | 80 | HR Managers, Organizational Development Specialists |

| Online Learning Platforms | 60 | eLearning Coordinators, IT Training Managers |

| Industry-Specific Training Needs | 50 | Sector-Specific Training Coordinators, Compliance Officers |

| Employee Feedback on Training Effectiveness | 70 | Employees across various levels, Team Leaders |

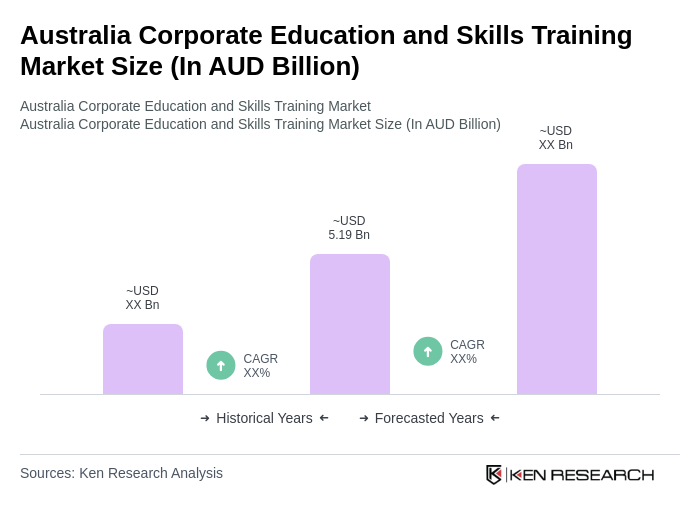

The Australia Corporate Education and Skills Training Market is valued at approximately AUD 5.19 billion, reflecting significant growth driven by the demand for upskilling and reskilling, particularly in technology and digital sectors.