Region:Asia

Author(s):Rebecca

Product Code:KRAA5846

Pages:90

Published On:September 2025

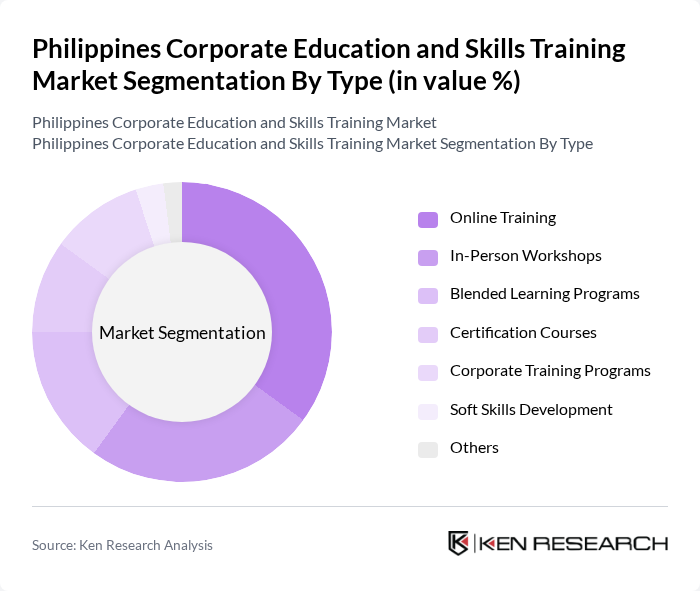

By Type:The market is segmented into various types of training programs, including Online Training, In-Person Workshops, Blended Learning Programs, Certification Courses, Corporate Training Programs, Soft Skills Development, and Others. Among these, Online Training has gained significant traction due to its flexibility and accessibility, especially during the pandemic. In-Person Workshops remain popular for hands-on learning experiences, while Certification Courses are increasingly sought after for professional development.

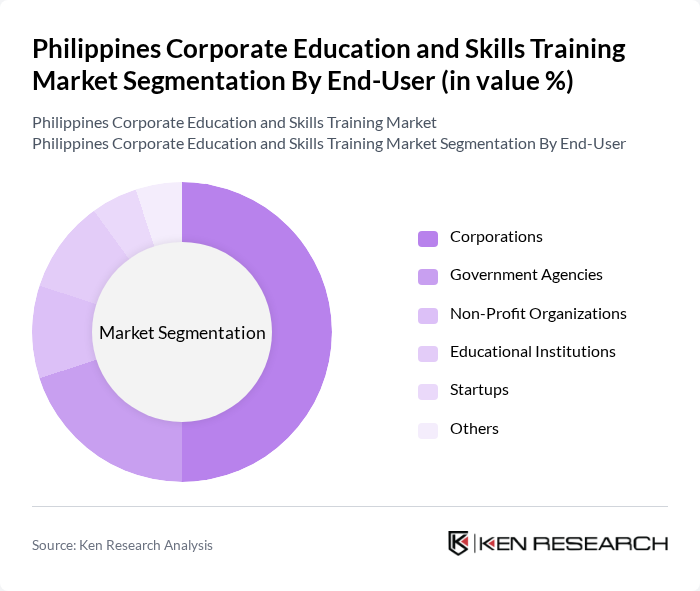

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Startups, and Others. Corporations dominate the market as they invest heavily in employee training to enhance productivity and competitiveness. Government Agencies also play a significant role, particularly in vocational training initiatives, while Educational Institutions are increasingly partnering with corporate entities to provide tailored training programs.

The Philippines Corporate Education and Skills Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as TESDA, Ateneo de Manila University, University of the Philippines, Coursera, EdX, Learning Tree International, Jollibee Foods Corporation, Accenture, IBM Philippines, Microsoft Philippines, Globe Telecom, PLDT, Smart Communications, KPMG Philippines, PwC Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and skills training market in the Philippines appears promising, driven by technological advancements and a growing emphasis on employee development. As companies increasingly adopt blended learning approaches, the integration of AI and analytics will enhance training effectiveness. Furthermore, the focus on mental health and well-being in the workplace is expected to shape training programs, fostering a culture of lifelong learning that aligns with evolving industry needs and employee expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Training In-Person Workshops Blended Learning Programs Certification Courses Corporate Training Programs Soft Skills Development Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Startups Others |

| By Industry | Information Technology Manufacturing Healthcare Retail Finance Hospitality Others |

| By Delivery Mode | Virtual Classrooms On-Site Training Hybrid Models Self-Paced Learning Others |

| By Duration | Short Courses (1-3 days) Medium Courses (1-3 months) Long Courses (3 months and above) Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 150 | Training Managers, HR Directors |

| Skills Gap Analysis | 100 | HR Professionals, Learning and Development Specialists |

| Employee Engagement in Training | 80 | Employees from various sectors, Team Leaders |

| Impact of Technology on Training | 70 | IT Managers, Training Coordinators |

| Government Training Initiatives | 60 | Policy Makers, Education Administrators |

The Philippines Corporate Education and Skills Training Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for skilled labor and the rise of digital learning platforms.