Region:Asia

Author(s):Shubham

Product Code:KRAA5196

Pages:82

Published On:September 2025

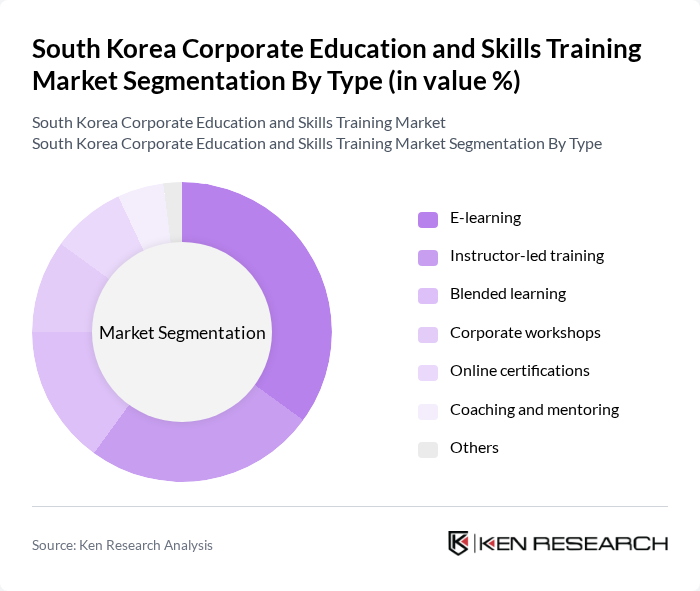

By Type:The market is segmented into various types of training methods, including E-learning, Instructor-led training, Blended learning, Corporate workshops, Online certifications, Coaching and mentoring, and Others. E-learning has gained significant traction due to its flexibility and accessibility, allowing employees to learn at their own pace. Instructor-led training remains popular for its interactive nature, while blended learning combines the best of both worlds. Corporate workshops and online certifications cater to specific skill sets, and coaching and mentoring provide personalized guidance.

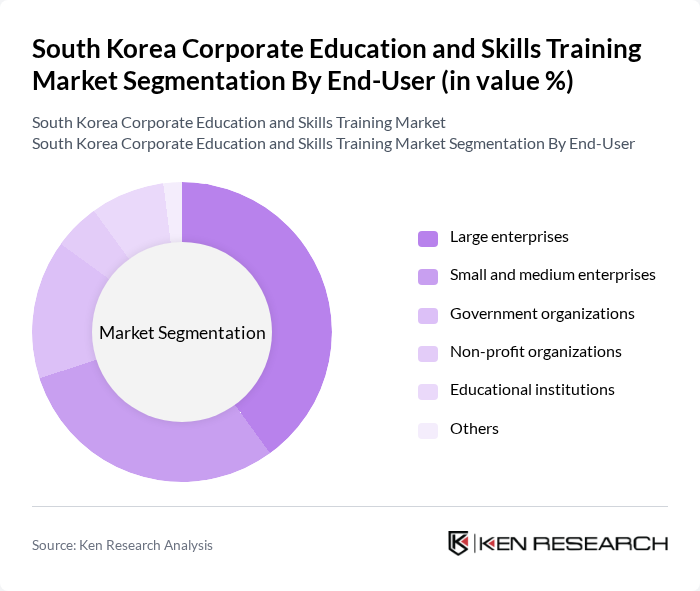

By End-User:The end-user segmentation includes Large enterprises, Small and medium enterprises, Government organizations, Non-profit organizations, Educational institutions, and Others. Large enterprises dominate the market due to their substantial training budgets and the need for comprehensive employee development programs. Small and medium enterprises are increasingly recognizing the importance of training, while government organizations and educational institutions play a crucial role in promoting skills development through various initiatives.

The South Korea Corporate Education and Skills Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung SDS, LG CNS, SK Telecom, Daewoo Engineering & Construction, Hyundai Heavy Industries, POSCO, Hanwha Group, KT Corporation, CJ Group, Amorepacific Corporation, Shinhan Financial Group, Hanjin Group, GS Group, Lotte Group, Doosan Group contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean corporate education and skills training market is poised for significant transformation, driven by technological advancements and evolving workforce needs. As companies increasingly adopt blended learning models, the integration of AI and analytics will enhance training effectiveness. Furthermore, the emphasis on soft skills and diversity training will shape program offerings, ensuring that employees are equipped to thrive in a dynamic work environment. This evolution will create a more agile workforce, ready to meet the challenges of the future.

| Segment | Sub-Segments |

|---|---|

| By Type | E-learning Instructor-led training Blended learning Corporate workshops Online certifications Coaching and mentoring Others |

| By End-User | Large enterprises Small and medium enterprises Government organizations Non-profit organizations Educational institutions Others |

| By Industry | Information Technology Manufacturing Healthcare Finance Retail Hospitality Others |

| By Training Format | Online courses Workshops Seminars Webinars On-the-job training Others |

| By Duration | Short-term courses (less than 1 month) Medium-term courses (1-6 months) Long-term courses (more than 6 months) Others |

| By Delivery Method | In-person training Virtual training Hybrid training Others |

| By Certification Type | Professional certifications Skill-based certifications Compliance certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs in IT Sector | 100 | HR Managers, Training Coordinators |

| Skills Development in Manufacturing | 80 | Operations Managers, Training Specialists |

| Soft Skills Training in Service Industry | 70 | Learning and Development Heads, Employee Engagement Managers |

| Government-Funded Training Initiatives | 60 | Policy Makers, Program Administrators |

| Online Learning Platforms Usage | 90 | Corporate Trainers, E-learning Developers |

The South Korea Corporate Education and Skills Training Market is valued at approximately USD 3.5 billion, reflecting a significant growth driven by the demand for skilled labor and continuous employee development in a competitive business environment.