Region:Asia

Author(s):Geetanshi

Product Code:KRAA6296

Pages:96

Published On:January 2026

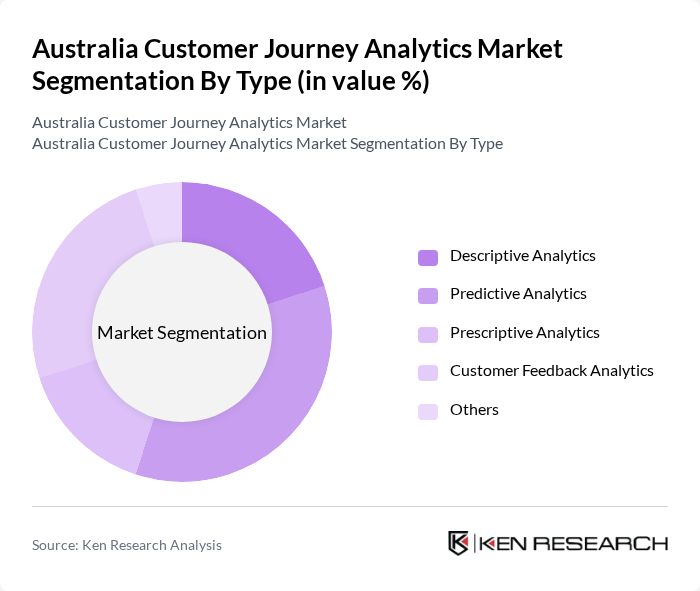

By Type:The market is segmented into various types, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Customer Experience Management Tools, and Others. Among these, Descriptive Analytics is currently the leading sub-segment, as businesses increasingly rely on historical data to understand customer behavior and improve decision-making processes. Predictive Analytics is also gaining traction, driven by the need for businesses to anticipate customer needs and enhance engagement strategies.

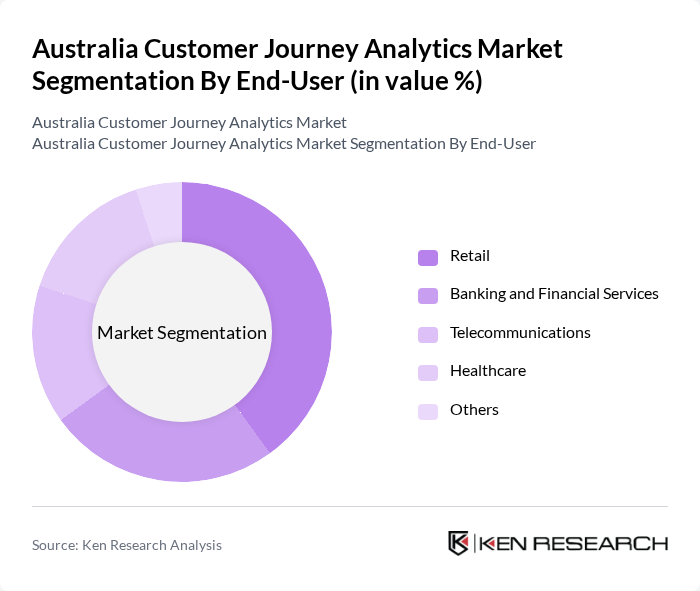

By End-User:The end-user segmentation includes Retail, Banking and Financial Services, Telecommunications, Healthcare, and Others. The Retail sector is the dominant segment, as companies leverage customer journey analytics to enhance shopping experiences and optimize inventory management. The Banking and Financial Services sector is also significant, focusing on customer retention and personalized service offerings through data insights.

The Australia Customer Journey Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adobe Systems, Salesforce, SAS Institute, Oracle Corporation, IBM Corporation, Microsoft Corporation, SAP SE, Google Analytics, HubSpot, Qualtrics, Amplitude, Mixpanel, Pendo, Segment, Zendesk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia Customer Journey Analytics Market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly adopt AI and machine learning, the ability to analyze customer interactions in real-time will enhance engagement strategies. Furthermore, the shift towards omnichannel experiences will necessitate sophisticated analytics tools, ensuring that companies can meet the demands of a diverse customer base while optimizing their marketing efforts and improving overall customer satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Customer Experience Management Tools Others |

| By End-User | Retail Banking and Financial Services Telecommunications Healthcare Others |

| By Industry Vertical | E-commerce Travel and Hospitality Media and Entertainment Automotive Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Analytics Type | Web Analytics Social Media Analytics Mobile Analytics Others |

| By Customer Segment | B2B B2C B2G Others |

| By Geographic Region | New South Wales Victoria Queensland Western Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Customer Experience | 120 | Marketing Managers, Customer Experience Directors |

| Financial Services User Journey | 100 | Product Managers, Digital Strategy Leads |

| Healthcare Patient Engagement | 80 | Healthcare Administrators, Patient Experience Officers |

| Travel and Hospitality Customer Insights | 70 | Operations Managers, Customer Service Representatives |

| E-commerce User Behavior | 100 | eCommerce Managers, Digital Marketing Specialists |

The Australia Customer Journey Analytics Market is valued at approximately USD 320 million, reflecting significant growth driven by digital transformation strategies, advanced analytics tools, and AI-driven personalization efforts among businesses.