Region:Asia

Author(s):Dev

Product Code:KRAB4221

Pages:85

Published On:October 2025

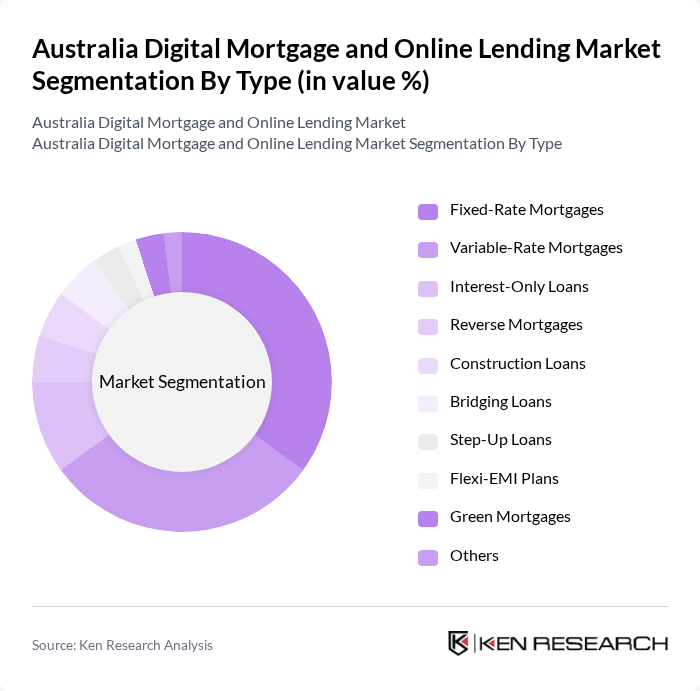

By Type:The market is segmented into various types of mortgage products, including Fixed-Rate Mortgages, Variable-Rate Mortgages, Interest-Only Loans, Reverse Mortgages, Construction Loans, Bridging Loans, Step-Up Loans, Flexi-EMI Plans, Green Mortgages, and Others. Among these, Fixed-Rate Mortgages remain popular due to their stability and predictability in monthly payments, appealing to risk-averse borrowers. Variable-Rate Mortgages are gaining traction as interest rates begin to fall, allowing borrowers to benefit from potential reductions in their repayments. The demand for Green Mortgages is rising as consumers become more environmentally conscious, with lenders now offering preferential rates for energy-efficient homes and sustainable building practices. Digital innovation is also enabling more tailored and flexible loan products, with AI and data analytics supporting faster approvals and more personalized offerings.

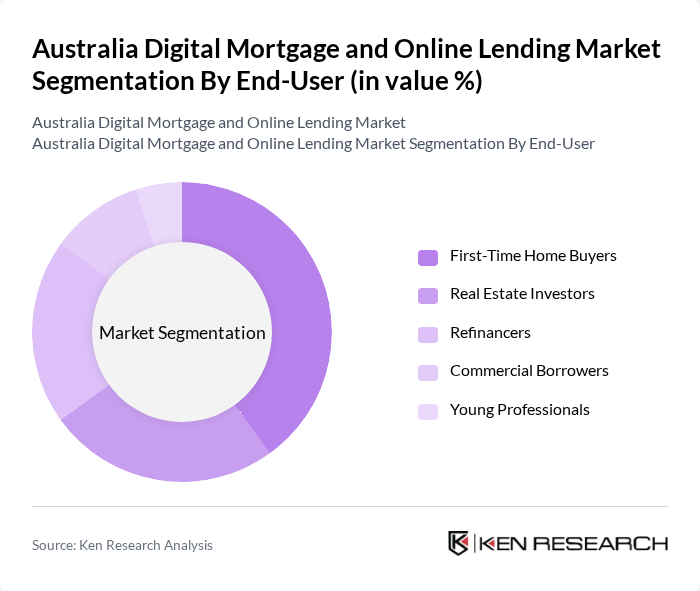

By End-User:The end-user segmentation includes First-Time Home Buyers, Real Estate Investors, Refinancers, Commercial Borrowers, and Young Professionals. First-Time Home Buyers represent a significant portion of the market, driven by government incentives and a growing desire for home ownership among millennials. Real Estate Investors are also prominent, capitalizing on the rising property values and rental demand. Refinancers are increasingly active, with nearly half of Australian mortgage holders considering refinancing as interest rates begin to fall, seeking better rates and terms in a cooling housing market. Commercial Borrowers and Young Professionals are entering the market with innovative financing options, supported by digital platforms that streamline the application and approval process.

The Australia Digital Mortgage and Online Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Commonwealth Bank of Australia, Westpac Banking Corporation, National Australia Bank, ANZ Banking Group, Pepper Money, Prospa, Homeloans Ltd, Lendi, Athena Home Loans, Zip Co Limited, MoneyMe, Bluestone Mortgages, Firstmac, Suncorp Group, MyState Limited, ING Australia, Tic:Toc, SocietyOne, Wisr, Plenti contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital mortgage and online lending market in Australia appears promising, driven by ongoing technological advancements and evolving consumer preferences. As more Australians embrace digital solutions, lenders are likely to enhance their offerings, focusing on user-friendly platforms and personalized services. Additionally, the integration of artificial intelligence and machine learning will streamline processes, improving efficiency and customer satisfaction. The market is expected to adapt to regulatory changes, ensuring compliance while fostering innovation and competition.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Rate Mortgages Variable-Rate Mortgages Interest-Only Loans Reverse Mortgages Construction Loans Bridging Loans Step-Up Loans Flexi-EMI Plans Green Mortgages Others |

| By End-User | First-Time Home Buyers Real Estate Investors Refinancers Commercial Borrowers Young Professionals |

| By Loan Amount | Low-Value Loans (up to AUD 250,000) Mid-Value Loans (AUD 250,000 - AUD 750,000) High-Value Loans (above AUD 750,000) |

| By Application | Home Purchase Home Renovation Debt Consolidation Investment Property Acquisition Mortgage Refinancing |

| By Distribution Channel | Direct Online Applications Mortgage Brokers Financial Institutions Comparison Websites Digital-Only Lenders |

| By Customer Segment | Individual Borrowers Small Businesses Corporates Self-Employed |

| By Policy Support | Government Subsidies Tax Incentives for Home Buyers Grants for First-Time Buyers Green Loan Incentives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Mortgage Users | 100 | Homebuyers, First-time Buyers |

| Online Lending Customers | 80 | Small Business Owners, Personal Loan Seekers |

| Mortgage Brokers | 60 | Independent Brokers, Mortgage Advisors |

| Fintech Executives | 40 | CEOs, Product Managers of Digital Lending Platforms |

| Regulatory Experts | 40 | Compliance Officers, Legal Advisors in Financial Services |

The Australia Digital Mortgage and Online Lending Market is valued at approximately AUD 99 billion, reflecting significant growth driven by the adoption of digital platforms and fintech innovations, particularly accelerated by the COVID-19 pandemic.