Region:Global

Author(s):Shubham

Product Code:KRAC0700

Pages:83

Published On:August 2025

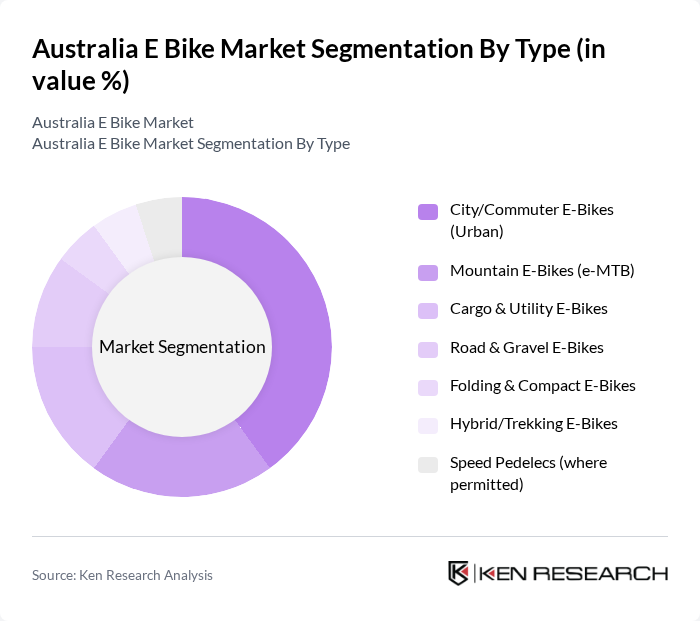

By Type:The e-bike market in Australia is segmented into various types, including City/Commuter E-Bikes, Mountain E-Bikes, Cargo & Utility E-Bikes, Road & Gravel E-Bikes, Folding & Compact E-Bikes, Hybrid/Trekking E-Bikes, and Speed Pedelecs. Among these, City/Commuter E-Bikes are the most popular due to their practicality for urban commuting, ease of use, and growing infrastructure supporting cycling. The increasing trend of remote work and the need for efficient transportation solutions have further propelled the demand for these e-bikes .

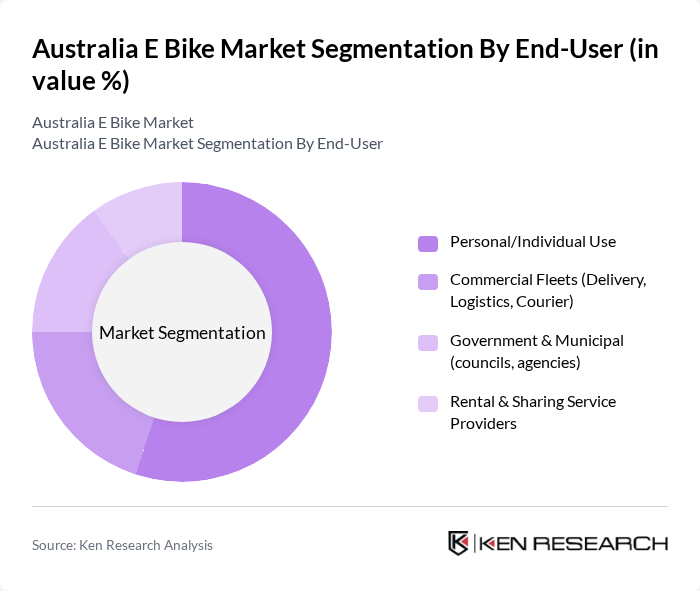

By End-User:The end-user segmentation of the e-bike market includes Personal/Individual Use, Commercial Fleets, Government & Municipal, and Rental & Sharing Service Providers. Personal/Individual Use dominates the market as more consumers opt for e-bikes for daily commuting and leisure activities. The convenience, cost-effectiveness, and health benefits associated with e-bikes have made them a preferred choice for individuals, especially in urban areas where traffic congestion is prevalent .

The Australia E Bike Market is characterized by a dynamic mix of regional and international players. Leading participants such as Giant Manufacturing Co., Ltd., Trek Bicycle Corporation, Specialized Bicycle Components, Inc., Merida Industry Co., Ltd., Cannondale (Cycling Sports Group, Dorel Industries), Bosch eBike Systems, Shimano Inc., Yamaha Motor Co., Ltd., Accell Group (including Haibike), Riese & Müller GmbH, Bulls Bikes (ZEG), Pedego Electric Bikes, Focus Bikes (Derby Cycle), Norco Bicycles (Live to Play Sports), Leitner Electric Bikes (Australia), Dyson Bikes (Australia), Reid Cycles (Australia), Smartmotion (Australia/NZ), Aventon Bikes, VanMoof contribute to innovation, geographic expansion, and service delivery in this space .

The future of the e-bike market in Australia appears promising, driven by increasing urbanization and government support for sustainable transport. As more Australians embrace eco-friendly commuting options, the market is expected to see a rise in e-bike adoption. Additionally, advancements in battery technology and the integration of smart features will enhance user experience, making e-bikes more appealing. The focus on health and fitness will further drive demand, positioning the e-bike market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | City/Commuter E-Bikes (Urban) Mountain E-Bikes (e-MTB) Cargo & Utility E-Bikes Road & Gravel E-Bikes Folding & Compact E-Bikes Hybrid/Trekking E-Bikes Speed Pedelecs (where permitted) |

| By End-User | Personal/Individual Use Commercial Fleets (Delivery, Logistics, Courier) Government & Municipal (councils, agencies) Rental & Sharing Service Providers |

| By Sales Channel | Specialty Bike Retailers Online/Direct-to-Consumer Mass Retail & Sporting Goods Stores Corporate/Institutional Direct Sales |

| By Price Range | Entry (Below AUD 2,000) Mid-Range (AUD 2,000–5,000) Premium (Above AUD 5,000) |

| By Battery Type | Lithium-Ion (Li-ion) Lithium Iron Phosphate (LFP) Others (incl. Lead-Acid, NiMH) |

| By Motor Type | Mid-Drive Motors Hub Motors (Front/Rear) |

| By Assistance Mode | Pedal-Assist (Pedelec) Throttle-Assist |

| By Usage | Daily Commuting Recreation & Fitness Delivery & Last-Mile Logistics Tourism & Rental |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Australian Capital Territory Northern Territory |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Current E-bike Users | 150 | Casual Riders, Commuters, Enthusiasts |

| Potential E-bike Buyers | 100 | Urban Residents, Eco-conscious Consumers, Fitness Enthusiasts |

| Retailers and Distributors | 80 | Store Managers, Sales Representatives, Supply Chain Managers |

| Industry Experts and Analysts | 50 | Market Analysts, Policy Makers, Transportation Planners |

| Local Government Officials | 40 | Urban Planners, Sustainability Officers, Transportation Coordinators |

The Australia E Bike Market is valued at approximately AUD 1.45 billion, reflecting strong growth driven by urbanization, environmental awareness, and government initiatives promoting sustainable transportation. This market is expected to continue expanding as e-bike adoption increases across various demographics.