Region:Asia

Author(s):Geetanshi

Product Code:KRAD0001

Pages:98

Published On:August 2025

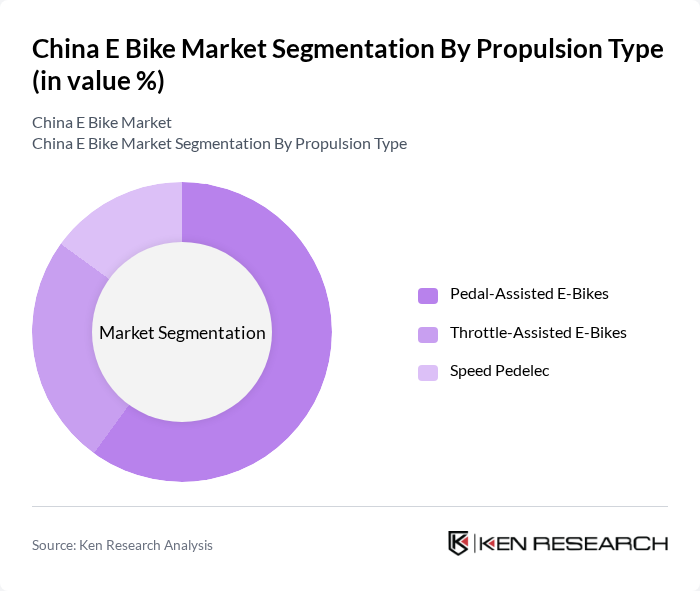

By Propulsion Type:The propulsion type segmentation includes Pedal-Assisted E-Bikes, Throttle-Assisted E-Bikes, and Speed Pedelec. Among these, Pedal-Assisted E-Bikes dominate the market due to their user-friendly nature, ability to provide a more natural cycling experience, and compliance with local regulations. Consumers increasingly favor these bikes for daily commuting, as they offer a balance between physical activity and assistance, making them ideal for urban environments .

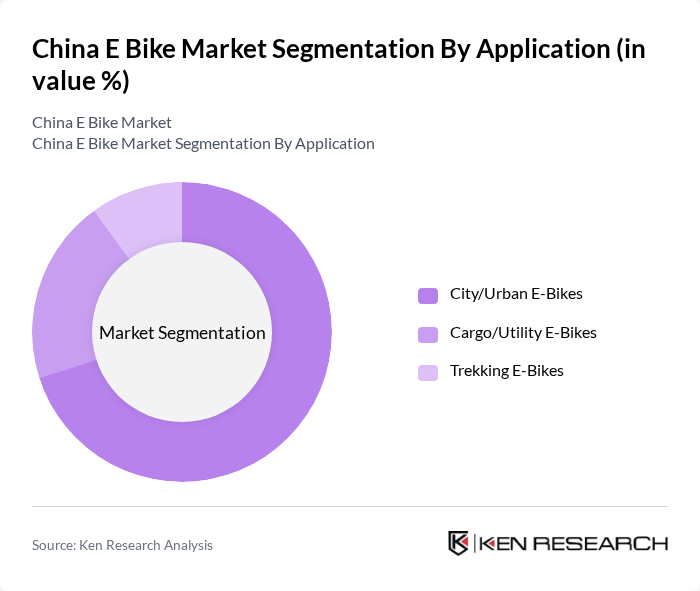

By Application:The application segmentation encompasses City/Urban E-Bikes, Cargo/Utility E-Bikes, and Trekking E-Bikes. City/Urban E-Bikes are the leading subsegment, driven by the increasing need for efficient urban transportation solutions. As cities become more congested, consumers are opting for e-bikes to navigate traffic and reduce commuting times. The convenience and practicality of these bikes for short-distance travel make them highly popular among urban dwellers .

The China E Bike Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yadea Technology Group Co., Ltd., Aima Technology Group Co., Ltd., Sunra Electric Vehicle Co., Ltd., Luyuan Electric Vehicle Co., Ltd., NIU Technologies, TAILG Electric Vehicle Co., Ltd., BYVIN Group, Giant Manufacturing Co., Ltd., Merida Industry Co., Ltd., Xiaomi Corporation, Accell Group N.V., Trek Bicycle Corporation, Specialized Bicycle Components, Inc., Rad Power Bikes, and Bosch eBike Systems contribute to innovation, geographic expansion, and service delivery in this space .

The future of the e-bike market in China appears promising, driven by ongoing urbanization and technological advancements. As cities continue to expand, the demand for sustainable transportation solutions will likely increase. Additionally, the integration of smart technologies, such as IoT and AI, will enhance user experience and safety. Manufacturers that adapt to these trends and invest in innovative features will be well-positioned to capture market share and meet evolving consumer preferences in future.

| Segment | Sub-Segments |

|---|---|

| By Propulsion Type | Pedal-Assisted E-Bikes Throttle-Assisted E-Bikes Speed Pedelec |

| By Application | City/Urban E-Bikes Cargo/Utility E-Bikes Trekking E-Bikes |

| By Battery Type | Lithium-Ion Batteries Lead-Acid Batteries Nickel-Metal Hydride Batteries |

| By Drive Type | Chain Drive Belt Drive |

| By End-User | Individual Consumers Delivery Services Corporate Fleets Government Agencies |

| By Sales Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Price Range | Budget E-Bikes Mid-Range E-Bikes Premium E-Bikes |

| By Usage | Daily Commuting Recreational Use Delivery and Logistics |

| By Region | East China South China North China West China |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Commuter Insights | 150 | Daily e-bike users, occasional riders |

| Retailer Feedback | 100 | Store Managers, Sales Representatives |

| Manufacturer Perspectives | 80 | Production Managers, Product Development Heads |

| Policy Maker Interviews | 50 | Transportation Officials, Urban Planners |

| Consumer Behavior Surveys | 120 | General public, potential e-bike buyers |

The China E Bike Market is valued at approximately USD 11 billion, driven by urbanization, government initiatives promoting electric vehicles, and increasing consumer demand for eco-friendly transportation options. This growth reflects a significant shift towards sustainable mobility solutions in urban areas.