Region:Asia

Author(s):Geetanshi

Product Code:KRAA0079

Pages:98

Published On:August 2025

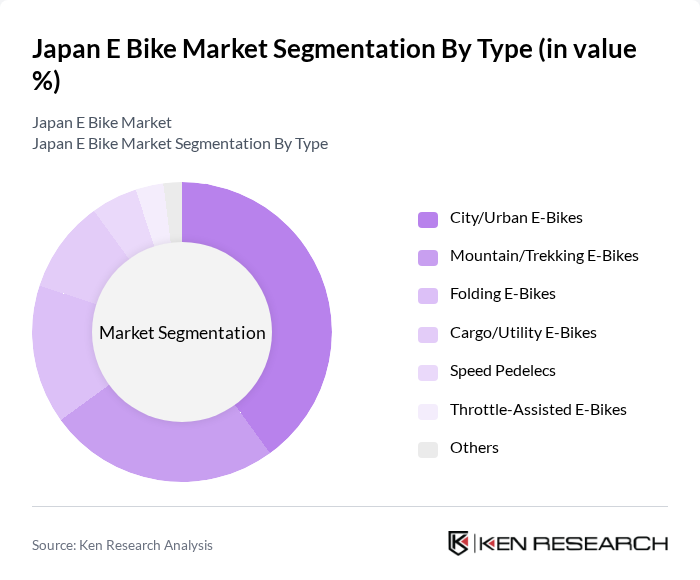

By Type:The e-bike market can be segmented into various types, including City/Urban E-Bikes, Mountain/Trekking E-Bikes, Folding E-Bikes, Cargo/Utility E-Bikes, Speed Pedelecs, Throttle-Assisted E-Bikes, and Others. Among these, City/Urban E-Bikes are the most popular due to their suitability for daily commuting in urban environments. The convenience of folding e-bikes also appeals to city dwellers with limited storage space. Mountain and trekking e-bikes cater to outdoor enthusiasts, while cargo e-bikes are gaining traction in logistics and delivery services .

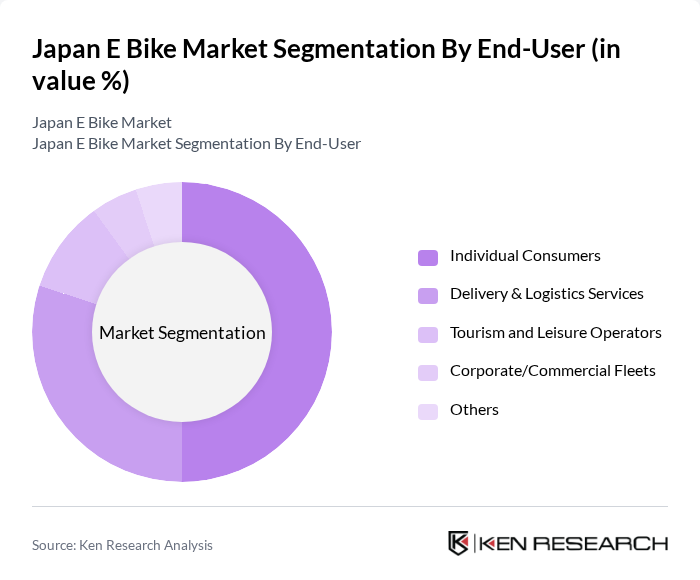

By End-User:The e-bike market is segmented by end-user into Individual Consumers, Delivery & Logistics Services, Tourism and Leisure Operators, Corporate/Commercial Fleets, and Others. Individual consumers represent the largest segment, driven by the growing trend of eco-friendly commuting and recreational cycling. Delivery and logistics services are increasingly adopting e-bikes for last-mile delivery solutions, while tourism operators leverage e-bikes to enhance visitor experiences in scenic areas .

The Japan E Bike Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yamaha Motor Co., Ltd., Panasonic Corporation, Shimano Inc., Bridgestone Cycle Co., Ltd., Giant Manufacturing Co., Ltd., Trek Bicycle Corporation, Merida Industry Co., Ltd., Specialized Bicycle Components, Inc., BESV Japan Inc., Panasonic Cycle Technology Co., Ltd., Fuji Bikes (Fuji-ta Bicycle Co., Ltd.), Cannondale (Dorel Industries Inc.), Tern Bicycles, Pedego Japan, VanMoof Japan contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-bike market in Japan appears promising, driven by increasing urbanization and government support for sustainable transport. As more consumers seek eco-friendly alternatives, the demand for e-bikes is expected to rise significantly. Innovations in battery technology and the integration of smart features will further enhance user experience. Additionally, partnerships between manufacturers and local governments can facilitate infrastructure development, ensuring that charging stations are more accessible, thus promoting widespread adoption of e-bikes across urban landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | City/Urban E-Bikes Mountain/Trekking E-Bikes Folding E-Bikes Cargo/Utility E-Bikes Speed Pedelecs Throttle-Assisted E-Bikes Others |

| By End-User | Individual Consumers Delivery & Logistics Services Tourism and Leisure Operators Corporate/Commercial Fleets Others |

| By Battery Type | Lithium-Ion Batteries Lead-Acid Batteries Nickel-Metal Hydride (NiMH) Batteries Others |

| By Price Range | Budget E-Bikes (Below JPY 70,000) Mid-Range E-Bikes (JPY 70,000–150,000) Premium E-Bikes (Above JPY 150,000) Others |

| By Distribution Channel | Online Retail Offline Retail (Specialty Stores, Mass Merchandisers) Direct Sales (Manufacturer-Owned Outlets) Others |

| By Region | Kanto Kansai Chubu Kyushu Hokkaido/Tohoku Others |

| By Usage Purpose | Commuting Recreation Delivery/Logistics Corporate/Institutional Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail E-Bike Sales | 100 | Store Managers, Sales Representatives |

| Consumer E-Bike Usage | 120 | End-users, Cycling Enthusiasts |

| Manufacturing Insights | 80 | Production Managers, R&D Engineers |

| Distribution Channel Feedback | 60 | Logistics Coordinators, Supply Chain Managers |

| Policy Impact Assessment | 40 | Government Officials, Policy Analysts |

The Japan E Bike Market is valued at approximately USD 2.9 billion, driven by urbanization, sustainable transportation trends, and government initiatives promoting electric mobility. This growth reflects a significant shift towards eco-friendly commuting solutions in urban areas.