Region:Global

Author(s):Geetanshi

Product Code:KRAA3665

Pages:80

Published On:September 2025

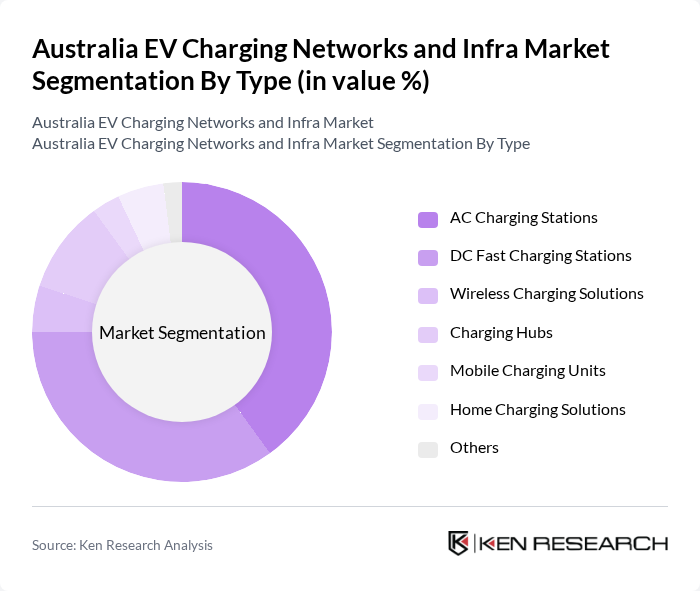

By Type:The market is segmented into various types of charging solutions, including AC Charging Stations, DC Fast Charging Stations, Wireless Charging Solutions, Charging Hubs, Mobile Charging Units, Home Charging Solutions, and Others. Among these, AC Charging Stations and DC Fast Charging Stations are the most prominent, driven by the increasing demand for efficient and rapid charging solutions. The trend towards faster charging capabilities is evident as consumers seek convenience and reduced downtime while charging their electric vehicles, with fast-charging network expansion being prioritized to reduce charging durations.

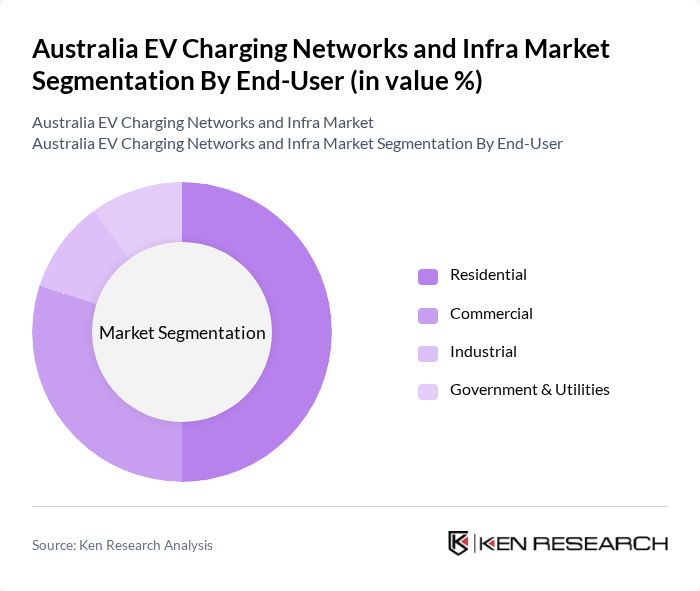

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is currently leading the market, as more homeowners are investing in home charging solutions to support their electric vehicles. The increasing awareness of environmental sustainability and the convenience of charging at home are key factors driving this trend. Commercial and Government sectors are also expanding their charging infrastructure to support fleet operations and public accessibility, with fleet electrification being a key trend in the market.

The Australia EV Charging Networks and Infra Market is characterized by a dynamic mix of regional and international players. Leading participants such as Chargefox, Ampol (AmpCharge), BP Pulse (BP), Viva Energy (Shell Recharge), Caltex (Ampol/Caltex network), AGL EV Charging, Alchemy Charge, ChargeAway, ChargePost, Elanga, Elu, JET Charge, Tritium, Tesla, Inc., Everty (acquired by AGL), NRMA Electric Charging Network, RACV Electric Charging Network, RACQ Electric Charging Network, RAA Electric Charging Network, RACT Electric Charging Network contribute to innovation, geographic expansion, and service delivery in this space.

The future of Australia’s EV charging networks is poised for significant transformation, driven by technological advancements and increased collaboration between public and private sectors. As the government continues to implement supportive policies, the integration of smart grid technologies will enhance charging efficiency. Additionally, the rise of mobile charging solutions is expected to address range anxiety, making EVs more appealing to consumers. Overall, the market is set to evolve rapidly, fostering a more sustainable transportation ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Charging Stations DC Fast Charging Stations Wireless Charging Solutions Charging Hubs Mobile Charging Units Home Charging Solutions Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Public Charging Private Charging Fleet Charging Destination Charging |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships International Investments |

| By Policy Support | Subsidies Tax Exemptions Grants Regulatory Support |

| By Charging Speed | Level 1 Charging Level 2 Charging Level 3 Charging Ultra-Fast Charging |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Charging Infrastructure | 120 | City Planners, Infrastructure Managers |

| Private Charging Solutions | 100 | Homeowners, Property Developers |

| Fleet Charging Strategies | 80 | Fleet Managers, Logistics Coordinators |

| Charging Technology Providers | 70 | Product Managers, R&D Engineers |

| Consumer EV Charging Behavior | 120 | EV Owners, Potential EV Buyers |

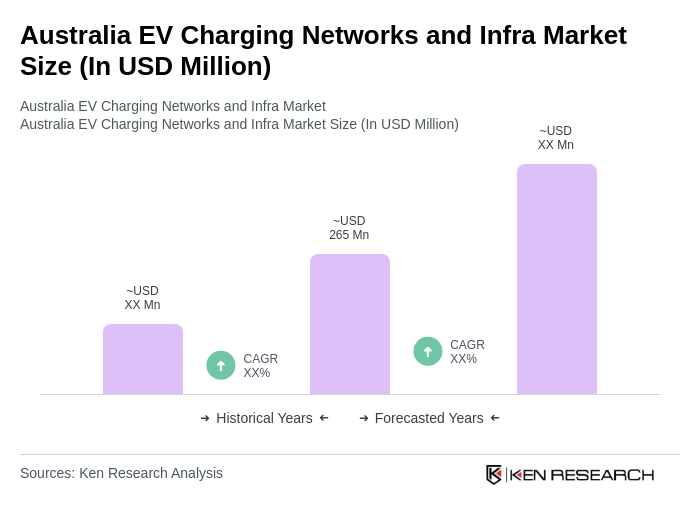

The Australia EV Charging Networks and Infra Market is valued at approximately USD 265 million, reflecting significant growth driven by the increasing adoption of electric vehicles, government incentives, and a focus on sustainable transportation solutions.