Region:Global

Author(s):Shubham

Product Code:KRAA1001

Pages:90

Published On:August 2025

By Type:The market is segmented into a range of services tailored to diverse operational requirements. The subsegments include Full-service fleet management, Maintenance and repair services, Fuel management services, Telematics and tracking solutions, Driver management services, Compliance and regulatory services, Vehicle acquisition and leasing, Accident and risk management, and Others. Full-service fleet management leads the segment, as it enables organizations to outsource all aspects of fleet operations, thereby improving efficiency and cost control .

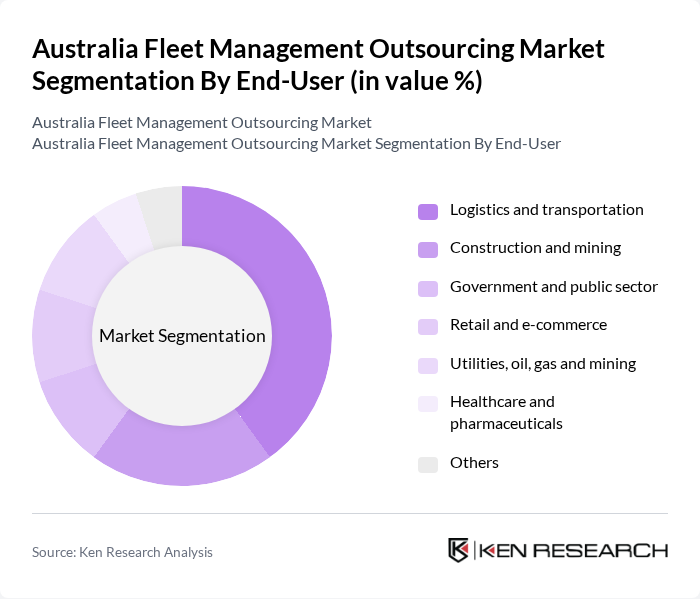

By End-User:The market is segmented by end-users, including Logistics and transportation, Construction and mining, Government and public sector, Retail and e-commerce, Utilities, oil, gas and mining, Healthcare and pharmaceuticals, and Others. The Logistics and transportation sector is the largest end-user, driven by the need for efficient supply chain management, real-time tracking, and fleet optimization. Other sectors such as construction, mining, and utilities also significantly utilize outsourced fleet management for operational reliability and compliance .

The Australia Fleet Management Outsourcing Market features a dynamic mix of regional and international providers. Leading participants such as Fleetcare, SG Fleet Group Limited, Eclipx Group, LeasePlan Australia, Smartfleet, Orix Australia, Custom Fleet, FleetPartners, AFS Fleet Management, Summit Fleet Lease Australia Pty Ltd., Future Fleet International Pty Ltd., Teletrac Navman, Linxio, McMillan Shakespeare Ltd., Geotab, Bridgestone Fleet Solutions, and Telstra Group Ltd. (MTData) drive innovation, geographic expansion, and enhanced service delivery in this sector .

The future of the Australia fleet management outsourcing market appears promising, driven by technological innovations and a growing emphasis on sustainability. As businesses increasingly adopt electric vehicles and integrate AI-driven solutions, operational efficiencies are expected to improve significantly. Furthermore, the expansion of e-commerce and logistics sectors will create additional demand for fleet management services, fostering a competitive landscape that encourages innovation and collaboration among service providers.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-service fleet management Maintenance and repair services Fuel management services Telematics and tracking solutions Driver management services Compliance and regulatory services Vehicle acquisition and leasing Accident and risk management Others |

| By End-User | Logistics and transportation Construction and mining Government and public sector Retail and e-commerce Utilities, oil, gas and mining Healthcare and pharmaceuticals Others |

| By Fleet Size | Small fleet (1-10 vehicles) Medium fleet (11-50 vehicles) Large fleet (51+ vehicles) |

| By Service Model | Outsourced fleet management In-house fleet management |

| By Geographic Coverage | New South Wales Victoria Queensland Western Australia South Australia Australian Capital Territory Tasmania Northern Territory |

| By Vehicle Type | Light-duty vehicles Heavy-duty vehicles Electric vehicles Commercial vehicles Passenger vehicles |

| By Pricing Model | Fixed pricing Variable pricing Subscription-based pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 100 | Fleet Managers, Operations Directors |

| Construction Equipment Fleet | 60 | Procurement Managers, Site Supervisors |

| Healthcare Transport Services | 40 | Logistics Coordinators, Facility Managers |

| Public Sector Fleet Operations | 50 | Government Fleet Managers, Policy Advisors |

| Technology-Driven Fleet Solutions | 45 | IT Managers, Innovation Officers |

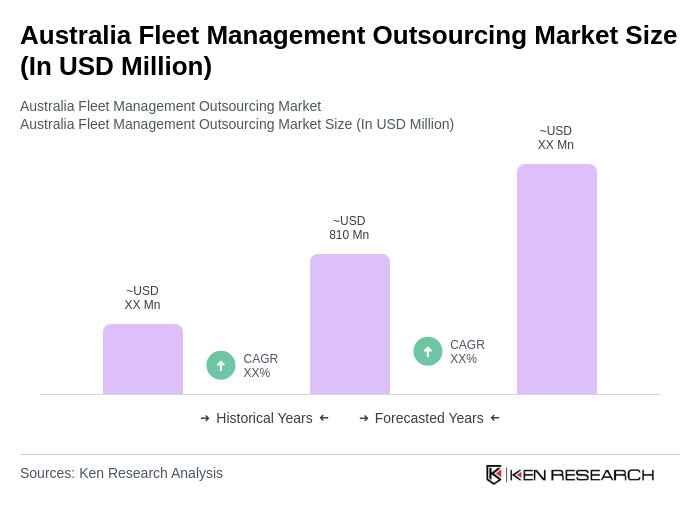

The Australia Fleet Management Outsourcing Market is valued at approximately USD 810 million, reflecting a significant growth trend driven by the demand for cost-efficient operations, technological advancements, and a focus on sustainability and regulatory compliance.