Region:Central and South America

Author(s):Shubham

Product Code:KRAA0787

Pages:99

Published On:August 2025

By Type:The market can be segmented into various types of services that cater to different operational needs. The subsegments include Full-service fleet management, Maintenance and repair services, Fuel management services, Telematics and tracking solutions, Driver management services, Vehicle leasing and financing services, Compliance and regulatory services, Accident and risk management, and Others. Among these, Full-service fleet management is the leading subsegment due to its comprehensive approach, allowing businesses to streamline operations and reduce costs effectively .

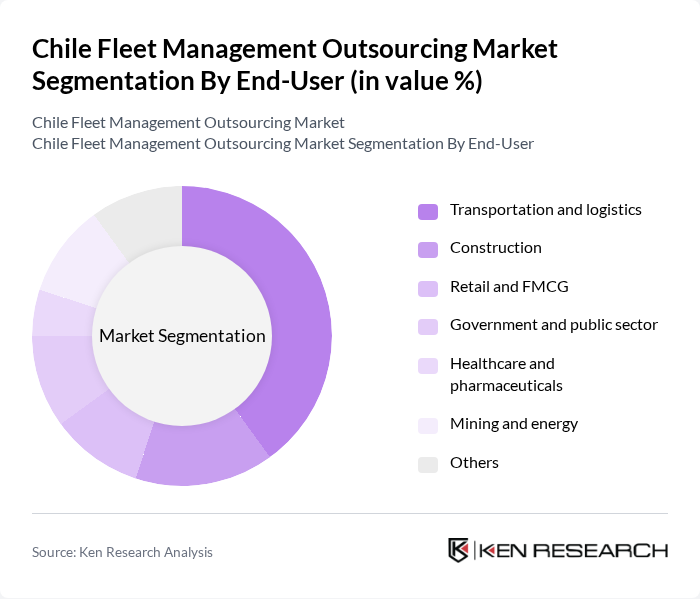

By End-User:The end-user segmentation includes Transportation and logistics, Construction, Retail and FMCG, Government and public sector, Healthcare and pharmaceuticals, Mining and energy, and Others. The Transportation and logistics sector is the dominant end-user, driven by the need for efficient supply chain management and the increasing volume of goods transported across the country .

The Chile Fleet Management Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sodexo Chile, Geotab, Teletrac Navman, Omnicomm, Verizon Connect, Fleet Complete, Samsara, TomTom Telematics, MiX Telematics, Chevin Fleet Solutions, Element Fleet Management, Arval Chile, LeasePlan Chile, Europcar Chile, ALD Automotive Chile contribute to innovation, geographic expansion, and service delivery in this space.

The Chile fleet management outsourcing market is poised for significant transformation as businesses increasingly prioritize efficiency and sustainability. With the rise of e-commerce and the adoption of electric vehicles, companies are likely to seek innovative solutions that align with environmental goals. Additionally, the integration of AI and IoT technologies will enhance operational capabilities, enabling real-time monitoring and predictive maintenance. These trends indicate a shift towards more sophisticated and responsive fleet management strategies, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-service fleet management Maintenance and repair services Fuel management services Telematics and tracking solutions Driver management services Vehicle leasing and financing services Compliance and regulatory services Accident and risk management Others |

| By End-User | Transportation and logistics Construction Retail and FMCG Government and public sector Healthcare and pharmaceuticals Mining and energy Others |

| By Fleet Size | Small fleet (1-10 vehicles) Medium fleet (11-50 vehicles) Large fleet (51+ vehicles) |

| By Service Model | Fully outsourced fleet management Partially outsourced fleet management In-house fleet management |

| By Geographic Coverage | Santiago Metropolitan Region Other urban areas Rural areas |

| By Vehicle Type | Light commercial vehicles Heavy commercial vehicles Passenger vehicles Electric vehicles |

| By Policy Support | Subsidies for fleet upgrades Tax incentives for green vehicles Grants for technology adoption |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fleet Management | 60 | Fleet Managers, Logistics Coordinators |

| Manufacturing Logistics | 50 | Operations Managers, Supply Chain Analysts |

| E-commerce Delivery Services | 40 | Logistics Directors, Fulfillment Managers |

| Public Transportation Fleet | 45 | Transport Managers, City Planners |

| Construction Equipment Fleet | 40 | Project Managers, Equipment Supervisors |

The Chile Fleet Management Outsourcing Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by the demand for efficient fleet operations and advanced technologies like telematics and data analytics.