Region:Asia

Author(s):Geetanshi

Product Code:KRAA2022

Pages:89

Published On:August 2025

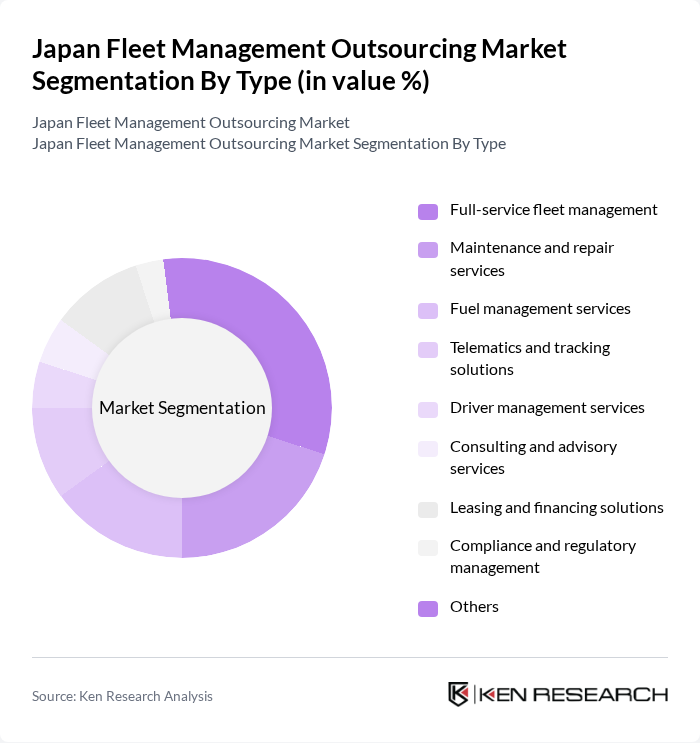

By Type:The market is segmented into various types of services that cater to different aspects of fleet management. The subsegments include:

The full-service fleet management segment is currently dominating the market due to its comprehensive nature, which includes vehicle acquisition, maintenance, and operational management. Companies prefer this model as it allows them to outsource all fleet-related activities to a single provider, ensuring streamlined operations and reduced administrative burdens. The increasing complexity of fleet operations and the need for integrated solutions—especially those leveraging advanced telematics and AI—are driving demand for full-service offerings, making it the leading subsegment in the market .

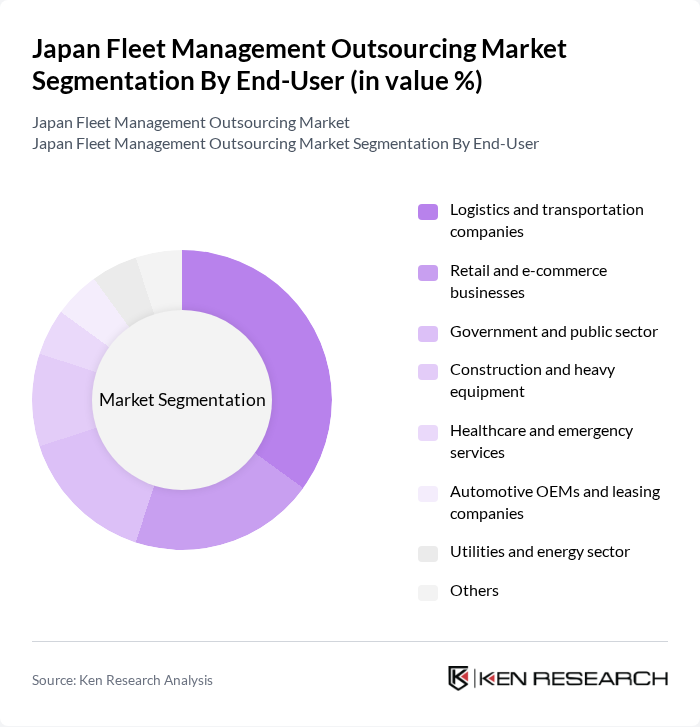

By End-User:The market is segmented based on the end-users of fleet management services. The subsegments include:

The logistics and transportation companies segment is the largest end-user of fleet management outsourcing services. This is primarily due to the increasing demand for efficient supply chain management and the need for real-time tracking of goods. As e-commerce continues to grow, logistics companies are investing in fleet management solutions to enhance delivery efficiency and customer satisfaction. The dominance of bundled leasing and technology-driven fleet management further solidifies logistics and transportation as the leading end-user segment in the market .

The Japan Fleet Management Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hitachi Transport System, Ltd., Mitsui & Co., Ltd., NTT Data Corporation, Toyota Tsusho Corporation, Fujitsu Limited, SoftBank Group Corp., Seino Holdings Co., Ltd., Yamato Holdings Co., Ltd., Sagawa Express Co., Ltd., Kintetsu World Express, Inc., Japan Post Holdings Co., Ltd., Marubeni Corporation, Sumitomo Mitsui Auto Service Company, Limited, ORIX Auto Corporation, Toyota Fleet Leasing Co., Ltd., Nissan Car Leasing Co., Ltd., Bridgestone Corporation, Denso Corporation, Isuzu Motors Limited, Mitsubishi Fuso Truck and Bus Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan fleet management outsourcing market appears promising, driven by technological innovations and a growing emphasis on sustainability. As companies increasingly adopt electric vehicles and integrate AI-driven solutions, operational efficiencies are expected to improve significantly. Additionally, the expansion of e-commerce will further fuel demand for efficient fleet management. However, addressing challenges such as high initial costs and data security will be crucial for sustained growth in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-service fleet management Maintenance and repair services Fuel management services Telematics and tracking solutions Driver management services Consulting and advisory services Leasing and financing solutions Compliance and regulatory management Others |

| By End-User | Logistics and transportation companies Retail and e-commerce businesses Government and public sector Construction and heavy equipment Healthcare and emergency services Automotive OEMs and leasing companies Utilities and energy sector Others |

| By Fleet Size | Small fleet (1-10 vehicles) Medium fleet (11-50 vehicles) Large fleet (51+ vehicles) Mega fleet (200+ vehicles) Others |

| By Service Model | Fully outsourced fleet management Partially outsourced (hybrid) model In-house fleet management Others |

| By Geographic Coverage | Urban areas Suburban areas Rural areas Nationwide coverage Others |

| By Vehicle Type | Light-duty vehicles (cars, vans) Heavy-duty vehicles (trucks, buses) Electric vehicles (EVs, hybrids) Specialized vehicles (refrigerated, hazardous goods) Others |

| By Pricing Model | Fixed pricing Variable pricing Subscription-based pricing Pay-per-use pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Fleet Management | 100 | Fleet Managers, Operations Directors |

| Retail Logistics Outsourcing | 90 | Supply Chain Managers, Procurement Heads |

| Healthcare Transportation Services | 50 | Logistics Coordinators, Facility Managers |

| Technology Integration in Fleet Management | 60 | IT Managers, Fleet Technology Specialists |

| Sustainability Practices in Fleet Operations | 40 | Sustainability Officers, Compliance Managers |

The Japan Fleet Management Outsourcing Market is valued at approximately USD 1.7 billion, reflecting a significant growth driven by the demand for operational efficiency, cost reduction, and advanced technologies like telematics and AI.