Region:Global

Author(s):Dev

Product Code:KRAD0477

Pages:94

Published On:August 2025

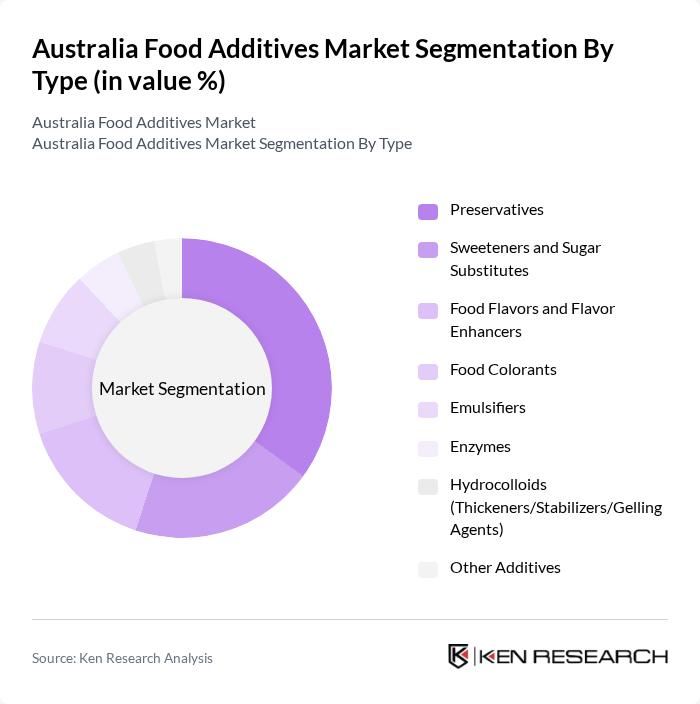

By Type:The food additives market can be segmented into various types, including preservatives, sweeteners and sugar substitutes, food flavors and flavor enhancers, food colorants, emulsifiers, enzymes, hydrocolloids (thickeners/stabilizers/gelling agents), and other additives. Among these, preservatives are currently the leading sub-segment due to their essential role in extending the shelf life of food products and preventing spoilage. The increasing demand for convenience foods and ready-to-eat meals has further propelled the use of preservatives in the food industry.

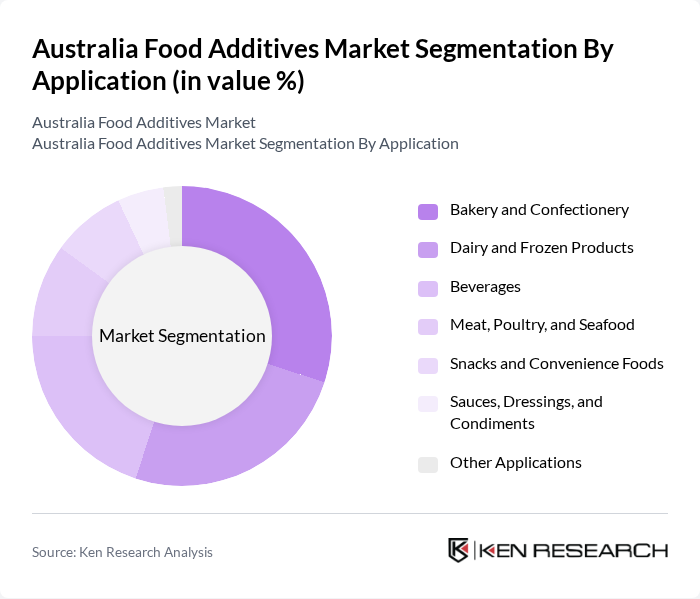

By Application:The applications of food additives are diverse, including bakery and confectionery, dairy and frozen products, beverages, meat, poultry, and seafood, snacks and convenience foods, sauces, dressings, and condiments, and other applications. The bakery and confectionery segment is currently the most significant application area, driven by the growing demand for baked goods and sweet treats. The trend towards healthier options has also led to innovations in this segment, with manufacturers seeking to enhance flavor and texture while reducing sugar content.

The Australia Food Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company (ADM), Cargill, Incorporated, BASF SE, DuPont de Nemours, Inc. (incl. IFF for flavors & fragrances), Ingredion Incorporated, Tate & Lyle PLC, Kerry Group plc, Ajinomoto Co., Inc., Givaudan SA, Sensient Technologies Corporation, Chr. Hansen Holding A/S (now part of Novonesis for biosolutions), DSM-Firmenich AG, Symrise AG, Corbion N.V., Bundaberg Sugar Ltd (Wilmar Sugar Australia) – food-grade sweeteners contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia food additives market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for clean label products continues to rise, manufacturers are likely to invest in research and development to create innovative, health-focused additives. Additionally, the expansion of e-commerce platforms is expected to facilitate greater access to diverse food products, enhancing market reach and consumer engagement. This dynamic environment will foster growth opportunities for both established and emerging players in the food additives sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Preservatives Sweeteners and Sugar Substitutes Food Flavors and Flavor Enhancers Food Colorants Emulsifiers Enzymes Hydrocolloids (Thickeners/Stabilizers/Gelling Agents) Other Additives |

| By Application | Bakery and Confectionery Dairy and Frozen Products Beverages Meat, Poultry, and Seafood Snacks and Convenience Foods Sauces, Dressings, and Condiments Other Applications |

| By End-User | Food and Beverage Manufacturers Foodservice (HORECA) Retail and Private Label Producers Household/Consumer |

| By Distribution Channel | Direct/B2B (Manufacturers and Distributors) Specialty Chemical Suppliers Online B2B Platforms Retail/Wholesale |

| By Formulation | Liquid Powder Granular |

| By Packaging Type | Bulk Industrial Packaging (Drums, IBCs, Sacks) Foodservice Packaging Retail Packaging Sustainable/Eco-friendly Packaging |

| By Price Range | Economy Mid-range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Sector | 120 | Production Managers, Quality Assurance Officers |

| Retail Food Outlets | 100 | Store Managers, Category Buyers |

| Consumer Health and Nutrition | 80 | Nutritionists, Dietitians |

| Food Regulatory Bodies | 50 | Regulatory Affairs Specialists, Compliance Officers |

| Food Additive Suppliers | 70 | Sales Managers, Product Development Leads |

The Australia Food Additives Market is valued at approximately USD 1.25 billion, reflecting a significant growth trend driven by the increasing demand for processed foods and innovations in food technology.