Region:Global

Author(s):Geetanshi

Product Code:KRAC0012

Pages:97

Published On:August 2025

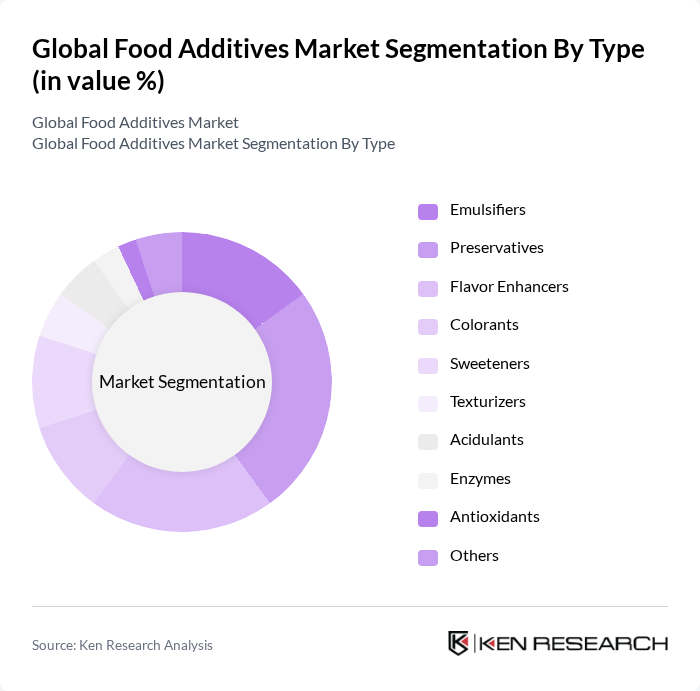

By Type:The food additives market is segmented into various types, including emulsifiers, preservatives, flavor enhancers, colorants, sweeteners, texturizers, acidulants, enzymes, antioxidants, and others. Among these,preservativesandflavor enhancersare particularly dominant due to their essential roles in extending shelf life and enhancing taste, respectively. The increasing consumer preference for convenience foods and ready-to-eat meals has further propelled the demand for these additives, as they play a crucial role in maintaining food quality, safety, and sensory appeal.

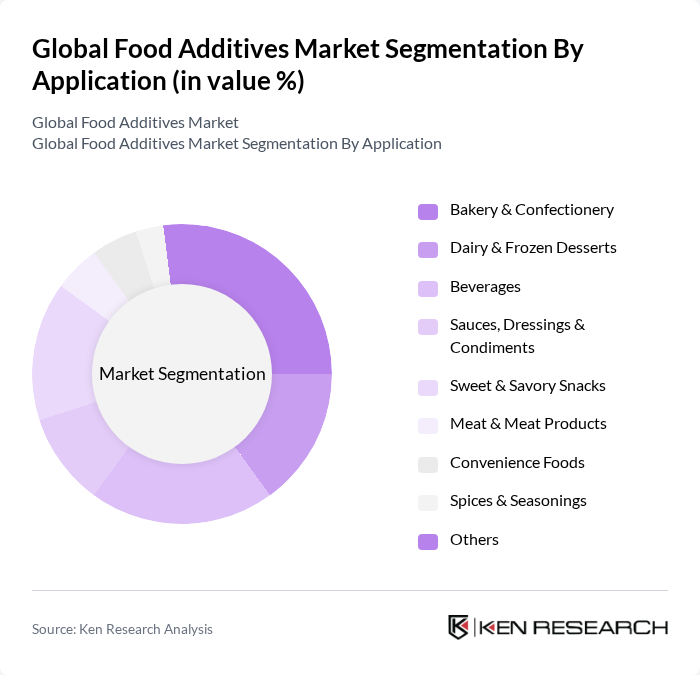

By Application:The food additives market is also segmented by application, which includes bakery & confectionery, dairy & frozen desserts, beverages, sauces, dressings & condiments, sweet & savory snacks, meat & meat products, convenience foods, spices & seasonings, and others. Thebakery & confectionerysegment is leading due to the high demand for baked goods and confections, which require various additives for texture, flavor, and preservation. The growing trend of snacking and the expansion of the beverage industry are also boosting demand for additives in sweet and savory snacks and beverages.

The Global Food Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company, BASF SE, Cargill, Incorporated, DuPont de Nemours, Inc., Ingredion Incorporated, Kerry Group plc, Tate & Lyle PLC, Ajinomoto Co., Inc., Givaudan SA, Sensient Technologies Corporation, Emsland Group, Chr. Hansen Holding A/S, Naturex S.A., DSM-Firmenich AG, Corbion N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the food additives market in Nigeria appears promising, driven by evolving consumer preferences and technological advancements. As the demand for clean label products continues to rise, manufacturers are likely to invest in research and development to create innovative, natural alternatives. Additionally, the expansion into emerging markets presents significant growth potential, as rising disposable incomes and changing dietary habits create new opportunities for food additive applications in diverse food products.

| Segment | Sub-Segments |

|---|---|

| By Type | Emulsifiers Preservatives Flavor Enhancers Colorants Sweeteners Texturizers Acidulants Enzymes Antioxidants Others |

| By Application | Bakery & Confectionery Dairy & Frozen Desserts Beverages Sauces, Dressings & Condiments Sweet & Savory Snacks Meat & Meat Products Convenience Foods Spices & Seasonings Others |

| By End-User | Food Manufacturers Beverage Producers Retailers Food Service Providers Households Others |

| By Distribution Channel | Direct Sales Online Retail Supermarkets/Hypermarkets Specialty Stores Convenience Stores Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, U.K., Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, Rest of APAC) South America (Brazil, Rest of South America) Middle East & Africa (UAE, South Africa, Rest of MEA) |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Liquid Powder Granular Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Sector | 100 | Production Managers, Quality Control Specialists |

| Food Retail and Distribution | 60 | Supply Chain Managers, Category Buyers |

| Regulatory Compliance | 40 | Compliance Officers, Food Safety Inspectors |

| Consumer Insights | 80 | Market Researchers, Consumer Behavior Analysts |

| Food Technology and Innovation | 50 | Food Scientists, R&D Managers |

The Global Food Additives Market is valued at approximately USD 120 billion, driven by the increasing demand for processed foods, consumer awareness regarding food safety, and the trend towards clean label and natural ingredient products.