Region:Global

Author(s):Rebecca

Product Code:KRAE2930

Pages:80

Published On:February 2026

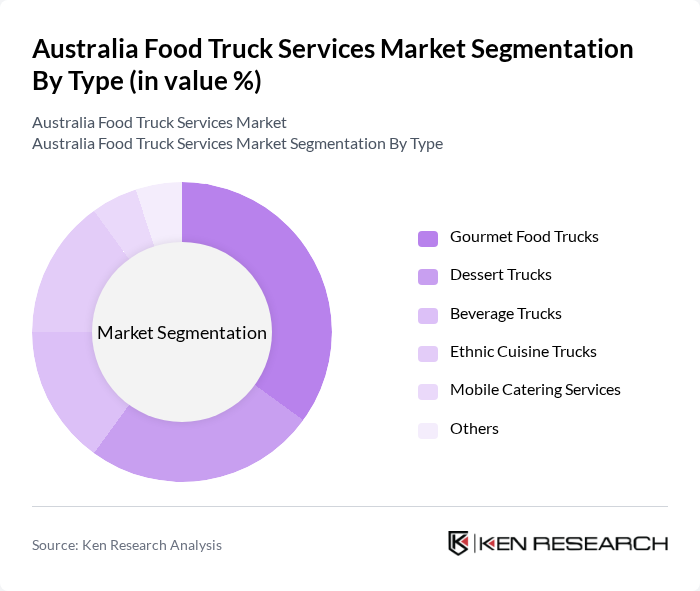

By Type:The food truck services market is segmented into various types, including gourmet food trucks, dessert trucks, beverage trucks, ethnic cuisine trucks, mobile catering services, and others. Among these, gourmet food trucks have gained significant popularity due to the increasing consumer preference for high-quality, unique food experiences. Dessert trucks also attract a considerable customer base, especially at events and festivals, where sweet treats are in high demand. Beverage trucks are becoming increasingly popular as consumers seek refreshing options, particularly in urban areas. The ethnic cuisine segment is thriving as Australia’s multicultural population drives demand for diverse culinary experiences. Mobile catering services are also on the rise, catering to corporate events and private parties, providing convenience and variety. Overall, the market is characterized by a dynamic mix of offerings that cater to diverse consumer preferences.

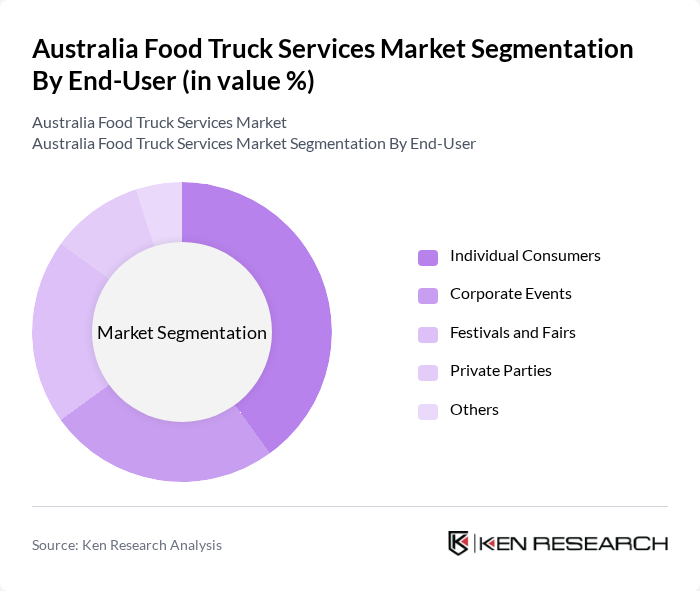

By End-User:The end-user segmentation includes individual consumers, corporate events, festivals and fairs, private parties, and others. Individual consumers represent a significant portion of the market, driven by the growing trend of street food and casual dining experiences. Corporate events are also a key segment, as businesses increasingly opt for food trucks to cater to their events, providing a unique dining experience for employees and clients. Festivals and fairs are prime locations for food trucks, attracting large crowds and offering diverse food options. Private parties are another growing segment, as consumers seek convenient catering solutions for gatherings. Overall, the end-user market is diverse, with each segment contributing to the overall growth of food truck services.

The Australia Food Truck Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mr. Spriggins, Taco Truck, The Food Truck Co., Dosa Hut, Beatbox Kitchen, The Doughnut Project, The Coffee Emporium, The Fish & Chip Shop, The Burger Truck, The Gelato Cart, The Pizza Wagon, The BBQ Bus, The Vegan Van, The Crepe Cart, The Smoothie Stop contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian food truck market appears promising, driven by evolving consumer preferences and technological advancements. As more consumers seek unique dining experiences, food trucks are expected to diversify their offerings, including plant-based and health-conscious options. Additionally, the integration of mobile ordering and payment technologies will enhance customer convenience, potentially increasing sales. The market is likely to see further growth as food trucks capitalize on these trends while navigating regulatory challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Gourmet Food Trucks Dessert Trucks Beverage Trucks Ethnic Cuisine Trucks Mobile Catering Services Others |

| By End-User | Individual Consumers Corporate Events Festivals and Fairs Private Parties Others |

| By Location | Urban Areas Suburban Areas Event Venues Tourist Attractions Others |

| By Cuisine Type | Australian Cuisine Asian Cuisine Mediterranean Cuisine American Cuisine Others |

| By Service Type | On-Site Catering Delivery Services Event Catering Others |

| By Payment Method | Cash Payments Card Payments Mobile Payments Others |

| By Marketing Channel | Social Media Marketing Event Sponsorship Word of Mouth Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Truck Operators | 100 | Owners, Managers |

| Customer Preferences | 150 | Regular Food Truck Customers, Casual Diners |

| Local Government Officials | 50 | Regulatory Officers, Licensing Authorities |

| Food Suppliers | 80 | Wholesale Distributors, Local Farmers |

| Community Stakeholders | 60 | Local Business Owners, Community Leaders |

The Australia Food Truck Services Market is valued at approximately USD 1.2 billion, reflecting a growing trend towards convenient dining options and diverse culinary experiences, particularly in urban centers like Sydney, Melbourne, and Brisbane.