Region:Asia

Author(s):Shubham

Product Code:KRAA5733

Pages:100

Published On:January 2026

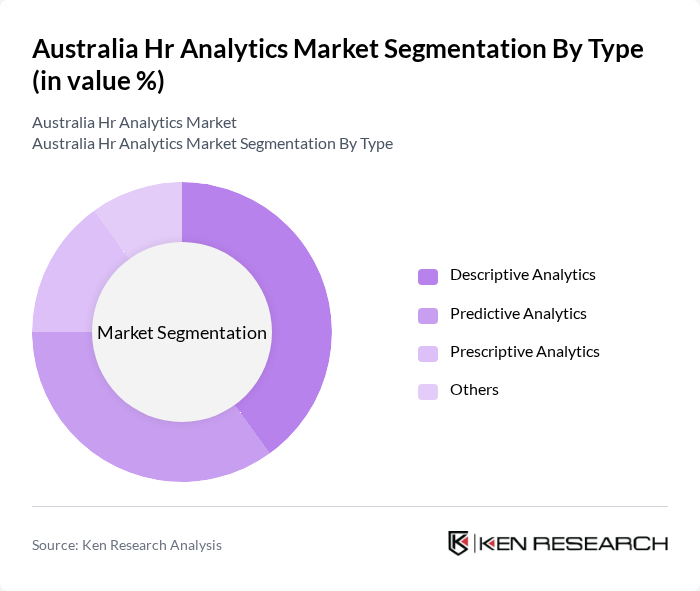

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, and Others. Each of these segments plays a crucial role in how organizations analyze and interpret HR data to make informed decisions.

Descriptive Analytics is currently the leading sub-segment in the market, as organizations increasingly rely on historical data to understand employee performance and engagement levels. This type of analytics provides insights into past trends, enabling HR departments to make informed decisions based on data. Predictive Analytics follows closely, as companies seek to forecast future trends and behaviors, allowing for proactive management of talent and resources.

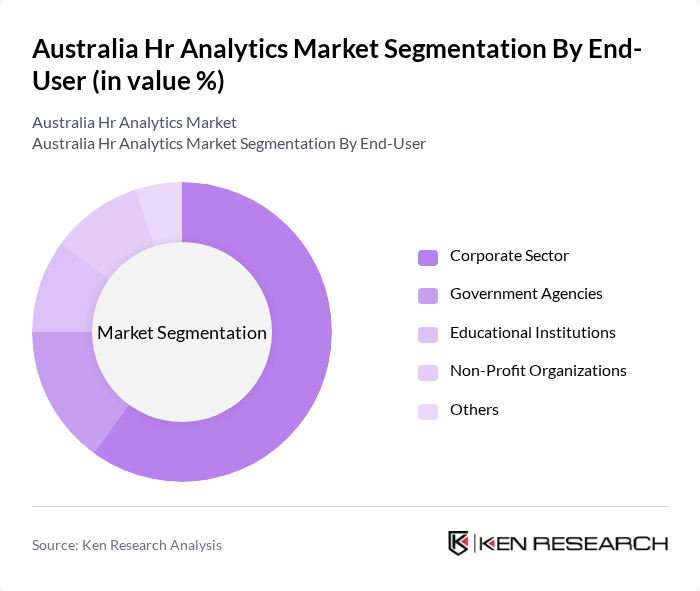

By End-User:The market is segmented by end-users, including Corporate Sector, Government Agencies, Educational Institutions, Non-Profit Organizations, and Others. Each segment has unique needs and applications for HR analytics.

The Corporate Sector dominates the market, driven by the need for efficient workforce management and enhanced employee performance. Companies are increasingly investing in HR analytics to streamline recruitment processes, improve employee retention, and enhance overall productivity. Government Agencies and Educational Institutions are also adopting HR analytics, but to a lesser extent, focusing on compliance and educational outcomes.

The Australia HR Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SuccessFactors, Workday, Oracle HCM Cloud, ADP, IBM Watson Talent, Cornerstone OnDemand, BambooHR, PeopleSoft, Ultimate Software, Ceridian Dayforce, Zoho People, Gusto, Sage People, Talentsoft, Visier contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian HR analytics market is poised for significant transformation, driven by advancements in technology and evolving workforce dynamics. As organizations increasingly prioritize employee experience and well-being, the demand for sophisticated analytics tools will rise. Furthermore, the integration of artificial intelligence and machine learning will enhance predictive capabilities, enabling HR departments to make more informed decisions. This evolution will likely lead to a more agile and responsive HR landscape, fostering innovation and improved employee engagement across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Others |

| By End-User | Corporate Sector Government Agencies Educational Institutions Non-Profit Organizations Others |

| By Industry Vertical | Healthcare Retail Manufacturing Financial Services Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Functionality | Recruitment Analytics Performance Management Analytics Learning and Development Analytics Others |

| By Company Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Geographic Region | New South Wales Victoria Queensland Western Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate HR Departments | 120 | HR Managers, Talent Acquisition Specialists |

| SMEs Utilizing HR Analytics | 100 | Business Owners, HR Consultants |

| HR Technology Vendors | 80 | Product Managers, Sales Directors |

| Public Sector HR Analytics | 70 | HR Directors, Policy Advisors |

| Industry Associations and Think Tanks | 60 | Research Analysts, Policy Makers |

The Australia HR Analytics Market is valued at approximately USD 100 million, reflecting a significant growth trend driven by the increasing adoption of data-driven decision-making in human resources and the integration of advanced technologies like AI and machine learning.