Region:Global

Author(s):Shubham

Product Code:KRAC0682

Pages:91

Published On:August 2025

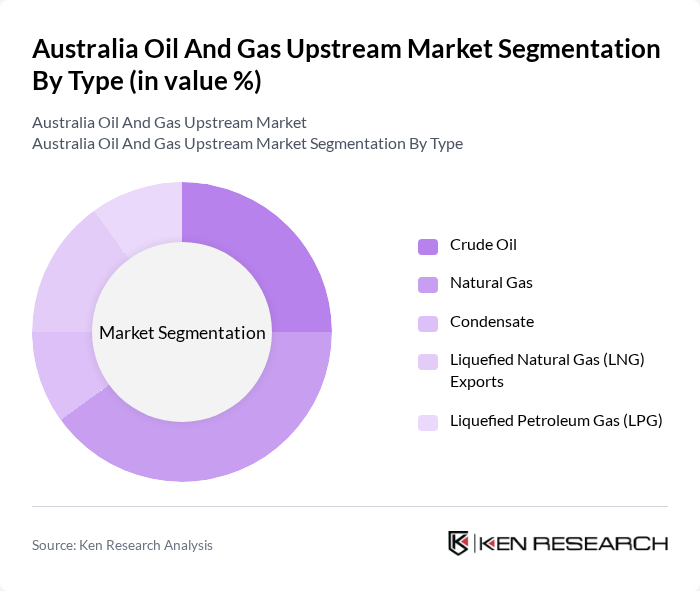

By Type:The market can be segmented into various types, including Crude Oil, Natural Gas, Condensate, Liquefied Natural Gas (LNG) Exports, and Liquefied Petroleum Gas (LPG). Each of these subsegments plays a crucial role in meeting domestic and international energy demands. Natural gas, in particular, has seen a surge in demand due to its cleaner-burning properties compared to coal and oil, making it a preferred choice for power generation and industrial applications.

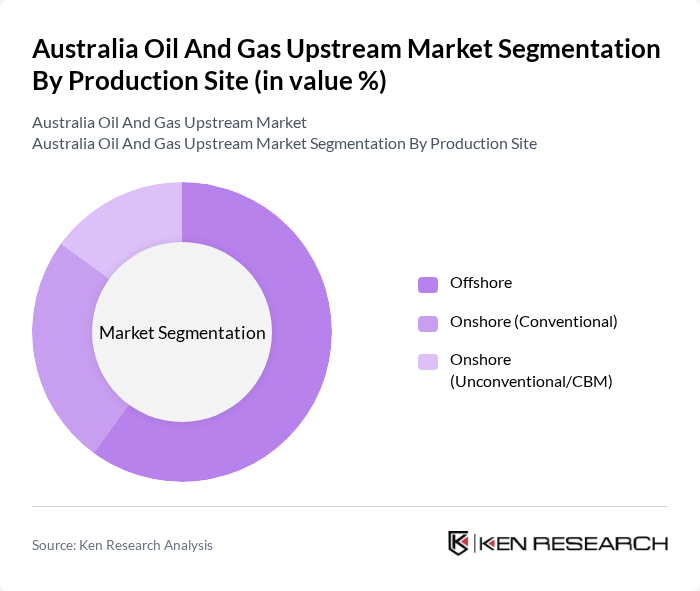

By Production Site:The production site segmentation includes Offshore, Onshore (Conventional), and Onshore (Unconventional/CBM). Offshore production is particularly significant in Australia due to the vast reserves located in the ocean, while onshore production, especially from coal seam gas, has gained traction in recent years. The choice of production site often depends on the geological characteristics and the economic viability of extraction methods.

The Australia Oil And Gas Upstream Market is characterized by a dynamic mix of regional and international players. Leading participants such as Woodside Energy Group Ltd, Santos Ltd, Beach Energy Ltd, Origin Energy Ltd, Chevron Australia Pty Ltd, ExxonMobil Australia Pty Ltd, Shell Australia Pty Ltd, BP Australia Pty Ltd, INPEX Australia Pty Ltd, TotalEnergies SE (Australia), Karoon Energy Ltd, Cooper Energy Ltd, Senex Energy Pty Ltd, Strike Energy Ltd, Vintage Energy Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian oil and gas upstream market appears promising, driven by technological advancements and a growing focus on sustainability. As companies increasingly adopt digital transformation strategies, operational efficiencies are expected to improve significantly. Furthermore, the integration of renewable energy sources into traditional oil and gas operations will likely enhance resilience against market fluctuations, positioning Australia as a leader in energy innovation and sustainability in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Crude Oil Natural Gas Condensate Liquefied Natural Gas (LNG) Exports Liquefied Petroleum Gas (LPG) |

| By Production Site | Offshore Onshore (Conventional) Onshore (Unconventional/CBM) |

| By Basin/Geology | North West Shelf/Offshore Carnarvon Basin (WA) Bonaparte & Browse Basins (WA/NT) Surat & Bowen Basins (QLD CSG) Gippsland & Otway Basins (VIC) Cooper & Eromanga Basins (SA/QLD) |

| By Activity | Exploration (Seismic, Wildcat Drilling) Development Drilling Production (Oil, Gas, Condensate) Decommissioning & Well Workovers |

| By Drilling Technology | Vertical Drilling Directional/Horizontal Drilling Hydraulic Fracturing Subsea Production Systems |

| By Operator Type | International Oil Companies (IOCs) National/State-affiliated and JV Operators Independent E&Ps |

| By Region | Western Australia Queensland Northern Territory Victoria South Australia |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Exploration Companies | 60 | CEOs, Exploration Managers |

| Gas Production Firms | 55 | Operations Directors, Production Engineers |

| Regulatory Bodies | 45 | Policy Makers, Environmental Analysts |

| Service Providers in Upstream Sector | 70 | Business Development Managers, Technical Consultants |

| Industry Associations | 40 | Research Analysts, Advocacy Directors |

The Australia Oil and Gas Upstream Market is valued at approximately USD 35 billion, reflecting significant growth driven by increasing energy demand and substantial investments in exploration and production activities.