Region:Asia

Author(s):Shubham

Product Code:KRAB0701

Pages:87

Published On:August 2025

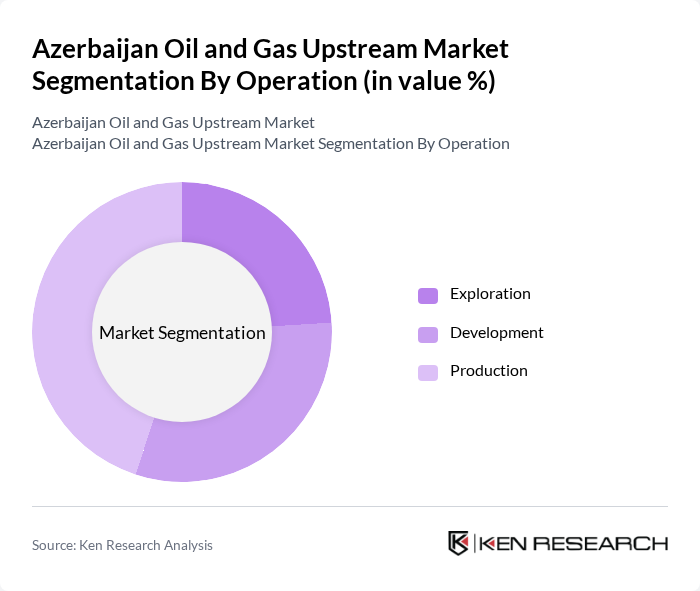

By Operation:The market is segmented into three main operations: Exploration, Development, and Production. Exploration involves the search for new oil and gas reserves, while Development focuses on preparing these reserves for production. Production is the final stage where extracted resources are processed and delivered to the market. TheProduction segmentis currently dominating the market due to high energy demand, ongoing projects in major fields like ACG and Shah Deniz, and the deployment of advanced recovery technologies .

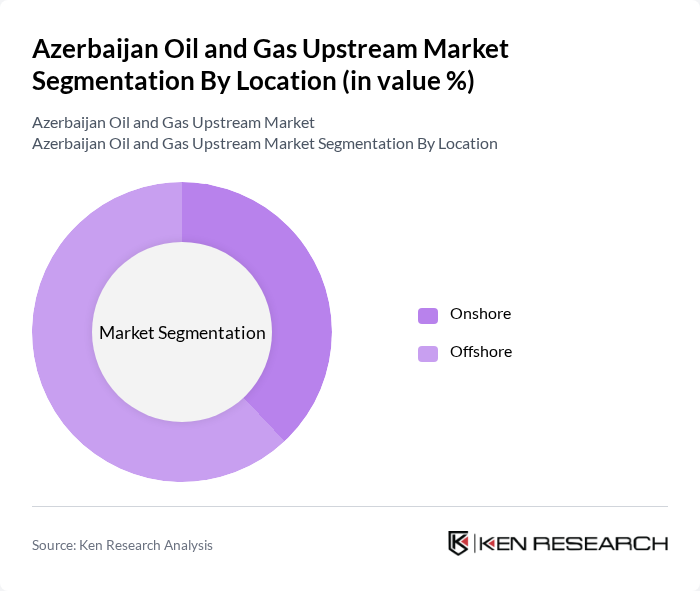

By Location:The market is divided into Onshore and Offshore locations. Onshore operations are primarily focused on land-based reserves, while Offshore operations target the rich hydrocarbon deposits in the Caspian Sea. TheOffshore segmentis leading the market due to recent discoveries, significant investments in offshore infrastructure, and the use of advanced deepwater extraction technologies .

The Azerbaijan Oil and Gas Upstream Market is characterized by a dynamic mix of regional and international players. Leading participants such as SOCAR (State Oil Company of Azerbaijan Republic), BP Azerbaijan, Chevron Azerbaijan, TotalEnergies Azerbaijan, Equinor Azerbaijan, Lukoil Azerbaijan, ExxonMobil Azerbaijan, Eni Azerbaijan, Petronas Azerbaijan, Wintershall Dea Azerbaijan, Dragon Oil Azerbaijan, OMV Petrom Azerbaijan, ACG (Azeri-Chirag-Gunashli Consortium), Shah Deniz Consortium, Caspian Drilling Company contribute to innovation, geographic expansion, and service delivery in this space.

The Azerbaijan oil and gas upstream market is poised for significant transformation as it navigates through regulatory reforms and environmental challenges. The focus on sustainable practices and technological advancements will likely drive operational efficiencies. Additionally, the increasing global demand for energy, coupled with Azerbaijan's strategic initiatives to enhance its infrastructure, positions the country as a key player in the energy sector. The government’s commitment to fostering partnerships with international oil companies will further bolster growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Operation | Exploration Development Production |

| By Location | Onshore Offshore |

| By Type | Crude Oil Natural Gas Condensates Others |

| By End-User | Power Generation Industrial Applications Transportation Others |

| By Region | Absheron Peninsula Gobustan Caspian Sea Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| By Pricing Strategy | Fixed Pricing Dynamic Pricing Competitive Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Exploration and Production Companies | 100 | CEOs, Operations Managers, Geologists |

| Service Providers in Upstream Sector | 60 | Business Development Managers, Technical Directors |

| Regulatory Bodies and Government Agencies | 40 | Policy Makers, Regulatory Affairs Specialists |

| Environmental Consultants | 50 | Sustainability Managers, Environmental Engineers |

| Financial Analysts and Investors | 50 | Investment Analysts, Portfolio Managers |

The Azerbaijan Oil and Gas Upstream Market is valued at approximately USD 28 billion, driven by the country's rich hydrocarbon resources, strategic location, and increasing foreign investments in exploration and production activities.