Region:Middle East

Author(s):Shubham

Product Code:KRAC0655

Pages:88

Published On:August 2025

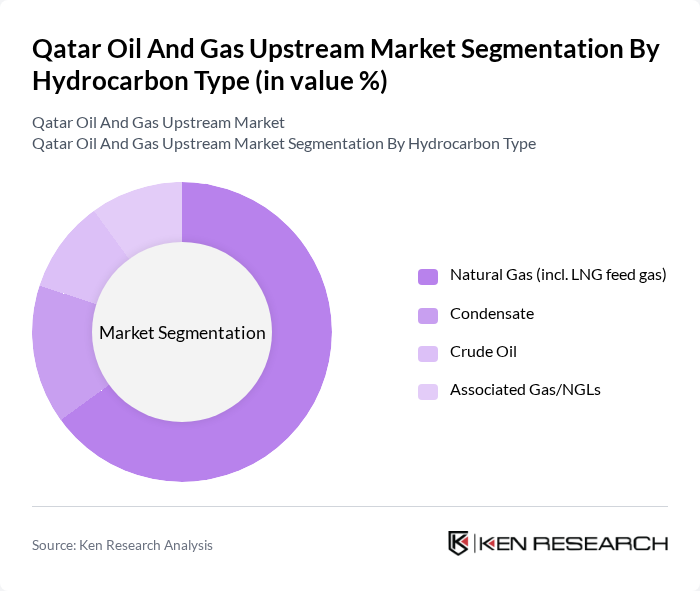

By Hydrocarbon Type:The hydrocarbon type segmentation includes Natural Gas (incl. LNG feed gas), Condensate, Crude Oil, and Associated Gas/NGLs. Natural gas, particularly LNG feed, dominates due to Qatar’s large North Field resources and LNG leadership, supported by global gas demand and its role as a transition fuel. Condensate and crude oil remain material, especially from offshore fields like Al?Shaheen where oil is accompanied by associated gas and NGL streams.

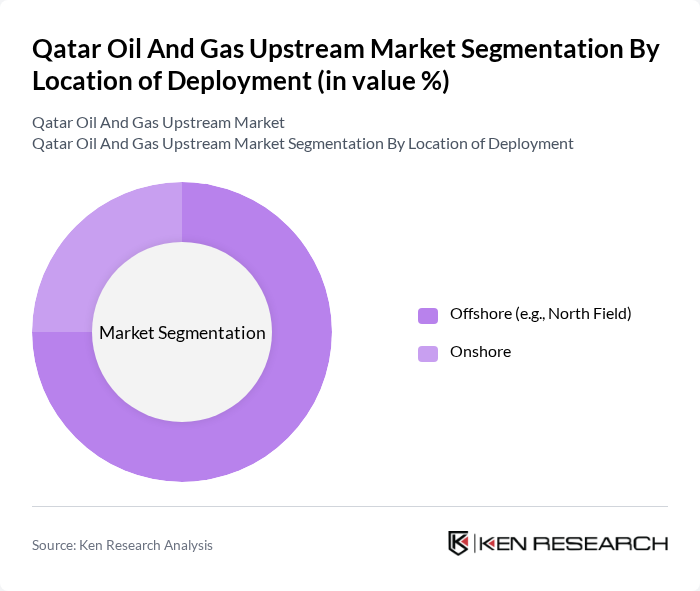

By Location of Deployment:The location of deployment segmentation includes Offshore (e.g., North Field) and Onshore. Offshore operations dominate due to the North Field’s scale and the concentration of major oil production at offshore fields such as Al?Shaheen, supported by sustained investment and IOC partnerships; onshore output is comparatively smaller and more oil?focused.

The Qatar Oil And Gas Upstream Market is characterized by a dynamic mix of regional and international players. Leading participants such as QatarEnergy, QatarEnergy LNG (formerly Qatargas), North Oil Company (QatarEnergy & TotalEnergies JV for Al?Shaheen), ExxonMobil, TotalEnergies, Shell, ConocoPhillips, Eni, Wintershall Dea, Occidental, Chevron Phillips Chemical Qatar (for upstream?linked condensate/NGL integration), Mitsui & Co., Ltd. (LNG/JV partner), Marubeni Corporation (LNG/JV partner), JERA Co., Inc. (offtake/JV partner), DNO ASA contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's oil and gas upstream market appears promising, driven by ongoing technological advancements and a commitment to sustainability. As the country enhances its LNG export capabilities, it is likely to solidify its position as a key player in the global energy landscape. Furthermore, strategic partnerships with international firms are expected to foster innovation and investment, ensuring that Qatar remains competitive in a rapidly evolving market. The focus on decarbonization initiatives will also shape the sector's trajectory, aligning with global energy transition goals.

| Segment | Sub-Segments |

|---|---|

| By Hydrocarbon Type | Natural Gas (incl. LNG feed gas) Condensate Crude Oil Associated Gas/NGLs |

| By Location of Deployment | Offshore (e.g., North Field) Onshore |

| By Basin/Field Cluster | North Field (North Field East, South, and Expansion) Al?Shaheen Dukhan Bul Hanine & Maydan Mahzam |

| By Upstream Activity | Exploration & Appraisal Development (drilling, well services) Production & Lifting Enhanced Oil Recovery/Reservoir Management |

| By Contracting/Operating Model | National Oil Company Operated (QatarEnergy and subsidiaries) Joint Ventures/PSAs with IOCs Service Contracts (EPC/EPIC, drilling, subsea) Independent/Partner?operated fields |

| By Capex Category | Drilling & Well Construction Subsurface/Seismic & Reservoir Studies Offshore Facilities & Subsea Production Facilities & Flowlines |

| By End Use of Produced Hydrocarbons | LNG Liquefaction Feedstock Domestic Power & Industry Export Pipelines/Petrochemicals Feedstock Condensate/NGLs to Refining & Trading |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Exploration and Production Companies | 100 | CEOs, Operations Managers |

| Drilling Services Providers | 80 | Technical Directors, Project Managers |

| Oilfield Equipment Manufacturers | 70 | Product Development Managers, Sales Directors |

| Regulatory Bodies and Government Agencies | 50 | Policy Makers, Regulatory Affairs Managers |

| Consulting Firms Specializing in Oil & Gas | 60 | Industry Analysts, Market Researchers |

The Qatar Oil and Gas Upstream Market is valued at approximately USD 27 billion, reflecting the country's significant natural gas reserves in the North Field and sustained global demand for LNG, alongside ongoing investments in technology and efficiency programs.