Region:Asia

Author(s):Geetanshi

Product Code:KRAB5129

Pages:84

Published On:October 2025

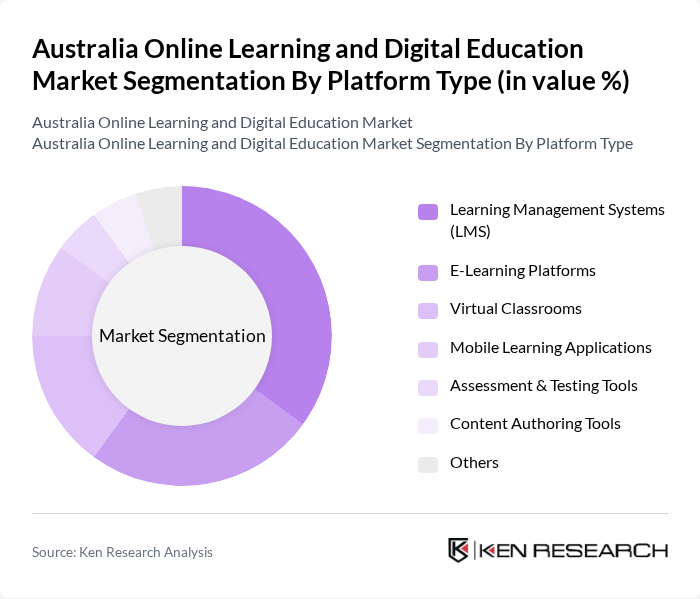

By Platform Type:The platform type segmentation includes various subsegments such as Learning Management Systems (LMS), E-Learning Platforms, Virtual Classrooms, Mobile Learning Applications, Assessment & Testing Tools, Content Authoring Tools, and Others. Among these, Learning Management Systems (LMS) are leading the market due to their comprehensive features that facilitate course management, tracking, and reporting, making them essential for educational institutions and corporate training programs. Recent trends indicate strong growth in mobile learning applications and game-based learning platforms, driven by increased smartphone penetration and demand for interactive, flexible learning experiences .

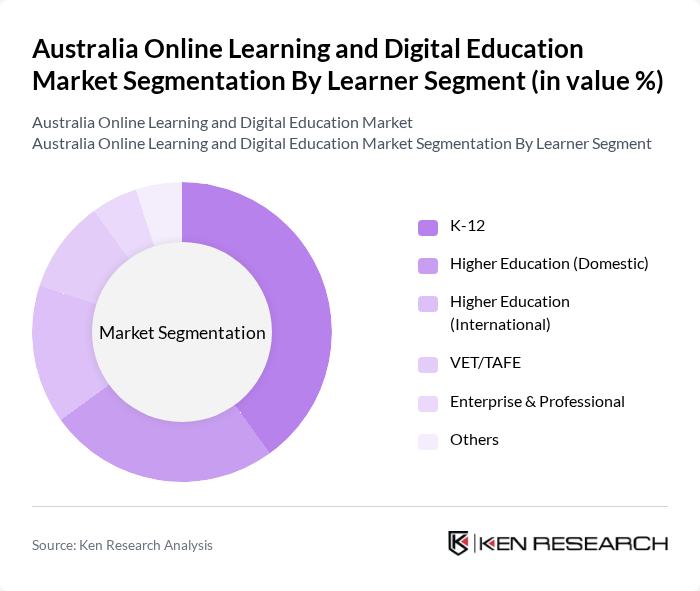

By Learner Segment:The learner segment includes K-12, Higher Education (Domestic), Higher Education (International), VET/TAFE, Enterprise & Professional, and Others. The K-12 segment is currently dominating the market, driven by the increasing integration of technology in schools and the growing demand for personalized learning experiences. Schools are increasingly adopting online platforms to enhance student engagement and facilitate remote learning. The enterprise and professional segment is also witnessing notable growth due to the rising need for upskilling and compliance training in corporate environments .

The Australia Online Learning and Digital Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as OpenLearning, Go1, Janison, Open Universities Australia, TAFE NSW, Coursera, Udemy, LinkedIn Learning, Blackboard, Moodle, Canvas (Instructure), FutureLearn, EdX, Pluralsight, Open Colleges Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online learning and digital education market in Australia appears promising, driven by technological advancements and evolving learner preferences. As institutions increasingly adopt innovative teaching methods, such as gamification and AI-driven personalization, the educational landscape will continue to transform. Additionally, the growing emphasis on lifelong learning will likely encourage more individuals to pursue online education, ensuring that the market remains dynamic and responsive to the needs of learners and employers alike.

| Segment | Sub-Segments |

|---|---|

| By Platform Type | Learning Management Systems (LMS) E-Learning Platforms Virtual Classrooms Mobile Learning Applications Assessment & Testing Tools Content Authoring Tools Others |

| By Learner Segment | K-12 Higher Education (Domestic) Higher Education (International) VET/TAFE Enterprise & Professional Others |

| By Delivery Modality | Synchronous Learning Asynchronous Learning Blended/Hybrid Learning Self-Paced Learning Others |

| By Subject Domain | Academic Subjects Vocational & Technical Training Professional & Corporate Skills Test Preparation Others |

| By Credential Type | Degree Programs Micro-Credentials & Short Courses Certificates & Diplomas Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Institutional Licensing Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Others (ACT, Tasmania, Northern Territory) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Higher Education Online Programs | 120 | University Deans, Online Program Coordinators |

| K-12 Digital Learning Platforms | 100 | School Administrators, Curriculum Developers |

| Vocational Training Online Courses | 80 | Training Managers, Course Instructors |

| EdTech Product Development | 70 | Product Managers, Educational Technologists |

| Student Experience in Online Learning | 120 | Current Online Students, Alumni |

The Australia Online Learning and Digital Education Market is valued at approximately USD 12 billion, reflecting significant growth driven by the adoption of digital technologies, flexible learning solutions, and the increasing acceptance of online certifications among employers.