Region:Asia

Author(s):Shubham

Product Code:KRAA6505

Pages:97

Published On:January 2026

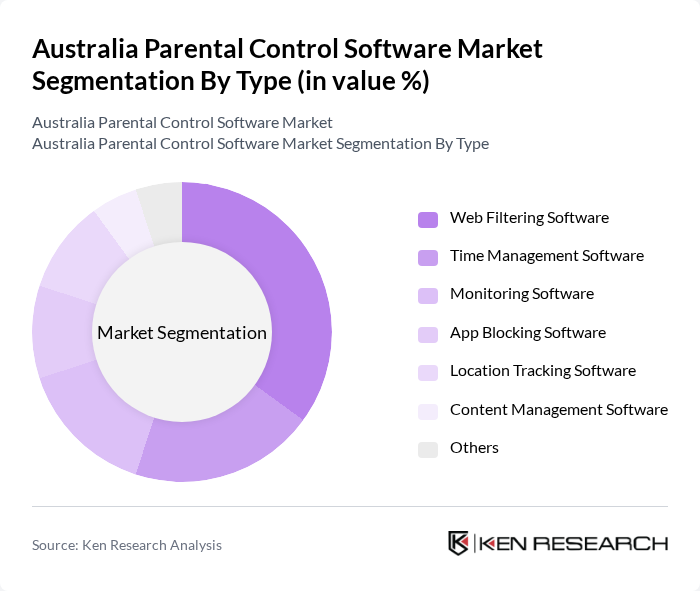

By Type:The market is segmented into various types of parental control software, including Web Filtering Software, Time Management Software, Monitoring Software, App Blocking Software, Location Tracking Software, Content Management Software, and Others. Among these, Web Filtering Software is the most dominant segment, as it allows parents to restrict access to inappropriate content, ensuring a safer online environment for children. The increasing prevalence of harmful online content has driven parents to prioritize web filtering solutions, making it a critical component of parental control software.

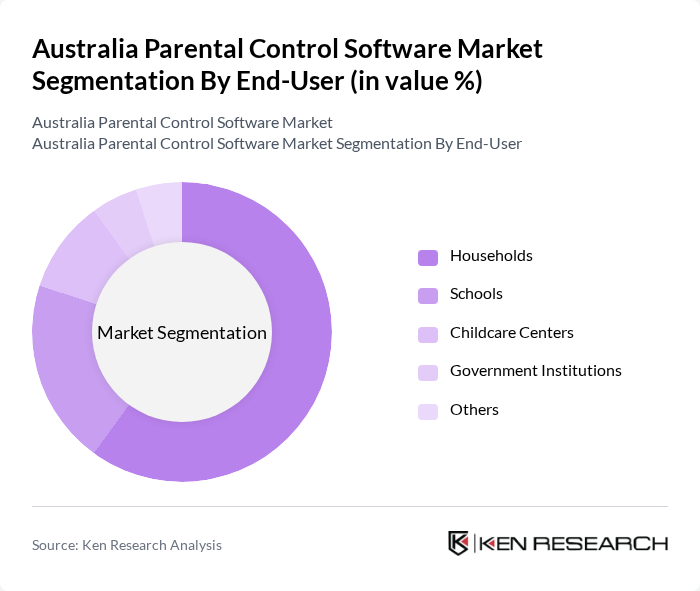

By End-User:The end-user segmentation includes Households, Schools, Childcare Centers, Government Institutions, and Others. Households represent the largest segment, as parents are increasingly investing in parental control software to safeguard their children from online dangers. The growing awareness of digital threats and the need for monitoring children's online activities have made households the primary consumers of these solutions.

The Australia Parental Control Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as NortonLifeLock, Qustodio, Net Nanny, Kaspersky Lab, McAfee, FamilyTime, Bark Technologies, Circle Media Labs, FamiSafe, KidLogger, Screen Time Labs, Kidgy, OurPact, Safe Lagoon, Boomerang Parental Control contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian parental control software market appears promising, driven by technological advancements and evolving consumer needs. As families increasingly prioritize online safety, the integration of AI and machine learning into parental control solutions is expected to enhance user experience and effectiveness. Additionally, the growing trend of remote learning will likely sustain demand for these tools, as parents seek comprehensive solutions to monitor their children's online activities across multiple devices, ensuring a safer digital environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Web Filtering Software Time Management Software Monitoring Software App Blocking Software Location Tracking Software Content Management Software Others |

| By End-User | Households Schools Childcare Centers Government Institutions Others |

| By Device Type | Smartphones Tablets Laptops Desktops Gaming Consoles Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Partnerships with ISPs Others |

| By Subscription Model | Monthly Subscription Annual Subscription One-Time Purchase Freemium Model Others |

| By Age Group | Children (0-5 years) Children (6-12 years) Teenagers (13-18 years) Others |

| By Geographic Region | New South Wales Victoria Queensland Western Australia South Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Parental Control Software Users | 120 | Parents of children aged 5-18 |

| Software Developers in EdTech | 45 | Product Managers, Software Engineers |

| Child Psychologists and Educators | 60 | School Counselors, Teachers |

| IT Decision Makers in Schools | 50 | IT Managers, School Administrators |

| Consumer Advocacy Groups | 40 | Consumer Rights Advocates, Policy Makers |

The Australia Parental Control Software Market is valued at approximately USD 145 million, reflecting a significant growth driven by increasing concerns over children's online safety and the rise in internet usage among younger demographics.