Region:Middle East

Author(s):Shubham

Product Code:KRAA6503

Pages:83

Published On:January 2026

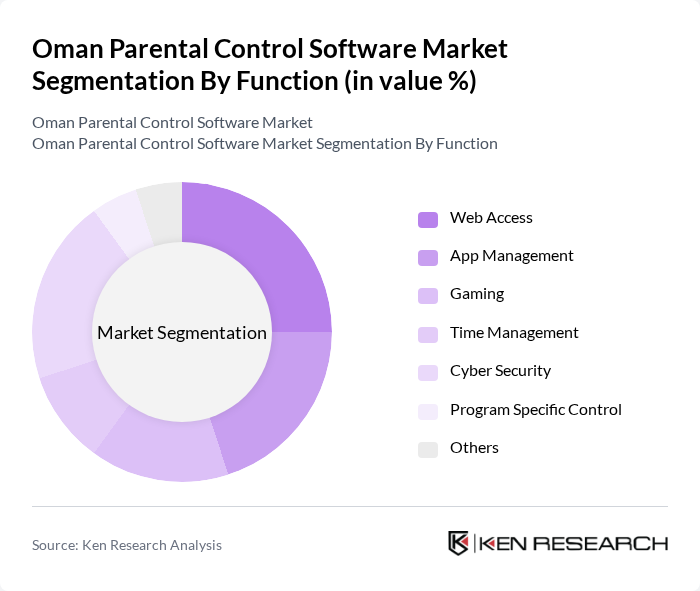

By Function:The market is segmented based on various functions that parental control software provides. The key functions include Web Access, App Management, Gaming, Time Management, Cyber Security, Program Specific Control, and Others. Each of these functions addresses specific needs of parents in monitoring and controlling their children's online activities.

The dominant function in the market is Web Access, which accounts for a significant portion of the market share. This is primarily due to the increasing need for parents to monitor their children's online activities and restrict access to inappropriate websites. As children spend more time online, parents are increasingly concerned about their exposure to harmful content, making Web Access a critical feature in parental control software. The demand for effective web filtering solutions continues to grow, driven by heightened awareness of online safety.

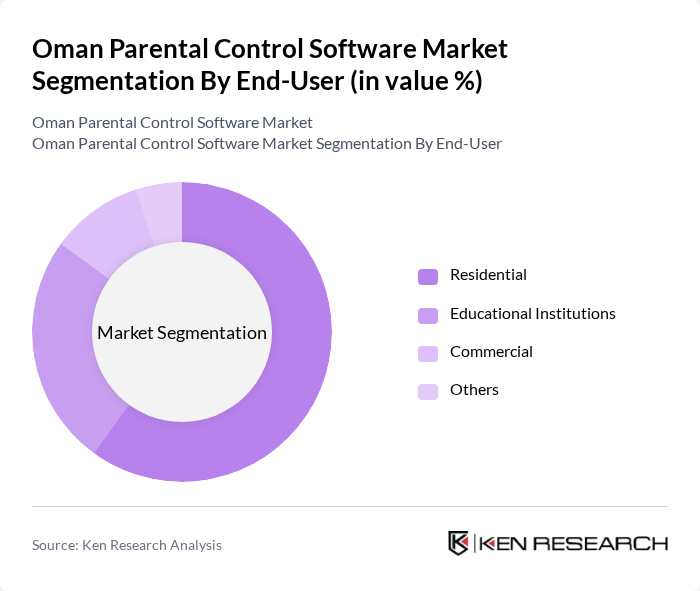

By End-User:The market is segmented based on end-users, which include Residential, Educational Institutions, Commercial, and Others. Each segment has unique requirements and usage patterns for parental control software.

The Residential segment leads the market, accounting for the majority of the share. This dominance is attributed to the growing number of families with children who are increasingly exposed to digital devices and the internet. Parents are actively seeking solutions to safeguard their children from online dangers, making residential users the primary consumers of parental control software. The increasing trend of remote learning and online gaming has further fueled the demand in this segment.

The Oman Parental Control Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qustodio, Norton Family, Kaspersky Safe Kids, Net Nanny, Bark, FamilyTime, KidLogger, Mobicip, FamiSafe, Screen Time, OurPact, Circle with Disney, Safe Lagoon, Kidgy, WebWatcher contribute to innovation, geographic expansion, and service delivery in this space.

The Oman parental control software market is poised for significant evolution, driven by technological advancements and increasing digital engagement among children. As parents become more aware of online risks, the demand for innovative solutions that incorporate AI and machine learning is expected to rise. Additionally, partnerships with educational institutions will likely enhance the credibility and reach of these solutions, fostering a safer online environment for children and promoting responsible internet usage.

| Segment | Sub-Segments |

|---|---|

| By Function | Web Access App Management Gaming Time Management Cyber Security Program Specific Control Others |

| By End-User | Residential Educational Institutions Commercial Others |

| By Device Type | Smartphones Computers and Video Games Tablets Digital Television Others |

| By Deployment Mode | Cloud-Based On-Premises Others |

| By Pricing Model | Free Basic Premium Others |

| By Operating System | Android iOS Windows macOS Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Parental Control Software Users | 120 | Parents of children aged 5-18 |

| Educators and School Administrators | 100 | Teachers, School Counselors, IT Coordinators |

| Child Psychologists and Counselors | 80 | Child Development Specialists, Family Therapists |

| Software Developers in EdTech | 70 | Product Managers, Software Engineers |

| Cybersecurity Experts | 60 | Cybersecurity Analysts, IT Security Managers |

The Oman Parental Control Software Market is valued at approximately USD 18 million, reflecting a growing demand for solutions that help parents protect their children from inappropriate content and cyber threats as internet usage increases.