Region:Middle East

Author(s):Shubham

Product Code:KRAA6597

Pages:82

Published On:January 2026

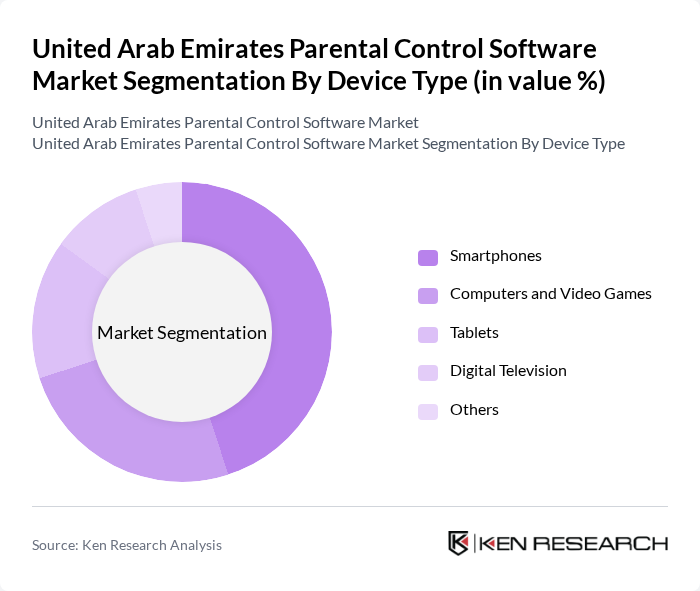

By Device Type:The market is segmented into various device types, including smartphones, computers and video games, tablets, digital television, and others. Among these, smartphones are the leading segment due to their ubiquitous presence and the increasing reliance on mobile devices for internet access. The growing trend of mobile gaming and social media usage among children further drives the demand for parental control solutions on smartphones. Following smartphones, computers and video games also hold significant market share as they are commonly used for educational and entertainment purposes.

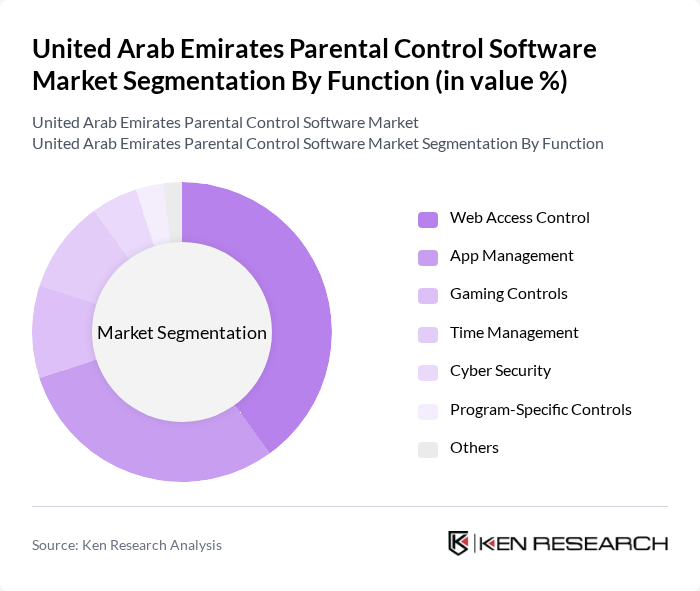

By Function:The market is also segmented based on the functions offered by parental control software, including web access control, app management, gaming controls, time management, cyber security, program-specific controls, and others. Web access control is the dominant function, as it allows parents to filter and monitor online content effectively. The increasing prevalence of inappropriate content online has heightened the need for robust web access control solutions. App management follows closely, as parents seek to manage and restrict app usage to ensure their children's safety and well-being.

The United Arab Emirates Parental Control Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qustodio LLC, Kaspersky Lab, McAfee LLC, Symantec Corporation, D-Link Corporation, Sandvine, Secucloud Network GmbH, AT&T Inc., Omantel, Bark Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the parental control software market in the UAE appears promising, driven by technological advancements and increasing awareness of online safety. As parents become more educated about digital risks, the demand for sophisticated monitoring tools is expected to rise. Additionally, the integration of artificial intelligence and machine learning will enhance the effectiveness of these solutions, providing tailored experiences for users. Companies that prioritize user-friendly interfaces and robust security features will likely lead the market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Smartphones Computers and Video Games Tablets Digital Television Others |

| By Function | Web Access Control App Management Gaming Controls Time Management Cyber Security Program-Specific Controls Others |

| By Deployment | On-Premise Cloud-Based |

| By Pricing Model | Free Basic Premium Others |

| By Operating System | Android iOS Windows macOS Linux Others |

| By End User | Residential Educational Institutions Commercial |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Parental Control Software Users | 150 | Parents of children aged 5-18 |

| Educational Institutions | 100 | School Administrators, IT Managers |

| Child Psychologists | 50 | Child Development Experts, Therapists |

| Software Developers | 75 | Product Managers, Software Engineers |

| Consumer Advocacy Groups | 30 | Consumer Rights Advocates, Researchers |

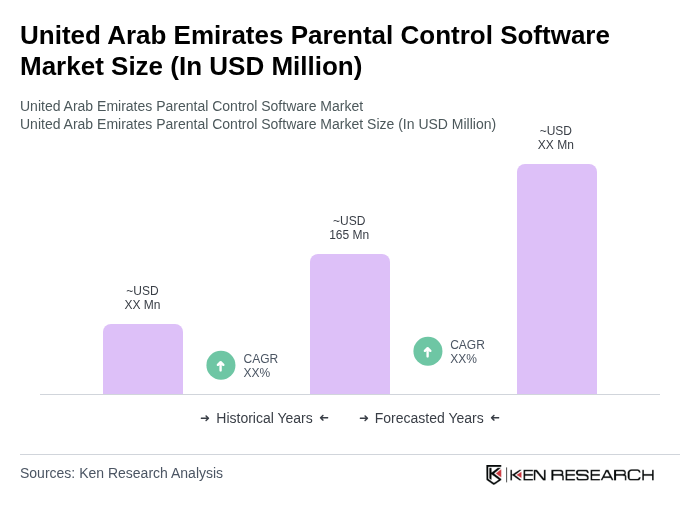

The United Arab Emirates Parental Control Software Market is valued at approximately USD 165 million, reflecting significant growth driven by increased internet penetration and rising concerns over online safety for children.