Region:Global

Author(s):Rebecca

Product Code:KRAB2852

Pages:90

Published On:October 2025

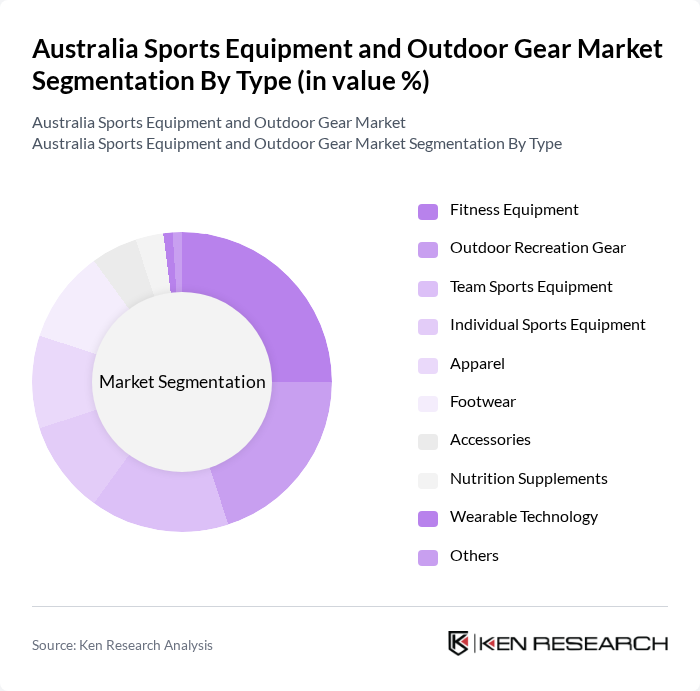

By Type:The market is segmented into various types of products, including fitness equipment, outdoor recreation gear, team sports equipment, individual sports equipment, apparel, footwear, accessories, nutrition supplements, wearable technology, and others. Each sub-segment caters to different consumer needs and preferences, reflecting the diverse interests in sports and outdoor activities. Fitness equipment remains the largest segment, driven by the popularity of home workouts, gym memberships, and advancements in smart fitness technology. Outdoor recreation gear is also significant, supported by the growing interest in camping, hiking, and adventure sports .

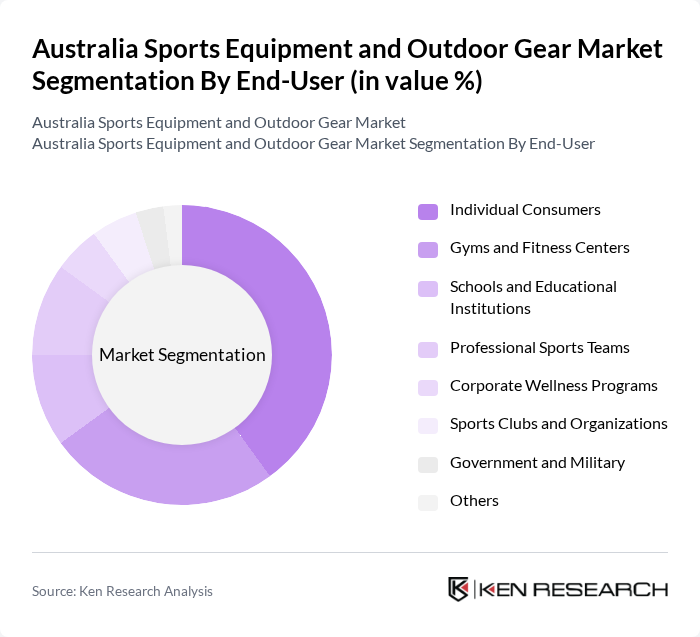

By End-User:The end-user segmentation includes individual consumers, gyms and fitness centers, schools and educational institutions, professional sports teams, corporate wellness programs, sports clubs and organizations, government and military, and others. This segmentation highlights the diverse applications of sports equipment and outdoor gear across various sectors. Individual consumers represent the largest share, reflecting the strong culture of personal fitness and recreational activity in Australia. Gyms and fitness centers are also significant buyers, followed by educational institutions and professional teams .

The Australia Sports Equipment and Outdoor Gear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas Australia Pty Ltd., Puma Australia Pty Ltd., Super Retail Group Limited, Decathlon (Australia) Pty Ltd., The North Face, Inc., Columbia Sportswear Company, Asics Oceania Pty Ltd., Kookaburra Sport Pty Ltd., Kathmandu Holdings Limited, Lorna Jane Pty Ltd., Lululemon Athletica Inc., Wilson Sporting Goods Co., New Balance Athletics, Inc., Gymshark Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia sports equipment and outdoor gear market appears promising, driven by ongoing trends in health consciousness and technological advancements. As more Australians prioritize fitness, the demand for innovative and high-quality gear is expected to rise. Additionally, the integration of smart technology into sports equipment will likely enhance user experience, further stimulating market growth. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Outdoor Recreation Gear Team Sports Equipment Individual Sports Equipment Apparel Footwear Accessories Nutrition Supplements Wearable Technology Others |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Educational Institutions Professional Sports Teams Corporate Wellness Programs Sports Clubs and Organizations Government and Military Others |

| By Sales Channel | Online Retail Specialty Stores Department Stores Direct Sales Wholesale Distributors Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Quality-Focused Customers First-Time Buyers Others |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage |

| By Distribution Mode | Direct Distribution Indirect Distribution Hybrid Distribution |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Sports Equipment | 60 | Store Managers, Sales Representatives |

| Outdoor Gear Consumer Insights | 50 | Outdoor Enthusiasts, Recreational Users |

| Market Trends in Sports Apparel | 40 | Brand Managers, Product Designers |

| Impact of E-commerce on Sports Equipment Sales | 55 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Preferences in Outdoor Activities | 45 | Active Lifestyle Participants, Fitness Coaches |

The Australia Sports Equipment and Outdoor Gear Market is valued at approximately AUD 12.3 billion, reflecting a significant growth trend driven by increased health consciousness and outdoor activities among consumers.