Region:Asia

Author(s):Rebecca

Product Code:KRAB2871

Pages:82

Published On:October 2025

By Type:

The Fitness Equipment segment leads the market, propelled by a surge in home workouts, the expansion of fitness centers, and the popularity of online fitness programs. Cardiovascular and strength training equipment are particularly in demand among consumers seeking to maintain health and fitness. The influence of fitness influencers, digital workout platforms, and increased awareness of the health benefits of regular exercise have driven investments in fitness equipment by both individuals and commercial gyms .

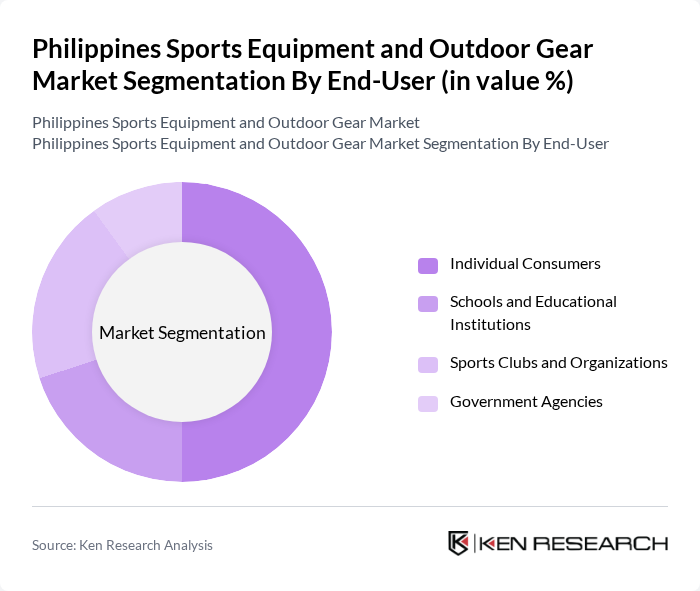

By End-User:

Individual Consumers constitute the largest end-user segment, reflecting a nationwide trend toward personal fitness and wellness. The proliferation of health-conscious individuals, coupled with the growth of home-based exercise and digital fitness platforms, has increased demand for sports equipment and outdoor gear for personal use. Schools and educational institutions remain significant contributors as they invest in sports programs and facilities, while sports clubs, organizations, and government agencies drive demand through team sports and community initiatives .

The Philippines Sports Equipment and Outdoor Gear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Decathlon Philippines, Toby's Sports, Sports Central, Nike Philippines, Adidas Philippines, Under Armour Philippines, Columbia Sportswear Philippines, The North Face Philippines, Mizuno Philippines, Asics Philippines, Salomon Philippines, Wilson Sporting Goods, Head Sports, K-Swiss Philippines, Skechers Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines sports equipment and outdoor gear market appears promising, driven by increasing health consciousness and government initiatives supporting sports development. As disposable incomes rise, consumers are likely to invest more in quality sports gear. Additionally, the trend towards sustainable products and smart technology in sports equipment is expected to gain traction, aligning with global market trends. The focus on community sports events will further enhance engagement and participation, fostering a vibrant market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Outdoor Gear Team Sports Equipment Individual Sports Equipment Accessories Apparel Others |

| By End-User | Individual Consumers Schools and Educational Institutions Sports Clubs and Organizations Government Agencies |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers First-Time Buyers |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage |

| By Distribution Mode | Direct Distribution Indirect Distribution Hybrid Distribution |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Equipment Sales | 120 | Store Managers, Sales Representatives |

| Outdoor Gear Consumer Insights | 100 | Outdoor Enthusiasts, Adventure Tour Operators |

| Fitness Equipment Market Trends | 120 | Gym Owners, Fitness Trainers |

| Sports Apparel Purchasing Behavior | 80 | Fashion Retailers, Sportswear Designers |

| Market Trends in E-commerce for Sports Gear | 90 | E-commerce Managers, Digital Marketing Specialists |

The Philippines Sports Equipment and Outdoor Gear Market is valued at approximately USD 570 million, reflecting a significant growth trend driven by increased health consciousness and a rising interest in fitness and outdoor activities among the population.