Region:Europe

Author(s):Rebecca

Product Code:KRAB2853

Pages:87

Published On:October 2025

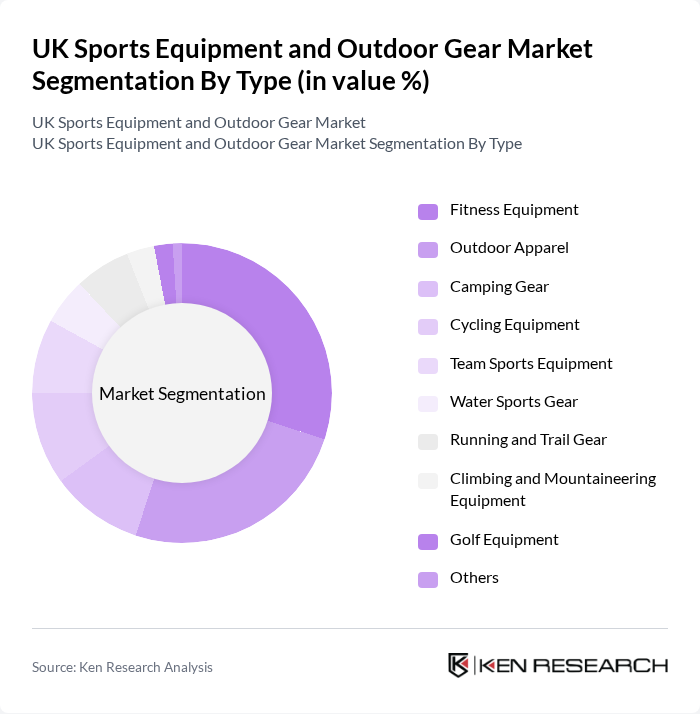

By Type:The market is segmented into various types of sports equipment and outdoor gear, including fitness equipment, outdoor apparel, camping gear, cycling equipment, team sports equipment, water sports gear, running and trail gear, climbing and mountaineering equipment, golf equipment, and others. Among these, fitness equipment and outdoor apparel are particularly dominant due to the increasing trend of home workouts and outdoor activities, respectively. Consumers are increasingly investing in high-quality gear that enhances their performance and comfort. The segmentation reflects broader European trends, where fitness and lifestyle-oriented categories see the strongest growth.

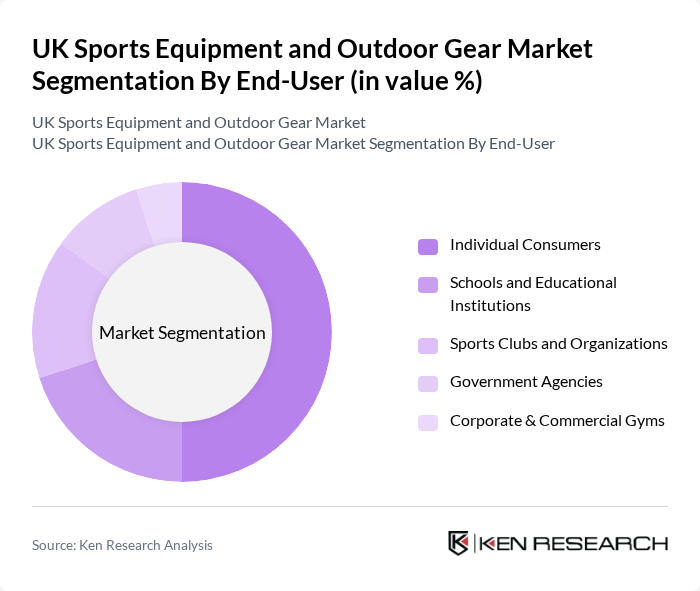

By End-User:The end-user segmentation includes individual consumers, schools and educational institutions, sports clubs and organizations, government agencies, and corporate & commercial gyms. Individual consumers represent the largest segment, driven by the growing trend of personal fitness and outdoor activities. Schools and educational institutions also contribute significantly, as they invest in sports equipment to promote physical education and extracurricular activities.

The UK Sports Equipment and Outdoor Gear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Decathlon S.A., Sports Direct International plc, JD Sports Fashion plc, The North Face (VF Corporation), Adidas AG, Nike, Inc., Under Armour, Inc., Puma SE, Columbia Sportswear Company, Merrell (Wolverine World Wide, Inc.), Mountain Hardwear (Columbia Sportswear Company), Salomon (Amer Sports Corporation), Osprey Europe Ltd., Berghaus Limited, Rab (Equip Outdoor Technologies Ltd.), Blacks Outdoor Retail Ltd., Cotswold Outdoor (Outdoor and Cycle Concepts Ltd.), Mountain Warehouse Ltd., Ellis Brigham Ltd., Go Outdoors Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The UK sports equipment and outdoor gear market is poised for growth, driven by increasing health consciousness and a rising interest in outdoor activities. As consumers seek innovative and sustainable products, companies are likely to invest in eco-friendly materials and smart technologies. Additionally, the expansion of e-commerce platforms will facilitate greater access to diverse product offerings, enhancing consumer engagement. Overall, the market is expected to adapt to changing consumer preferences while navigating economic challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Outdoor Apparel Camping Gear Cycling Equipment Team Sports Equipment Water Sports Gear Running and Trail Gear Climbing and Mountaineering Equipment Golf Equipment Others |

| By End-User | Individual Consumers Schools and Educational Institutions Sports Clubs and Organizations Government Agencies Corporate & Commercial Gyms |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Specialty Sports Shops Wholesale Distributors Direct-to-Consumer (DTC) Brand Stores |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers First-Time Buyers |

| By Product Lifecycle Stage | New Products Growth Stage Products Mature Products |

| By Usage Frequency | Daily Users Weekly Users Occasional Users Rare Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Sports Equipment Retailers | 120 | Store Managers, Sales Directors |

| Outdoor Gear Manufacturers | 80 | Product Development Managers, Marketing Heads |

| Consumer Insights on Sports Participation | 150 | Active Sports Participants, Outdoor Enthusiasts |

| Fitness and Wellness Trends | 60 | Fitness Trainers, Wellness Coaches |

| Market Trends in E-commerce | 100 | E-commerce Managers, Digital Marketing Specialists |

The UK Sports Equipment and Outdoor Gear Market is valued at approximately GBP 11.3 billion, reflecting a significant growth driven by increasing health consciousness and a rise in outdoor activities among consumers.