Region:Global

Author(s):Shubham

Product Code:KRAA1877

Pages:92

Published On:August 2025

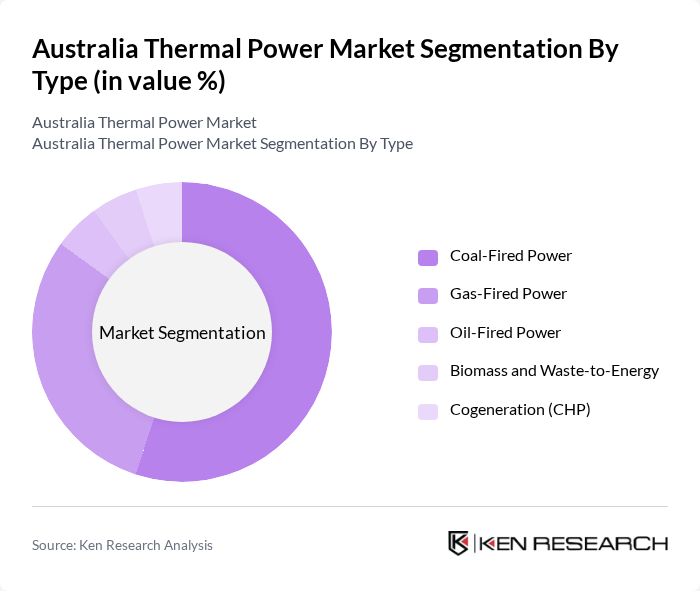

By Type:The thermal power market can be segmented into various types, including coal-fired power, gas-fired power, oil-fired power, biomass and waste-to-energy, and cogeneration (CHP). Coal-fired power has historically been the dominant source due to legacy infrastructure and low fuel costs, particularly in New South Wales and Queensland; however, its share is declining as ageing units retire and emissions policies tighten. Gas-fired power is gaining traction for flexible, fast-start generation to support renewable integration and peak demand, while oil-fired units are limited and typically used for backup; biomass and waste-to-energy remain niche but present in selected industrial and municipal projects .

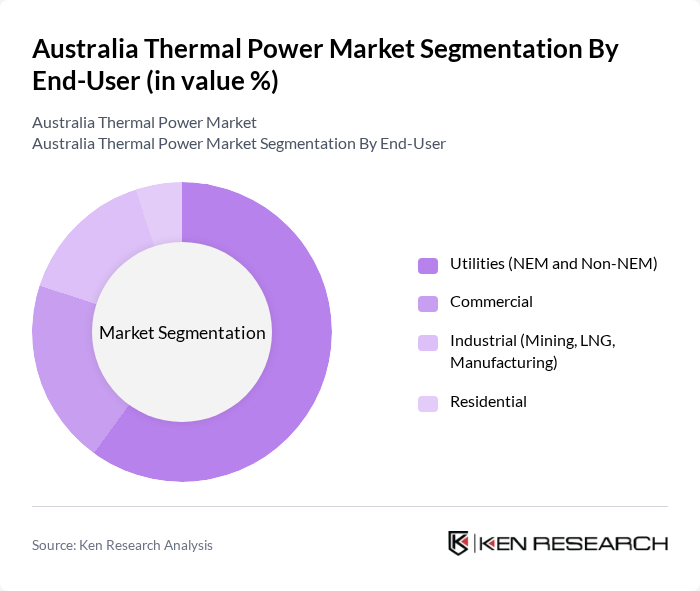

By End-User:The end-user segmentation includes utilities (NEM and Non-NEM), commercial, industrial (mining, LNG, manufacturing), and residential sectors. The utilities segment is the largest consumer of thermal power, reflecting scheduled dispatch in the NEM and state systems to meet reliability standards and firm variable renewable output. The industrial sector is a significant user of onsite and grid-supplied thermal power, especially in mining operations, alumina/aluminum refining, and LNG processing hubs in Queensland and Western Australia; commercial consumption is tied to peak demand in metropolitan load centers, while direct residential reliance on thermal generation is indirect via retail supply .

The Australia Thermal Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as AGL Energy Limited, Origin Energy Limited, EnergyAustralia, Alinta Energy, Stanwell Corporation Limited, CS Energy Limited, Snowy Hydro Limited, Synergy (Electricity Generation and Retail Corporation, WA), ATCO Australia Pty Ltd, APA Group, Jemena, ENGIE Australia & New Zealand, Delta Electricity, Viva Energy (Geelong Energy Hub, Gas Terminal), Zenith Energy Pty Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia thermal power market is poised for transformation, driven by a combination of technological advancements and regulatory pressures. As the country moves towards a more sustainable energy framework, thermal power plants are expected to integrate hybrid solutions, combining traditional generation with renewable sources. This shift will be crucial in maintaining energy security while adhering to stringent emission targets. Furthermore, the focus on digital transformation in energy management will enhance operational efficiencies and reduce costs, positioning thermal power as a vital player in Australia’s energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Coal-Fired Power Gas-Fired Power Oil-Fired Power Biomass and Waste-to-Energy Cogeneration (CHP) |

| By End-User | Utilities (NEM and Non-NEM) Commercial Industrial (Mining, LNG, Manufacturing) Residential |

| By Application | Baseload Generation Peaking and Mid-merit Generation Backup/Reserve and Ancillary Services Combined Heat and Power (Process Steam) |

| By Investment Source | State-Owned Utilities and Corporations Private IPPs and Energy Retailers Public-Private Partnerships (PPP) Foreign Direct Investment (FDI) |

| By Policy/Market Mechanism | National Electricity Market (NEM) and Capacity/Auction Mechanisms Emissions Reduction and Safeguard Mechanism Renewable Energy Certificates (LGCs/STCs) Interaction Gas Security/Market Interventions and Fuel Supply Agreements |

| By Ownership/Operation | Vertically Integrated Gentailers State-Owned Generators Merchant IPPs Embedded/On-site Generators (Mines, LNG) |

| By Region | New South Wales Queensland Victoria South Australia Western Australia Tasmania Northern Territory Australian Capital Territory |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coal-Fired Power Generation | 95 | Plant Managers, Operations Directors |

| Gas-Fired Power Generation | 75 | Energy Analysts, Technical Managers |

| Regulatory Compliance and Policy Impact | 60 | Regulatory Affairs Specialists, Environmental Consultants |

| Thermal Power Market Trends | 85 | Market Researchers, Industry Experts |

| Investment and Financing in Thermal Power | 65 | Financial Analysts, Investment Managers |

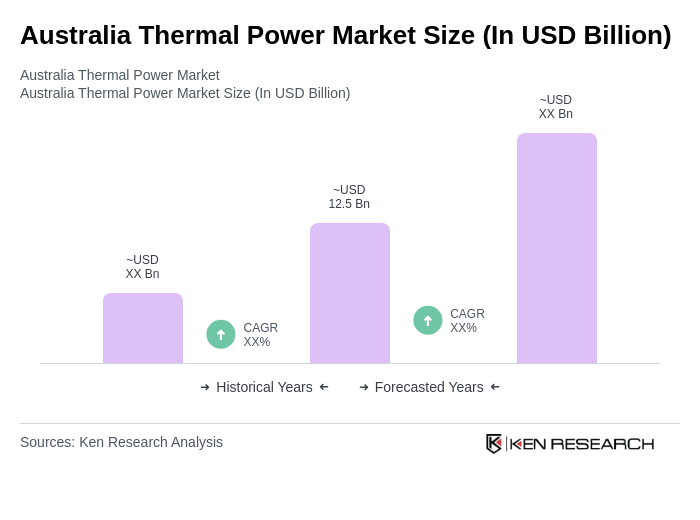

The Australia Thermal Power Market is valued at approximately USD 12.5 billion, reflecting the scale of coal- and gas-fired generation assets and wholesale market revenues. This valuation is based on a five-year historical analysis of the sector.