Region:North America

Author(s):Geetanshi

Product Code:KRAD0049

Pages:95

Published On:August 2025

By Type:The thermal power market can be segmented into coal, natural gas, oil, nuclear, biomass, waste-to-energy, geothermal, and others. Among these, natural gas has emerged as the dominant source due to its lower emissions compared to coal and its ability to provide reliable base-load and peak-load power. The shift towards cleaner energy sources, government incentives for natural gas infrastructure, and the phase-out of coal-fired generation have further solidified its position in the market .

By Technology:The thermal power market is also segmented by technology, including steam turbine, gas turbine, and combined cycle. Combined cycle technology leads the market due to its high efficiency and lower emissions, as it utilizes waste heat for additional power generation. This makes it the preferred choice for new thermal power plants and upgrades, especially in natural gas-fired facilities .

The Canada Thermal Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as TransAlta Corporation, Capital Power Corporation, Emera Inc., ATCO Power Ltd., Ontario Power Generation Inc., SaskPower International Inc., Northland Power Inc., Maxim Power Corp., AltaGas Ltd., Canadian Utilities Limited, Brookfield Renewable Partners L.P., Fortis Inc., Innergex Renewable Energy Inc., Hydro-Québec, Manitoba Hydro, Newfoundland and Labrador Hydro contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada thermal power market is poised for transformation, driven by a shift towards decarbonization and increased investment in energy efficiency. As the government intensifies its focus on reducing emissions, thermal power plants will likely adopt cleaner technologies. Additionally, the integration of smart grid solutions will enhance operational efficiency, enabling better management of energy resources. This evolving landscape presents opportunities for innovation and collaboration within the sector, ensuring its relevance in a rapidly changing energy environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Coal Natural Gas Oil Nuclear Biomass Waste-to-Energy Geothermal Others |

| By Technology | Steam Turbine Gas Turbine Combined Cycle |

| By End-User | Residential Commercial Industrial |

| By Application | Base Load Generation Peak Load Generation Backup Power Combined Heat and Power (CHP) |

| By Geography | Western Canada Central Canada Eastern Canada |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Provincial Energy Regulators | 60 | Regulatory Affairs Managers, Policy Analysts |

| Thermal Power Plant Operators | 50 | Plant Managers, Operations Supervisors |

| Energy Consultants | 40 | Energy Analysts, Market Strategists |

| Environmental Impact Assessors | 40 | Environmental Scientists, Compliance Officers |

| Utility Company Executives | 45 | CEOs, CFOs, Strategic Planning Directors |

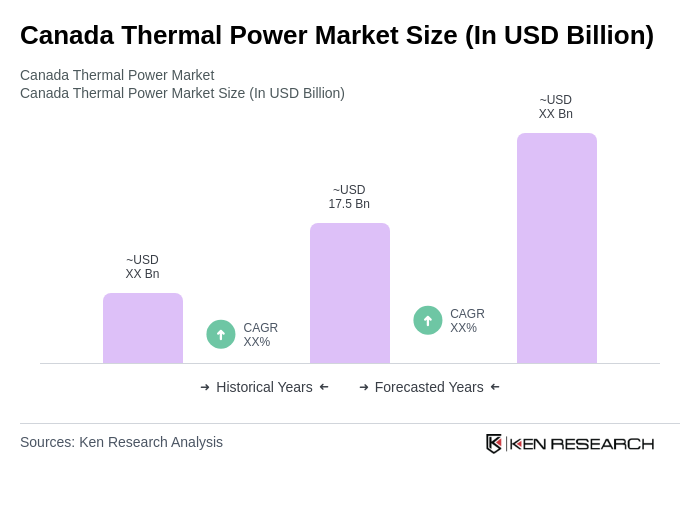

The Canada Thermal Power Market is valued at approximately USD 17.5 billion, reflecting a five-year historical analysis. This growth is driven by increasing energy demands and investments in modernizing infrastructure while transitioning to cleaner fuels.