Thailand Cold Chain Market Outlook to 2026F

Driven by Rising Import-Export Trade Volume and Domestic Consumption of Meat, Seafood and Popularity of Ready to Eat Frozen Processed Food

Region:Asia

Author(s):Sarthak Kaushik

Product Code:KR1257

November 2022

119

About the Report

Market Overview:

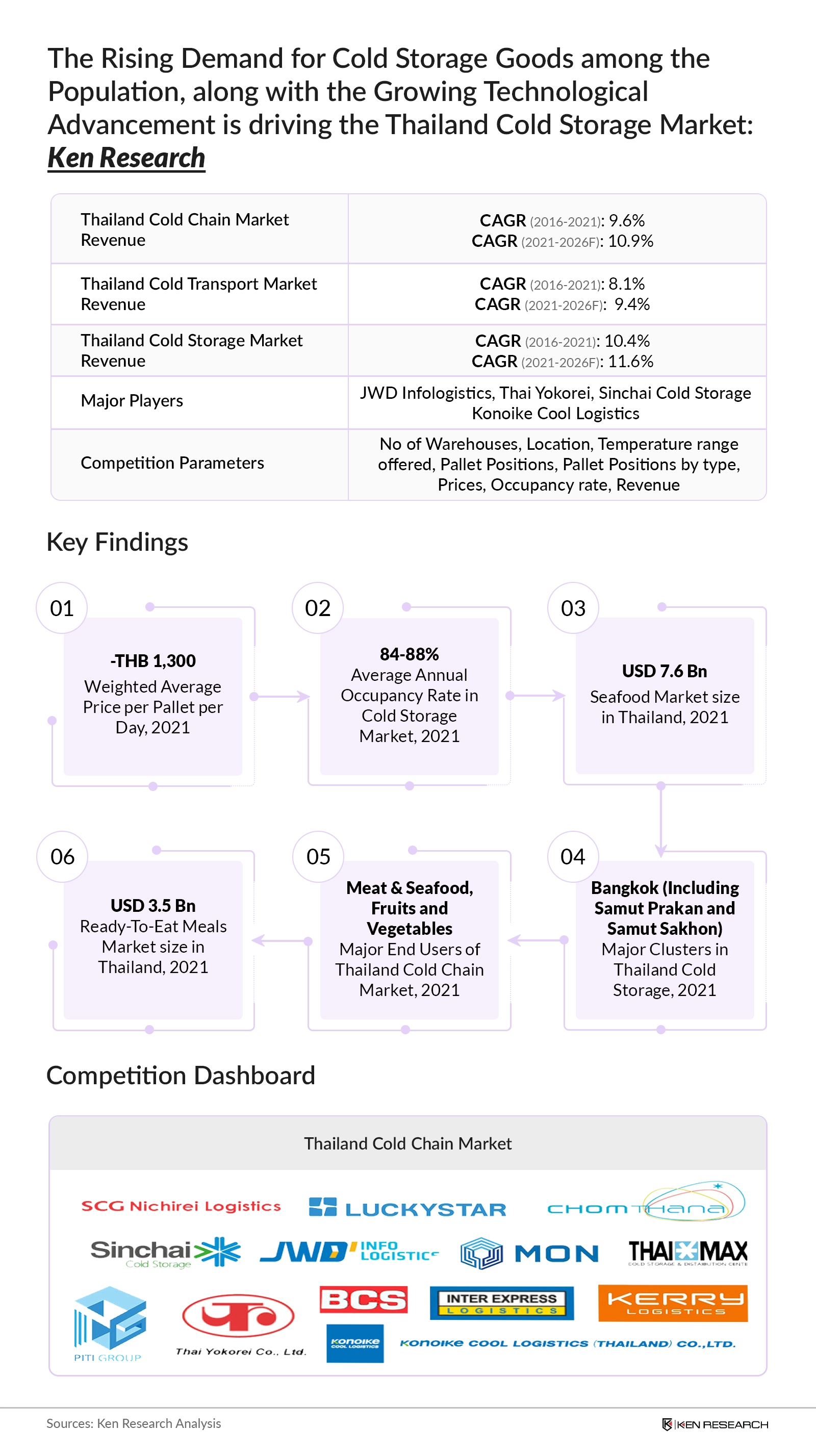

- The Thailand Cold Chain Industry comprises of Cold Storage and Cold Transport with presence of major companies such as JWD logistics, Thaimax, Yokorei and Interexpress Logistics operating in the market

- The Cold chain market is slightly consolidated with the presence of some big market leaders catering to main end users as Meat and Seafood, Fruits and Vegetables industry.

- Since the past decade, the Government is investing in Physical Infrastructure development of Thailand in terms of roads and Highways, Major seaport , airports development, Special Economic Zones

Key Trends by Market Segment:

By Temperature Range: The Thailand Cold Storage market is dominated by freezers and chillers owing to growing consumption and international trade of meat and sea food along with frozen ready-to-eat food items.

Competitive Landscape

Future Outlook

Scope of the Report

|

By Revenue |

Cold Chain Transport Cold Chain Storage |

|

By Ownership |

Owned Third Party Logistics |

|

By Temperature Range |

Ambient Frozen Chillers |

|

By End-User Application |

Meat and Seafood Fruits and Vegetables Dairy Products Bakery and Confectionary Pharmaceuticals Others |

|

By Region: |

Bangkok (Including Samut Prakan and Samut Sakhon) Chonburi ChiangMai Others |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

Banks and its Subsidiaries

Cold Chain Facilities Providers

Frozen products Distributors

Refrigerator Space Manufacturers

FMCG Distributers

FMCG Companies

Global Cold Chain Companies

Technology Companies

Tourism Agencies

Government Bodies & Regulating Authorities

Time Period Captured in the Report

Historical Period: 2016-2021

Base Period: 2021

Forecast Period: 2022-2026F

Companies

Major Players Mentioned in the Report

JWD Infologistics

Thai Yokorei co Ltd

Sinchai Cold Storage

Konoike Cool Logistics

SCG Nicherei Logistics

Thaimax Cold Storage

Table of Contents

1. Executive Summary

1.1 Executive Summary of Thailand Cold Chain Market

2. Country Overview and Infrastructure Analysis of Thailand

2.1 Country Overview of Thailand

2.2 Thailand Population Analysis, 2021

2.3 Cross Comparison of Quality of Infrastructure of ASEAN Countries

2.4 Infrastructure Overview of Thailand

2.5 Road Transport Overview

2.6 Air Transport Overview

2.7 Sea Transport Overview

3. Thailand Cold Chain Market Overview and Genesis

3.1 Thailand Cold Chain Industry Supply Ecosystem

3.2 Overview of Thailand Cold Chain Market

3.3 Understanding Value Chain of Thailand Cold Chain Industry

3.4 Major and Other Challenges in Thailand Cold Chain Market Value Chain

3.5 Existing Technologies in Thailand Cold Chain Market

3.6 Thailand Cold Chain Market Size, 2016-2021

3.7 Seasonality Trends in the Industry

4. Thailand Cold Chain Market Segmentation

4.1 Thailand Cold Chain Market Revenues by Cold Storage and Cold Transport, 2021

4.2 Thailand Cold Chain Market Revenues by Ownership (Owned and Third Party Logistics), 2021

4.3 Thailand Cold Chain Market Revenues by End Users (Meat & Sea Food, Fruits & Vegetables, Vaccines & Pharmaceuticals, Dairy Products & Others), 2021

5. Thailand Cold Storage Market Overview

5.1 Thailand Cold Storage Market Ecosystem

5.2 Warehouse Regional Cluster in Thailand

5.3 Thailand Cold Storage Market Size, 2016-2021

5.4 Thailand Cold Storage Market Size by Price and Occupancy Rate (in %), 2016- 2021

5.5 Thailand Cold Storage Market Segmentation by Temperature Range (Ambient, Frozen and Chillers), 2021

5.6 Thailand Cold Storage Market Segmentation by End Users (Meat & Sea Food, Fruits &Vegetables, Vaccines & Pharmaceuticals, Dairy Products and Others), 2021

5.6 Thailand Cold Storage Market Segmentation by Region (Bangkok(Including Samut Prakan), Chonburi, ChiangMai and Others), 2021

5.7 Thailand Cold Storage Market Segmentation by Level of Automation,2021

5.8 Benefits of Cold Storage Automation

6. Thailand Cold Transport Market Overview

6.1 Overview of Thailand Cold Transportation Industry

6.2 Value Chain Analysis of Thailand

6.3 Challenges and Opportunities in Thailand Cold transportation Market

6.4 Thailand Cold Transport Market Revenue, 2016-2021

6.5 Thailand Cold Transport Market Segmentation by Type of Reefer Truck (Reefer Vans, 20 foot reefers and 40 foot reefers), 2021

6.6 Thailand Cold Transport Market Segmentation by Mode of Transportation (Land, Sea and Air), 2021

6.7 Thailand Cold Transport Market Segmentation by Location (International and Domestic) & Vicinity (Intercity and Intracity), 2021

6.8 Thailand Cold Transport Market Segmentation by End Users (Meat & Sea Food, Fruits & Vegetables, Vaccines & Pharmaceuticals, Dairy Products, Frozen Processed Foods and Others) 2021

7. Thailand Cold Chain Market Competition Landscape

7.1 Market Positioning Analysis of Major Cold Chain Players in Thailand

7.2 Market Share of Major Cold Storage Players in Thailand

7.3 Recent Development in Cold Storage Players in Thailand

7.4 Cross Comparison of Thailand Cold Chain Market Players (Establishment Year, Services,

Industries Catered, No. of cold storages, Location of cold storages, Temperature Range

Offered, Total Pallets Positions, Occupancy Rates, Cold Transport Services, Certifications, Future Growth, Automation)

8. Thailand Cold Chain Industry Analysis

8.1 Decision making process for Thailand Cold Chain Market

8.2 SWOT Analysis of Thailand Cold Chain Market

8.3 Technological Advancements in the Thailand Cold Chain Market

8.4 Future Technological Trends in the Thailand Cold Chain Market

8.5 Growth drivers of the Thailand Chain Market

8.6 Issues and Challenges in the Thailand Cold Chain Market

8.7 Regulatory Landscape in Thailand Cold Chain Market

8.8 Tax tariff and incentives in Thailand

8.9 International Trade Agreements of Thailand

9. End User Analysis of Thailand Cold Chain Market

9.1 Key Temperature Controlled Products with different Shelf Lives

9.2 In-Depth Analysis for Cold Storage in Thailand

9.3 Thailand Meat and Seafood Market

9.4 Thailand Fruits and Vegetable Market

9.5 Thailand Ready to Eat Meals Market

9.6 Thailand Dairy Products Market

9.7 Thailand Pharmaceutical Market

10. Future Outlook of Thailand Cold Chain Industry

10.1 Future Market Sizing of Cold Chain Industry, 2021-2026F

10.2 Future Market Segmentation By Market Type and By Ownership (Owned and Third Party Logistics), 2026F

10.3 Future Market Segmentation By End User (Meat & Sea Food, Fruits & Vegetables, Vaccines &

Pharmaceuticals, Dairy Products, Frozen Processed Food & Others), 2026F

11. Future Outlook of Thailand Cold Storage Market

11.1 Future Cold Storage Market Sizing

11.2 Thailand Cold Storage Market Size by Pallets, Price and Occupancy Rate, 2026F

11.3 Thailand Cold Storage Market Segmentation by Temperature(Ambient, Frozen andChillers) and by End User (Meat & Sea Food, Fruits & Vegetables, Vaccines & Pharmaceuticals, Dairy Products & Others), 2026F

11.4 Thailand Cold Storage Market Segmentation by Automation and by Major Cities, 2026F

12. Future Outlook of Thailand Cold Transport Market

12.1 Thailand Cold Transport Market Revenue, 2021-2026F

12.2 Future Segmentation by Reefer Trucks (Reefer Vans, 20 foot reefers and 40 foot reefers) and Mode of Transportation (Land, Sea and Air), 2026F

12.3 Future Market Segmentation by Location (International and Domestic) & Vicinity (Intercity and Intracity), 2026F

12.4 Future Segmentation by End User (Meat & Sea Food, Fruits & Vegetables, Vaccines & Pharmaceuticals, Dairy Products, Frozen Processed Foods & Others), 2026F

13. Market Opportunities and Analyst Recommendations

13.1 Recommendations to set up a Cold Chain Unit in Thailand

13.2 Analyst Recommendations

13.3 Industry Speaks

14. Research Methodology

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Desk research to review the number of cold storage units/ambient warehouses, number of cold storage and ambient pallets, trading and production of products such as meat, seafood, fruits and vegetables, warehouses by location, financial and operating parameters for captive and non - captive companies

Step 3: Validating and Finalizing:

Conduct trade desk interviews via CATIs with the cold chain accreditation authorities and cold storage companies to understand their viewpoint on the current status of cold storage market, new cold storage and ambient warehousing units and end user perception, understanding the trends and challenges in the sector couple with assessing number of reefer trucks, temperature range, major end users and flow corridors.

Step 4: Research output:

We will be conducting disguised interviews with multiple cold chain companies to get their viewpoint around their operational and financial performance. This approach will support our team to validate the information that was shared by their top management with an objective to ensure data accuracy.

Frequently Asked Questions

01 What is the Study Period of this Market Report?

The Thailand Cold Chain Market is covered from 2016–2021 in this report, including a forecast for 2022-2026.

02 What is the Future Growth Rate of the Thailand Cold Chain Market?

The Thailand Cold Chain Market is expected to witness a CAGR of ~11% over the next four years.

03 What are the Key Factors Driving the Thailand Cold Chain Market?

Change in Lifestyle and Urbanization led to Rising Domestic Consumption of Processed food. Increasing domestic and international demand of meat seafood, fruits and vegetables

04 Where is the most cold storage located within the Thailand Cold Chain Market?

Bangkok Metropolitan Area (Including Samut Prakan) are considered as most prominent regional cluster for cold storage penetration in Thailand.

05 Who are the Key Players in the Thailand Cold Chain Market?

JWD Infologistics, Thai Yokorei co Ltd, Sinchai Cold Storage and Konoike Cool Logistic, Thaimax, SCG Nicherei Logistics

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.