Region:Middle East

Author(s):Rebecca

Product Code:KRAD7381

Pages:84

Published On:December 2025

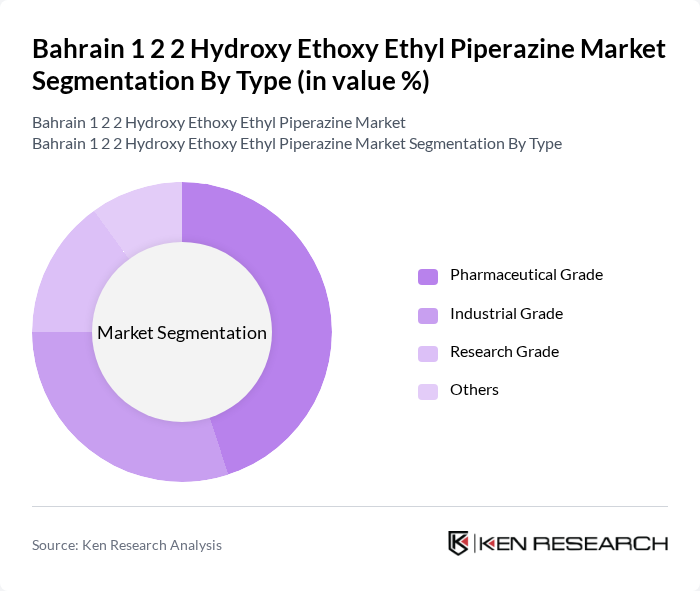

By Type:

The Pharmaceutical Grade segment is the leading sub-segment in the Bahrain market, driven by the increasing demand for high-quality intermediates in drug formulation and development. Pharmaceutical companies are focusing on sourcing high-purity chemicals to ensure the efficacy and safety of their products. This trend is further supported by the growing number of biotech firms and research institutions in the region, which require pharmaceutical-grade materials for their innovative projects.

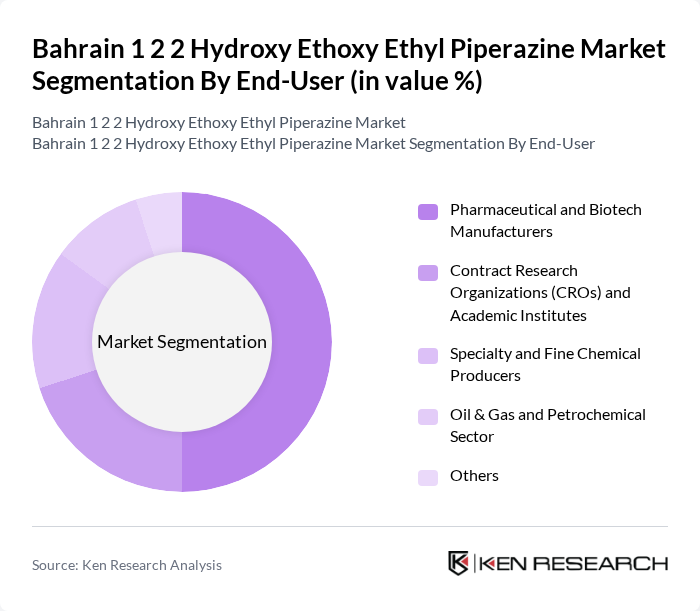

By End-User:

The Pharmaceutical and Biotech Manufacturers segment dominates the market, accounting for a significant share due to the increasing investment in drug development and the rising prevalence of chronic diseases. The demand for high-quality intermediates and active pharmaceutical ingredients (APIs) is driving growth in this sector, as manufacturers seek reliable suppliers to meet their production needs.

The Bahrain 1 2 2 Hydroxy Ethoxy Ethyl Piperazine Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Evonik Industries AG, Eastman Chemical Company, Merck KGaA, Lanxess AG, Solvay S.A., Dow Inc., Clariant AG, Huntsman Corporation, Wacker Chemie AG, Mitsubishi Gas Chemical Company, Inc., Croda International Plc, Afton Chemical Corporation, Specialty Chemicals Middle East W.L.L., Gulf Petrochemical Industries Company (GPIC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Hydroxy Ethoxy Ethyl Piperazine market in Bahrain appears promising, driven by increasing pharmaceutical demand and ongoing investments in chemical manufacturing. As local firms enhance their production capabilities, the market is likely to witness a surge in innovative applications. Additionally, the integration of sustainable practices and technological advancements will play a crucial role in shaping the industry landscape, fostering a competitive environment that encourages growth and efficiency in production processes.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceutical Grade Industrial Grade Research Grade Others |

| By End-User | Pharmaceutical and Biotech Manufacturers Contract Research Organizations (CROs) and Academic Institutes Specialty and Fine Chemical Producers Oil & Gas and Petrochemical Sector Others |

| By Application | Active Pharmaceutical Ingredient (API) Intermediates Corrosion Inhibitors and Process Chemicals Chemical Synthesis and Catalysis Laboratory and Analytical Reagents Others |

| By Distribution Channel | Direct Sales to Industrial End-Users Local Chemical Distributors and Traders Regional (GCC) Specialty Chemical Distributors Online and E-Procurement Platforms Others |

| By Geography | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Customer Type | Large Enterprises (Refining, Petrochemicals, Pharma) Small & Medium Enterprises (SMEs) Government and Public Sector Entities Research and Academic Institutions Others |

| By Regulatory Compliance | GMP-Compliant and Pharma Grade Suppliers REACH/Globally Compliant Importers ISO-Certified Local Distributors Non-certified and Spot Market Suppliers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | Formulation Scientists, Product Managers |

| Agrochemical Sector | 80 | Research Directors, Regulatory Affairs Managers |

| Industrial Chemicals | 70 | Production Managers, Quality Control Analysts |

| Research Institutions | 50 | Academic Researchers, Lab Technicians |

| End-User Feedback | 90 | Procurement Officers, Application Engineers |

The Bahrain 1 2 2 Hydroxy Ethoxy Ethyl Piperazine market is valued at approximately USD 42 million, reflecting a five-year historical analysis that indicates growth driven by demand in pharmaceuticals and petrochemicals.