Region:Middle East

Author(s):Shubham

Product Code:KRAC8970

Pages:84

Published On:November 2025

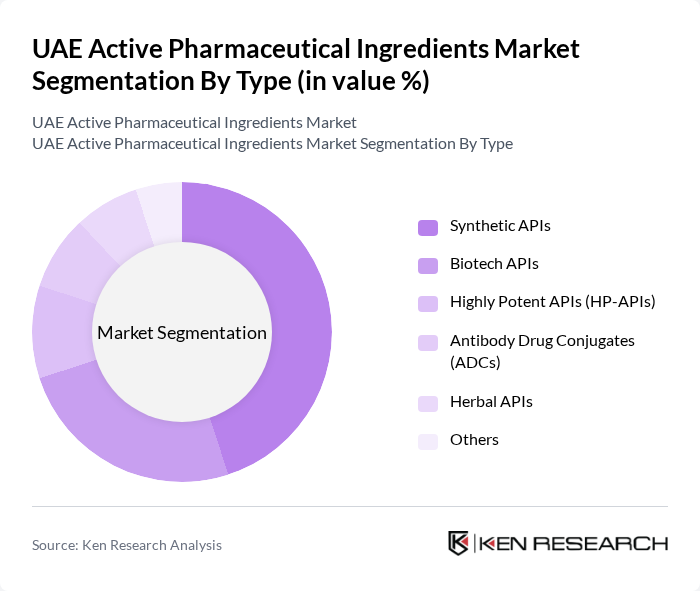

By Type:The market is segmented into various types of active pharmaceutical ingredients, including synthetic APIs, biotech APIs, highly potent APIs (HP-APIs), antibody drug conjugates (ADCs), herbal APIs, and others. Among these, synthetic APIs dominate the market due to their widespread use in generic drug formulations and the established manufacturing processes that ensure cost-effectiveness and scalability. The increasing demand for affordable medications and the robust infrastructure for chemical synthesis have further solidified the position of synthetic APIs in the market. Biotech APIs are the fastest-growing segment, driven by advancements in biopharmaceuticals and personalized medicine .

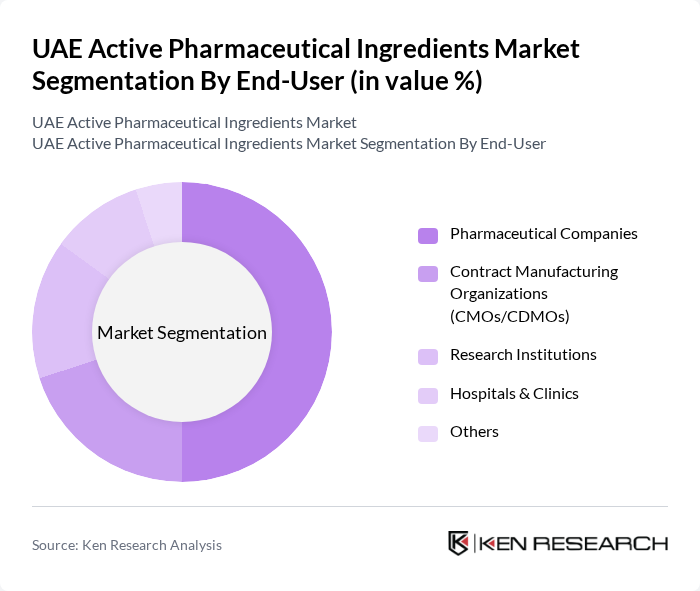

By End-User:The end-user segmentation includes pharmaceutical companies, contract manufacturing organizations (CMOs/CDMOs), research institutions, hospitals & clinics, and others. Pharmaceutical companies are the leading end-users, driven by the increasing production of generic drugs and the need for high-quality APIs to meet regulatory standards. The trend towards outsourcing API production to CMOs has also contributed to the growth of this segment, as companies seek to focus on core competencies while ensuring a reliable supply of active ingredients. The rise in clinical trials and biopharmaceutical innovation has further expanded demand among research institutions and hospitals .

The UAE Active Pharmaceutical Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Pharmaceutical Industries (Julphar), Neopharma, Global Pharma (Sanofi Company), Medpharma (Julphar Group), LifePharma FZE, Pharmax Pharmaceuticals, Aster DM Healthcare, Al Ain Pharmaceutical Manufacturing Co., Al Hayat Pharmaceuticals, Al Hikma Pharmaceuticals, Tabuk Pharmaceuticals Manufacturing Co., Amgen UAE, Pfizer Gulf FZ LLC, AstraZeneca Gulf FZ LLC, Roche UAE contribute to innovation, geographic expansion, and service delivery in this space.

The UAE active pharmaceutical ingredients market is poised for significant transformation, driven by technological advancements and a shift towards personalized medicine. As the healthcare landscape evolves, the integration of digital technologies in production processes will enhance efficiency and reduce costs. Furthermore, the increasing focus on sustainable practices will likely lead to the adoption of eco-friendly manufacturing methods, positioning the UAE as a leader in innovative pharmaceutical solutions in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic APIs Biotech APIs Highly Potent APIs (HP-APIs) Antibody Drug Conjugates (ADCs) Herbal APIs Others |

| By End-User | Pharmaceutical Companies Contract Manufacturing Organizations (CMOs/CDMOs) Research Institutions Hospitals & Clinics Others |

| By Therapeutic Area | Cardiovascular Oncology Infectious Diseases Neurology Diabetes & Metabolic Disorders Others |

| By Formulation Type | Oral Injectable Topical Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 80 | Production Managers, Quality Control Officers |

| API Distributors | 60 | Supply Chain Managers, Sales Directors |

| Healthcare Providers | 50 | Pharmacists, Hospital Administrators |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Market Analysts | 40 | Industry Analysts, Research Directors |

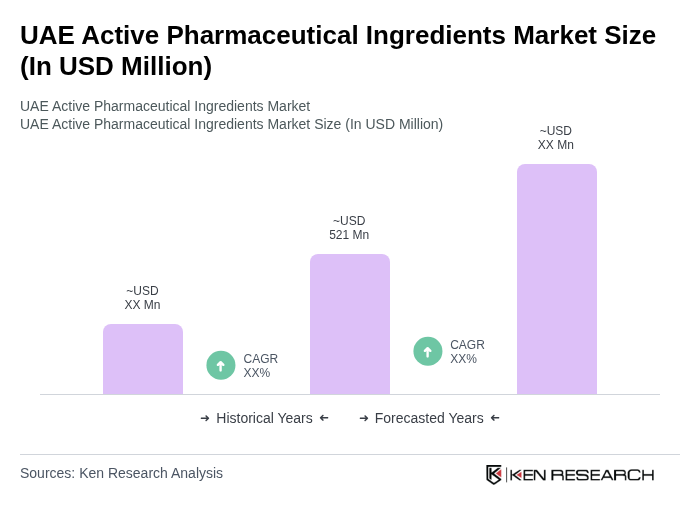

The UAE Active Pharmaceutical Ingredients market is valued at approximately USD 521 million, reflecting a significant growth driven by the increasing demand for generic drugs and the expansion of the pharmaceutical sector in the region.