Region:Middle East

Author(s):Rebecca

Product Code:KRAD7570

Pages:94

Published On:December 2025

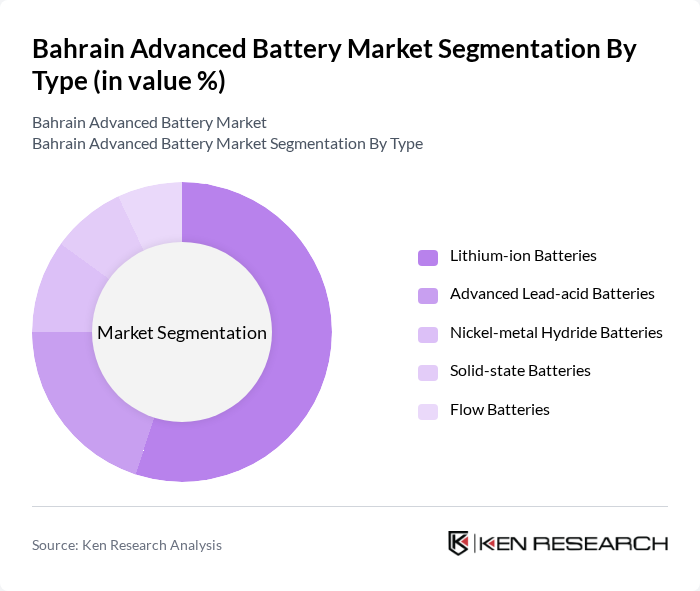

By Type:The advanced battery market can be segmented into various types, including Lithium-ion Batteries, Advanced Lead-acid Batteries, Nickel-metal Hydride Batteries, Solid-state Batteries, and Flow Batteries. Among these, Lithium-ion Batteries dominate the market due to their high energy density, lightweight nature, and widespread application in electric vehicles and consumer electronics. The increasing adoption of electric mobility and renewable energy storage solutions further drives the demand for Lithium-ion technology.

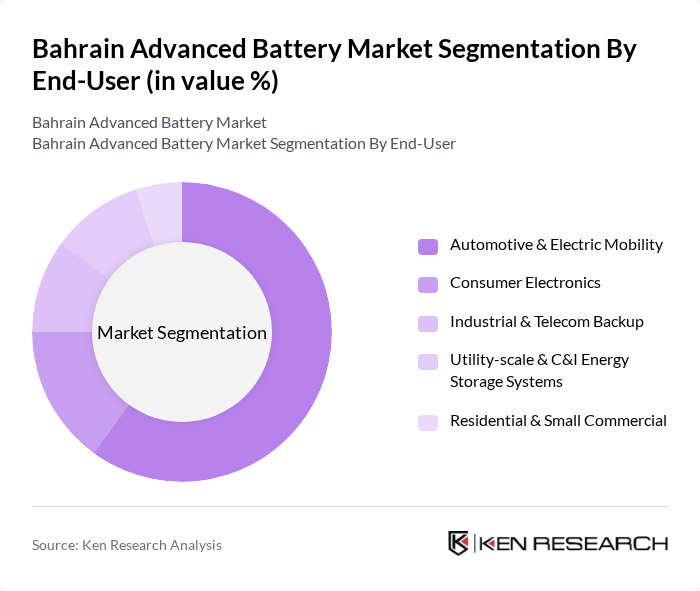

By End-User:The advanced battery market is segmented by end-user applications, including Automotive & Electric Mobility, Consumer Electronics, Industrial & Telecom Backup, Utility-scale & C&I Energy Storage Systems, and Residential & Small Commercial. The Automotive & Electric Mobility segment is the leading end-user, driven by the global shift towards electric vehicles and the increasing need for efficient energy storage solutions in transportation.

The Bahrain Advanced Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Batteries Company B.S.C. (BAHCO), Gulf Batteries Industries Co. (Gulf Batteries), Al Mulla & Behbehani BSC (Battery & Auto Electrical Division), Almoayyed International Group (Power & Energy Division), Yokogawa Middle East & Africa B.S.C.(c), ABB Group – Bahrain Operations, Siemens Middle East – Bahrain, Huawei Digital Power – Bahrain Projects, Schneider Electric – Bahrain, Hitachi Energy – GCC & Bahrain Projects, GE Vernova – Grid & Storage Solutions in Bahrain, Tesla Energy – Regional ESS & EV Infrastructure Presence, LG Energy Solution – Regional Supply to GCC Projects, Contemporary Amperex Technology Co. Limited (CATL) – GCC Partnerships, BYD Company Limited – New Energy & Storage Projects in the Middle East contribute to innovation, geographic expansion, and service delivery in this space.

The future of the advanced battery market in Bahrain appears promising, driven by increasing investments in renewable energy and electric vehicle infrastructure. As the government continues to implement supportive policies, including financial incentives and regulatory frameworks, the market is expected to attract more international partnerships. Additionally, advancements in battery recycling technologies and sustainability practices will likely enhance the overall market landscape, fostering innovation and growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Lithium-ion Batteries Advanced Lead-acid Batteries Nickel-metal Hydride Batteries Solid-state Batteries Flow Batteries |

| By End-User | Automotive & Electric Mobility Consumer Electronics Industrial & Telecom Backup Utility-scale & C&I Energy Storage Systems Residential & Small Commercial |

| By Application | Electric Vehicles & Charging Infrastructure Renewable Energy Integration & Grid-scale Storage UPS & Data Centers Portable & IoT Devices Marine, Defense & Other Specialty Uses |

| By Distribution Channel | Direct OEM Supply Project-based EPC & System Integrators Industrial & Automotive Distributors Retail Outlets & Service Garages Online & Regional Traders |

| By Geography | Capital Governorate (Manama) Northern Governorate Southern Governorate Muharraq Governorate Southern & Industrial Zones (e.g., Sitra, Hidd) |

| By Technology | High energy-density Systems Fast-charging & High-power Technologies Advanced Battery Management Systems (BMS) Second-life & Recycling Technologies Hybrid & Next-generation Chemistries |

| By Policy Support | Government Subsidies & EV Incentives Customs & Tax Incentives for Clean Tech Research, Innovation & Pilot Project Grants Regulatory Support & Grid Interconnection Frameworks Public–Private Partnership Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Battery Suppliers | 90 | Supply Chain Managers, Product Development Engineers |

| Renewable Energy Storage Solutions | 75 | Project Managers, Technical Directors |

| Battery Recycling Facilities | 55 | Operations Managers, Environmental Compliance Officers |

| Consumer Electronics Battery Manufacturers | 65 | Quality Assurance Managers, R&D Specialists |

| Government Regulatory Bodies | 45 | Policy Makers, Regulatory Affairs Specialists |

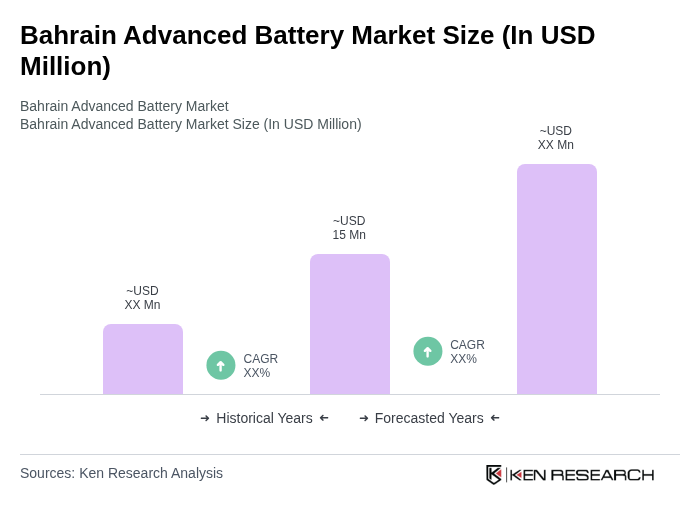

The Bahrain Advanced Battery Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by rising demand for electric vehicles, renewable energy storage, and government initiatives promoting sustainable energy practices.