Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4107

Pages:97

Published On:December 2025

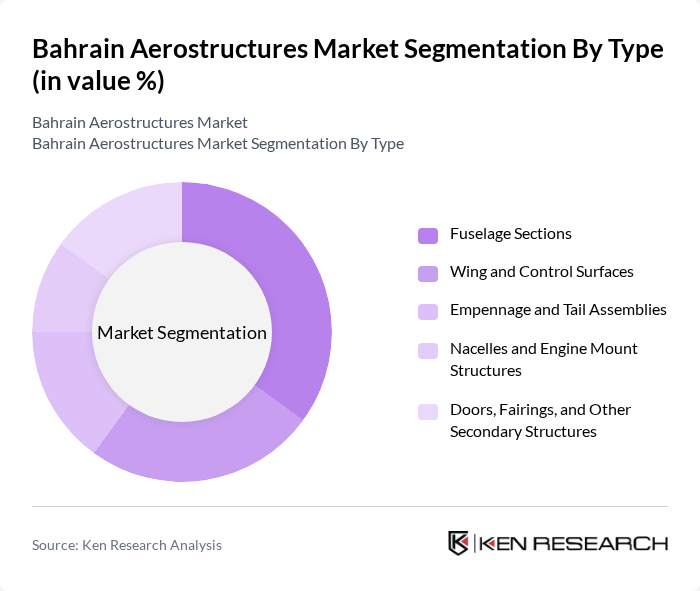

By Type:The aerostructures market can be segmented into various types, including fuselage sections, wing and control surfaces, empennage and tail assemblies, nacelles and engine mount structures, and doors, fairings, and other secondary structures. Among these, fuselage sections are currently dominating the market due to their critical role in aircraft design and safety. The increasing production rates of commercial aircraft have led to a higher demand for fuselage components, which are essential for structural integrity and aerodynamics.

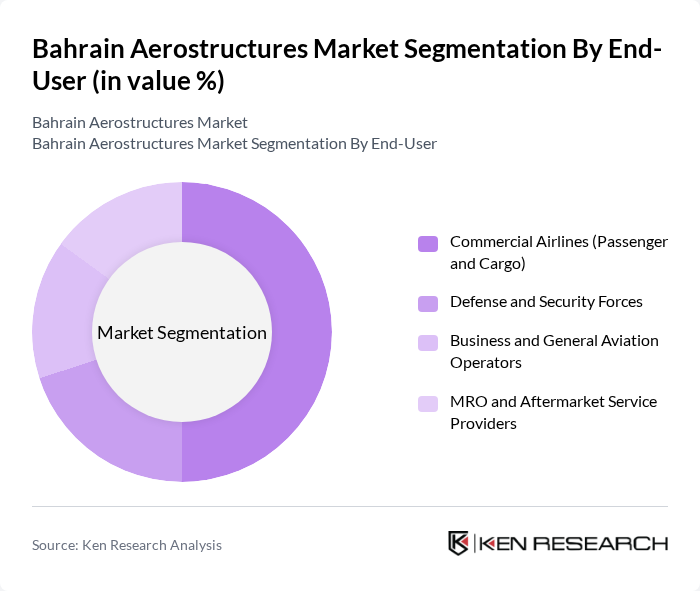

By End-User:The end-user segmentation includes commercial airlines (passenger and cargo), defense and security forces, business and general aviation operators, and MRO and aftermarket service providers. The commercial airlines segment is leading the market, driven by the resurgence of air travel post-pandemic and the need for fleet modernization. Airlines are increasingly investing in new aircraft to enhance operational efficiency and meet environmental standards, thus boosting demand for aerostructures.

The Bahrain Aerostructures Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Airport Company (BAC), Bahrain Airport Services (BAS), Gulf Air, Arab Shipbuilding and Repair Yard (ASRY), Roboze S.p.A., Lockheed Martin Corporation, Airbus SE, The Boeing Company, Spirit AeroSystems Holdings, Inc., Leonardo S.p.A., Rolls-Royce plc, Safran S.A., Raytheon Technologies Corporation, Northrop Grumman Corporation, Embraer S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain aerostructures market is poised for significant growth, driven by increasing demand for lightweight materials and government investments in aerospace infrastructure. As the aviation sector expands, local manufacturers are likely to benefit from enhanced production capabilities and partnerships with international firms. Furthermore, the focus on sustainable aviation practices and technological advancements in manufacturing processes will shape the future landscape, fostering innovation and competitiveness in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Fuselage Sections Wing and Control Surfaces Empennage and Tail Assemblies Nacelles and Engine Mount Structures Doors, Fairings, and Other Secondary Structures |

| By End-User | Commercial Airlines (Passenger and Cargo) Defense and Security Forces Business and General Aviation Operators MRO and Aftermarket Service Providers |

| By Material | Aluminum and Aluminum-Lithium Alloys Carbon Fiber Reinforced Composites Titanium and High-Temperature Alloys Steel and Other Metallic Alloys Advanced Polymers and Hybrid Materials |

| By Manufacturing Process | Additive Manufacturing and Rapid Prototyping Machining and Subtractive Processes Forming, Fabrication, and Assembly Surface Treatment and Finishing |

| By Application | Fixed-Wing Commercial Aircraft Military Fighter and Transport Aircraft Helicopters and Rotary-Wing Platforms UAVs and Drones Space and Emerging Aerial Platforms |

| By Supply Chain Stage | Raw Material and Semi-Finished Product Suppliers Component and Sub-Assembly Manufacturers Final Assembly, Integration, and Testing MRO, Upgrade, and Retrofit Services |

| By Policy Support | Industrial and Investment Incentives Tax and Customs Relief Schemes R&D and Innovation Grants Workforce Development and Training Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerostructures Manufacturing | 110 | Production Managers, Operations Directors |

| Aerospace Supply Chain Management | 85 | Supply Chain Analysts, Procurement Managers |

| Regulatory Compliance in Aerospace | 55 | Compliance Officers, Quality Assurance Managers |

| Research & Development in Aerostructures | 65 | R&D Engineers, Product Development Managers |

| Market Trends and Forecasting | 75 | Market Analysts, Business Development Executives |

The Bahrain Aerostructures Market is valued at approximately USD 1.2 billion, reflecting a robust growth trajectory driven by increasing demand for both commercial and military aircraft, as well as advancements in the aerospace manufacturing sector.