Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4803

Pages:90

Published On:December 2025

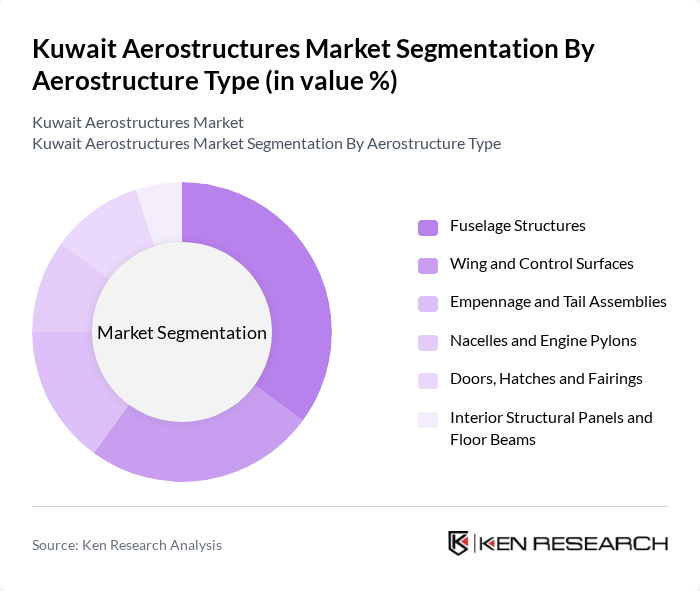

By Aerostructure Type:The aerostructure type segmentation includes various components essential for aircraft construction. The subsegments are Fuselage Structures, Wing and Control Surfaces, Empennage and Tail Assemblies, Nacelles and Engine Pylons, Doors, Hatches and Fairings, and Interior Structural Panels and Floor Beams. Among these, Fuselage Structures dominate the market due to their critical role in aircraft integrity and safety. The increasing production rates of commercial aircraft have led to a higher demand for fuselage components, making them a focal point for manufacturers.

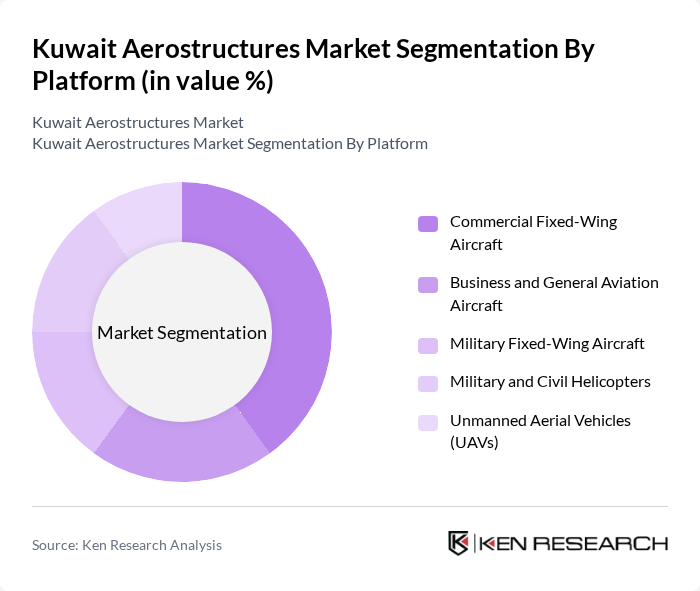

By Platform:The platform segmentation encompasses various types of aircraft, including Commercial Fixed-Wing Aircraft, Business and General Aviation Aircraft, Military Fixed-Wing Aircraft, Military and Civil Helicopters, and Unmanned Aerial Vehicles (UAVs). The Commercial Fixed-Wing Aircraft segment leads the market, driven by the increasing demand for air travel and the expansion of airline fleets. The growth in this segment is supported by the rising number of passengers and the need for efficient air transport solutions.

The Kuwait Aerostructures Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Airways Engineering & Maintenance, Jazeera Airways Technical Services, Kuwait Air Force (Directorate of Air Force Engineering & Maintenance), Kuwait Directorate General of Civil Aviation (DGCA) – Technical Affairs, Gulf Aerospace Company (GAC), National Aviation Services (NAS) – Aircraft Maintenance & Support, AAR Corp., Boeing Defense, Space & Security, Airbus Defence and Space, Lockheed Martin Corporation, Northrop Grumman Corporation, BAE Systems plc, Raytheon Technologies Corporation, Safran Group, Leonardo S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait aerostructures market is poised for significant growth, driven by increasing air travel and government initiatives aimed at enhancing the aerospace sector. As the region invests in advanced manufacturing technologies, local firms are likely to adopt sustainable practices and automation, improving efficiency. Furthermore, partnerships with international aerospace companies will facilitate knowledge transfer and innovation, positioning Kuwait as a competitive player in the global aerostructures landscape.

| Segment | Sub-Segments |

|---|---|

| By Aerostructure Type | Fuselage Structures Wing and Control Surfaces Empennage and Tail Assemblies Nacelles and Engine Pylons Doors, Hatches and Fairings Interior Structural Panels and Floor Beams |

| By Platform | Commercial Fixed?Wing Aircraft Business and General Aviation Aircraft Military Fixed?Wing Aircraft Military and Civil Helicopters Unmanned Aerial Vehicles (UAVs) |

| By Material | Aluminum and Other Metal Alloys Carbon Fiber Reinforced Composites Glass and Aramid Fiber Composites Titanium and High?Temperature Alloys Advanced Polymers and Hybrid Materials |

| By Manufacturing Technology | Additive Manufacturing (3D Printing) Traditional Machining and Subtractive Processes Forming, Forging and Stamping Composite Lay?up and Autoclave Curing Assembly, Integration and Surface Treatment |

| By Application | OEM Aircraft Manufacturing and Final Assembly Maintenance, Repair and Overhaul (MRO) Structural Upgrades Retrofit and Life?Extension Programs Defense Offset and Localization Projects |

| By End?User | Commercial Airlines (e.g., Kuwait Airways, Jazeera Airways) Kuwait Air Force and Defense Agencies Leasing Companies and Aircraft Owners MRO Providers and Engineering Service Firms OEMs and Tier?1/Tier?2 Aerostructure Suppliers |

| By Procurement & Policy Framework | Government Procurement and Offset Agreements Local Content and Industrial Participation Programs R&D Grants and Innovation Incentives Tax and Customs Incentives for Aerospace Manufacturing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerostructures Manufacturing | 100 | Production Managers, Operations Directors |

| Supply Chain Management | 80 | Logistics Coordinators, Procurement Managers |

| Research & Development | 60 | Aerospace Engineers, Product Development Leads |

| Regulatory Compliance | 50 | Quality Assurance Managers, Compliance Officers |

| Market Trends & Insights | 70 | Industry Analysts, Market Researchers |

The Kuwait Aerostructures Market is valued at approximately USD 60 million, reflecting a historical analysis over five years. This valuation aligns with the growth in related aerospace segments, driven by increasing demand for both commercial and military aircraft.