Region:Middle East

Author(s):Rebecca

Product Code:KRAD6144

Pages:87

Published On:December 2025

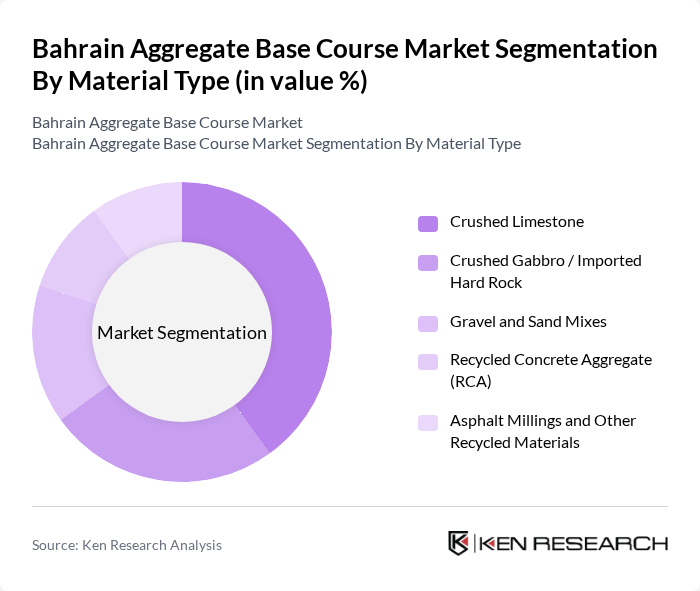

By Material Type:The material type segmentation includes various subsegments such as Crushed Limestone, Crushed Gabbro / Imported Hard Rock, Gravel and Sand Mixes, Recycled Concrete Aggregate (RCA), and Asphalt Millings and Other Recycled Materials. Crushed Limestone is widely used in Bahrain and the broader Middle East as a primary base course and sub?base material due to its local availability, favorable engineering properties, and cost-effectiveness, making it a preferred choice for road and building projects. The demand for Recycled Concrete Aggregate and other recycled materials is gradually increasing in line with regional trends toward sustainability and circular economy practices in construction aggregates.

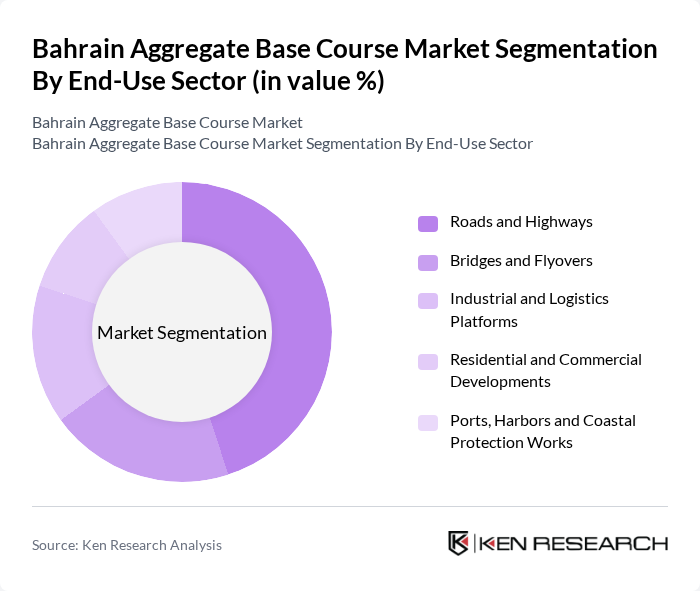

By End-Use Sector:The end-use sector segmentation encompasses Roads and Highways, Bridges and Flyovers, Industrial and Logistics Platforms, Residential and Commercial Developments, and Ports, Harbors, and Coastal Protection Works. Roads and Highways represent the dominant segment, reflecting Bahrain’s continued investment in transport corridors, junction upgrades and connectivity projects as part of national infrastructure programmes. Additionally, Industrial and Logistics Platforms are gaining traction in line with the expansion of logistics, free zones, and e?commerce-related warehousing and distribution facilities, which require significant volumes of engineered base course for yards, pavements, and access roads.

The Bahrain Aggregate Base Course Market is characterized by a dynamic mix of regional and international players. Leading participants such as Haji Hassan Group B.S.C. (Haji Hassan Ready Mix & Quarry Division), Nass Corporation B.S.C. (Nass Asphalt / Nass Sand & Gravel), Cebarco Bahrain W.L.L., Kooheji Contractors W.L.L., Almoayyed Contracting Group, Bahrain Asphalt Establishment, Bahrain Precast Concrete Co. W.L.L., Ahmed Mansoor Al?Aali Co. B.S.C. (AMA Group), Gulf Asphalt Company W.L.L., Aradous Ready Mix Concrete W.L.L., Al Kobaisi Group (Al Kobaisi Ready Mix & Crushers), Seef Precast & Pre?stressed Concrete Products Co., Eastern Asphalt and Mixed Concrete Co. W.L.L. (EAMCO), Sarens Nass Middle East W.L.L., Hafeera Contracting Company W.L.L. contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain aggregate base course market is poised for growth, driven by ongoing infrastructure investments and a shift towards sustainable construction practices. As the government continues to prioritize transportation projects, the demand for high-quality aggregate materials will likely increase. Additionally, the integration of advanced construction technologies and eco-friendly materials will shape the market landscape, fostering innovation and efficiency. Strategic partnerships with local governments will further enhance market dynamics, ensuring a robust supply chain and compliance with evolving regulations.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Crushed Limestone Crushed Gabbro / Imported Hard Rock Gravel and Sand Mixes Recycled Concrete Aggregate (RCA) Asphalt Millings and Other Recycled Materials |

| By End-Use Sector | Roads and Highways Bridges and Flyovers Industrial and Logistics Platforms Residential and Commercial Developments Ports, Harbors and Coastal Protection Works |

| By Application | Base Course for Flexible Pavements Sub?base and Subgrade Stabilization Railway Track Bed and Ballast Support Airport Runways, Taxiways and Aprons Yard Paving, Parking Areas and Internal Roads |

| By Source of Supply | On?Island Quarries and Crushing Plants Imported Aggregates (Saudi Arabia, UAE, Oman and Others) Construction & Demolition Waste Recycling Facilities Marine Dredged Aggregates and Sand |

| By Procurement & Distribution Channel | Direct Contracts with Quarries / Producers Construction Material Distributors & Traders Long?term Framework / Framework Supply Agreements Spot Purchases for Small & Emergency Projects |

| By Compliance & Quality Standard | Bahrain Ministry of Works & Municipalities Specifications AASHTO and ASTM Standards Airport and Port Authority Specifications Project?Specific Performance?Based Specifications |

| By Contracting & Pricing Model | Long?Term Supply Contracts (Indexed Pricing) Project?Based Lump Sum Supply Cost?Plus and Pass?Through Material Contracts Spot Market and Short?Term Supply Agreements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Infrastructure Development Projects | 100 | Project Managers, Civil Engineers |

| Residential Construction | 80 | Contractors, Architects |

| Commercial Building Developments | 70 | Developers, Quantity Surveyors |

| Road and Highway Construction | 90 | Government Officials, Infrastructure Planners |

| Aggregate Supply Chain Management | 60 | Supply Chain Managers, Logistics Coordinators |

The Bahrain Aggregate Base Course market is valued at approximately USD 160 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for construction materials due to ongoing infrastructure projects and urban development across the country.