Region:Middle East

Author(s):Rebecca

Product Code:KRAB7040

Pages:96

Published On:October 2025

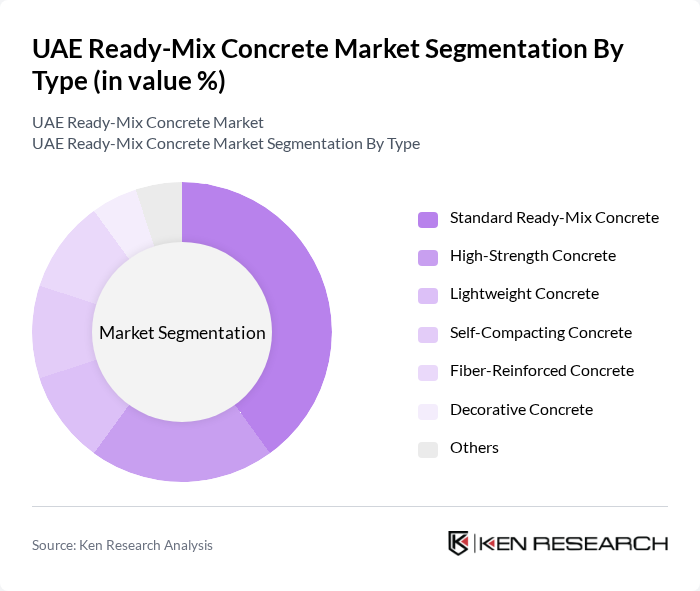

By Type:The market is segmented into various types of ready-mix concrete, including Standard Ready-Mix Concrete, High-Strength Concrete, Lightweight Concrete, Self-Compacting Concrete, Fiber-Reinforced Concrete, Decorative Concrete, and Others. Among these, Standard Ready-Mix Concrete is the most widely used due to its versatility and cost-effectiveness, making it a preferred choice for a variety of construction projects.

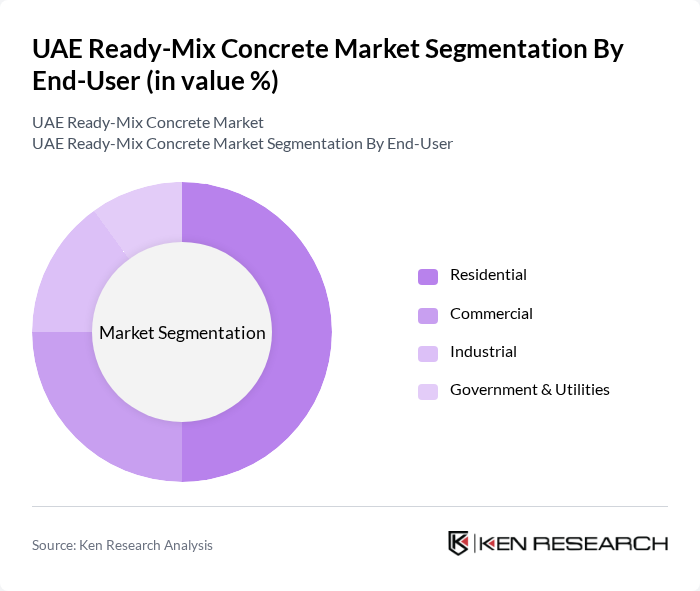

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment dominates the market, driven by the increasing demand for housing and urban development projects. The growth in population and the rise in disposable income have led to a surge in residential construction activities, further boosting the demand for ready-mix concrete.

The UAE Ready-Mix Concrete Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Cement Factory, Al Ain Cement Factory, Readymix Abu Dhabi, Unibeton Ready Mix, Gulf Ready Mix Concrete, Sharjah Ready Mix, National Ready Mix Concrete Co., CEMEX UAE, Al Falah Ready Mix, Al Jazeera Ready Mix, Al Maktoum Ready Mix, Al Mufeed Ready Mix, Al Murooj Ready Mix, Al Qusais Ready Mix, Al Sufouh Ready Mix contribute to innovation, geographic expansion, and service delivery in this space.

The UAE ready-mix concrete market is poised for significant growth, driven by ongoing infrastructure projects and urbanization trends. As the government continues to invest heavily in construction, the demand for high-quality concrete solutions will rise. Additionally, the integration of smart technologies and sustainable practices will shape the industry's future, enhancing efficiency and environmental compliance. Companies that adapt to these trends will likely gain a competitive edge, positioning themselves favorably in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Ready-Mix Concrete High-Strength Concrete Lightweight Concrete Self-Compacting Concrete Fiber-Reinforced Concrete Decorative Concrete Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Infrastructure Projects Residential Construction Commercial Buildings Road Construction Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Discount Pricing |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Quality Standards | ISO Certified Non-ISO Certified Custom Specifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Engineers |

| Commercial Building Developments | 80 | Construction Managers, Architects |

| Infrastructure Projects (Roads, Bridges) | 70 | Procurement Officers, Civil Engineers |

| Ready-Mix Concrete Suppliers | 60 | Sales Managers, Operations Directors |

| Regulatory Bodies and Associations | 50 | Policy Makers, Industry Analysts |

The UAE Ready-Mix Concrete Market is valued at approximately USD 3.5 billion, driven by significant investments in infrastructure and real estate development, particularly in urban areas like Dubai and Abu Dhabi.