Region:Middle East

Author(s):Dev

Product Code:KRAD3415

Pages:95

Published On:November 2025

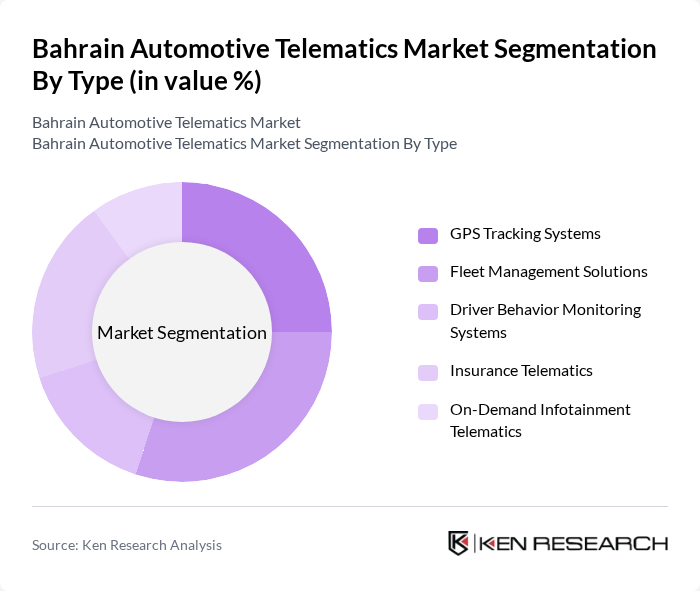

By Type:The market can be segmented into various types of telematics solutions, including GPS Tracking Systems, Fleet Management Solutions, Driver Behavior Monitoring Systems, Insurance Telematics, and On-Demand Infotainment Telematics. Each of these subsegments plays a vital role in enhancing vehicle performance, safety, and user experience.

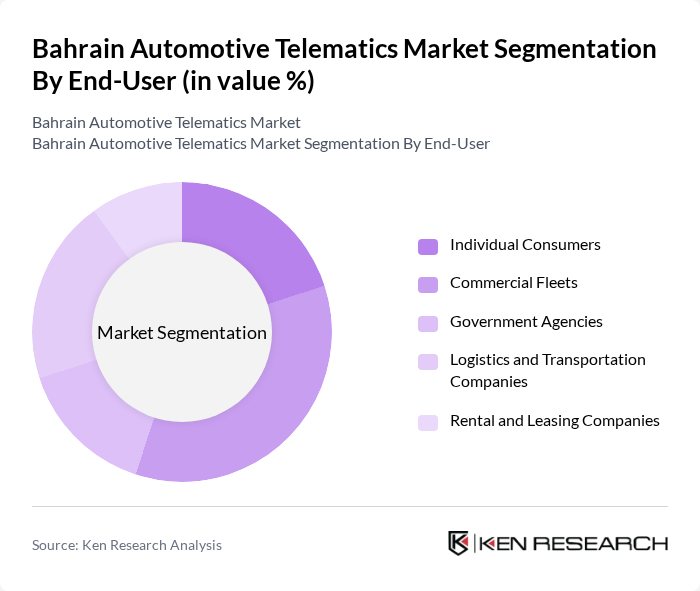

By End-User:The end-user segmentation includes Individual Consumers, Commercial Fleets, Government Agencies, Logistics and Transportation Companies, and Rental and Leasing Companies. Each segment has unique requirements and preferences, influencing the adoption of telematics solutions.

The Bahrain Automotive Telematics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zain Bahrain, Batelco, Gulf Automotive, Almoayyed International Group, Axiom Telecom, Mena Telecom, Bahrain Telecommunication Company (Batelco), Al-Futtaim Group, Al-Moayyed Group, Al-Mohannad Group, Al-Haddad Motors, Al-Salam Bank, Bahrain National Holding, Bahrain Duty Free Shop Complex, Ahlia University contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain automotive telematics market appears promising, driven by technological advancements and increasing consumer demand for connected solutions. As 5G networks expand, the potential for real-time data transmission will enhance telematics capabilities, making them more attractive to consumers and businesses alike. Additionally, the integration of AI and machine learning will enable more sophisticated analytics, improving vehicle safety and operational efficiency. These trends are expected to shape the market landscape significantly in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | GPS Tracking Systems Fleet Management Solutions Driver Behavior Monitoring Systems Insurance Telematics On-Demand Infotainment Telematics |

| By End-User | Individual Consumers Commercial Fleets Government Agencies Logistics and Transportation Companies Rental and Leasing Companies |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Two-Wheelers Electric Vehicles Light and Heavy Commercial Vehicles |

| By Application | Vehicle Tracking Fleet Management Insurance Telematics Emergency Services Remote Diagnostics Fuel Management |

| By Technology | Embedded Telematics Tethered Telematics Integrated Telematics OBD-II Devices Smartphone-Based Telematics |

| By Distribution Channel | Direct Sales Online Sales Distributors Automotive OEMs |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Fleet Management | 45 | Fleet Managers, Operations Directors |

| Private Vehicle Owners | 60 | Car Owners, Tech-Savvy Consumers |

| Telematics Service Providers | 35 | Product Managers, Business Development Executives |

| Automotive Manufacturers | 32 | R&D Managers, Marketing Directors |

| Government Transportation Officials | 28 | Policy Makers, Regulatory Affairs Managers |

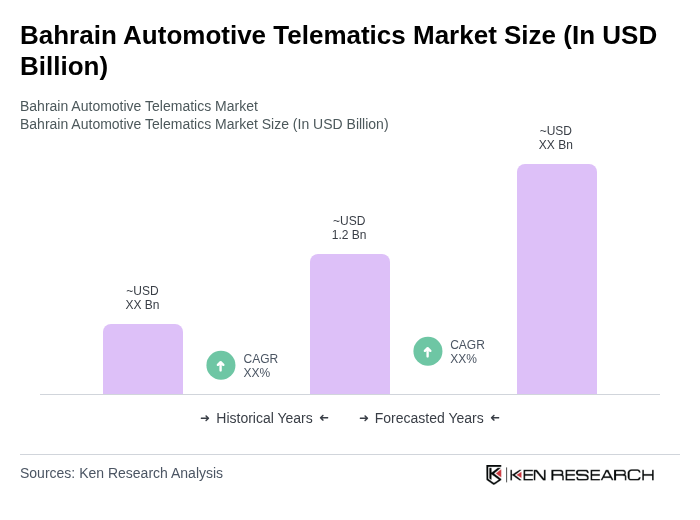

The Bahrain Automotive Telematics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of connected vehicles, advancements in GPS and IoT technologies, and increasing demand for fleet management solutions.