Region:Middle East

Author(s):Shubham

Product Code:KRAD5341

Pages:100

Published On:December 2025

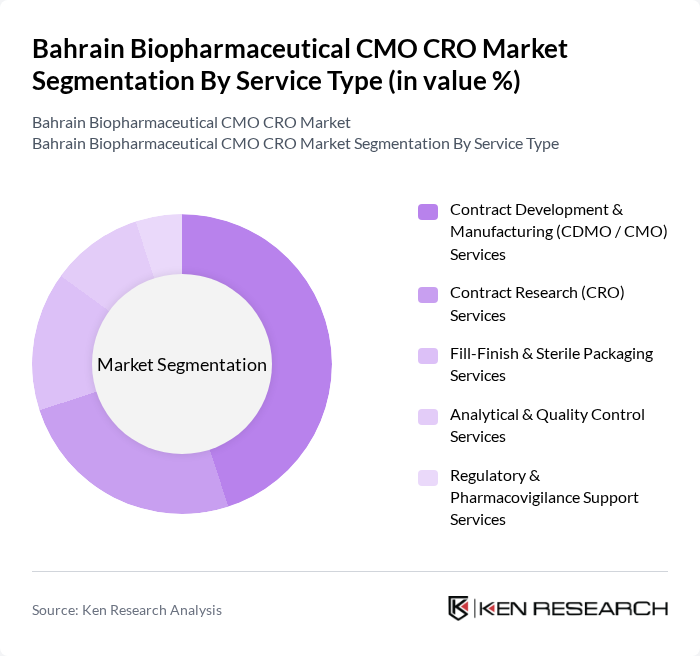

By Service Type:The service type segmentation includes various offerings that cater to the needs of biopharmaceutical companies. The primary subsegments are Contract Development & Manufacturing (CDMO / CMO) Services, Contract Research (CRO) Services, Fill-Finish & Sterile Packaging Services, Analytical & Quality Control Services, and Regulatory & Pharmacovigilance Support Services. Among these, Contract Development & Manufacturing Services is the leading subsegment, aligned with the global trend where contract manufacturing captures the largest share of biopharmaceutical CMO and CRO revenues as sponsors expand biologics and complex injectable production while relying on external capacity. The increasing demand for efficient and cost-effective manufacturing solutions, combined with the need for access to specialized bioprocessing technologies, has accelerated outsourcing of development, scale?up, and commercial manufacturing to CDMOs, while CRO services continue to grow in parallel as companies focus internal resources on core R&D and pipeline strategy.

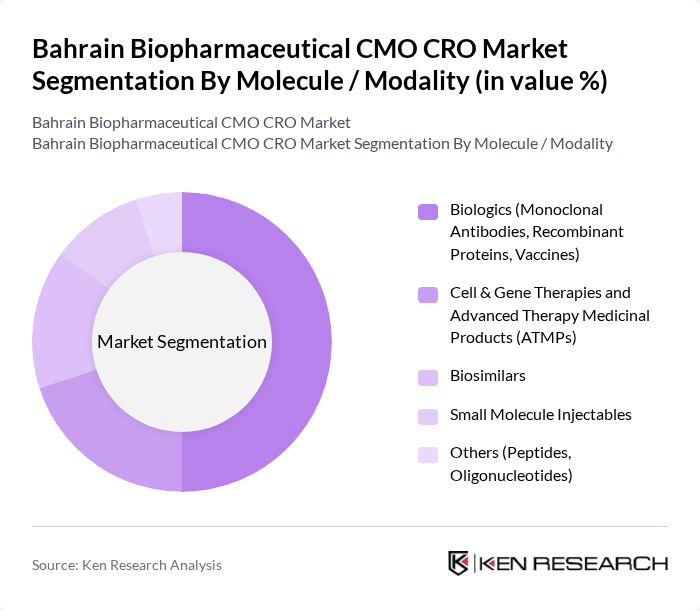

By Molecule / Modality:This segmentation focuses on the types of molecules and modalities being developed and manufactured. The subsegments include Biologics (Monoclonal Antibodies, Recombinant Proteins, Vaccines), Cell & Gene Therapies and Advanced Therapy Medicinal Products (ATMPs), Biosimilars, Small Molecule Injectables, and Others (Peptides, Oligonucleotides). Biologics are currently the dominant subsegment, consistent with global biopharmaceutical outsourcing patterns where biologics account for the majority of CMO and CRO revenue due to higher development complexity, larger batch sizes, and the expanding role of monoclonal antibodies, recombinant proteins, and vaccines in treatment portfolios. The increasing prevalence of chronic and immune?mediated diseases, continued demand for oncology and autoimmune therapies, and growing emphasis on vaccine preparedness drive sustained investment in biologics, while interest in cell and gene therapies and other advanced modalities is steadily building capabilities in specialized regional and international CDMOs and CROs that support Bahrain?linked projects.

The Bahrain Biopharmaceutical CMO CRO Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Biotech Company W.L.L. (Bahrain), Bahrain Oncology Center – Clinical Research Unit, King Hamad University Hospital Clinical Research Center, Bahrain Defense Force (BDF) Hospital – Clinical Trials & Research Unit, Salmaniya Medical Complex – Research & Clinical Studies Unit, Ministry of Health Bahrain – Public Health Laboratory & Vaccine Programs, National Health Regulatory Authority (NHRA) – Clinical Trials & Regulatory Oversight, Arabian Gulf University – College of Medicine & Medical Research Center, Royal College of Surgeons in Ireland – Medical University of Bahrain (RCSI Bahrain) Research Office, Bahrain Specialist Hospital – Clinical Research Collaborations, King Hamad American Mission Hospital (KHAMH) – Research & Innovation Initiatives, G42 Healthcare (UAE) – Regional CRO/CDMO Partner Active in Gulf Trials, IQVIA – Middle East Operations Covering Bahrain, Syneos Health – Regional CRO Services for Bahrain-Based Studies, Parexel – Global CRO with Middle East Presence Supporting Bahrain Projects contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain biopharmaceutical CMO and CRO market appears promising, driven by increasing investments in healthcare infrastructure and government initiatives aimed at fostering local production. As the demand for personalized medicine rises, companies are likely to adopt advanced biomanufacturing technologies. Furthermore, the focus on sustainability and digital transformation will shape operational strategies, enabling firms to enhance efficiency and reduce environmental impact, positioning Bahrain as a competitive player in the biopharmaceutical landscape.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Contract Development & Manufacturing (CDMO / CMO) Services Contract Research (CRO) Services Fill-Finish & Sterile Packaging Services Analytical & Quality Control Services Regulatory & Pharmacovigilance Support Services |

| By Molecule / Modality | Biologics (Monoclonal Antibodies, Recombinant Proteins, Vaccines) Cell & Gene Therapies and Advanced Therapy Medicinal Products (ATMPs) Biosimilars Small Molecule Injectables Others (Peptides, Oligonucleotides) |

| By Development Stage | Preclinical & Early Development Clinical Trial Manufacturing & Services (Phase I–III) Commercial-Scale Manufacturing Lifecycle Management & Technology Transfer |

| By End-User | Global and Regional Biopharmaceutical Companies Generic and Biosimilar Manufacturers Academic & Research Institutions in Bahrain Government & Public Health Agencies Others (Healthcare Investors, Hospital-Based Research Units) |

| By Therapy Area Focus | Oncology and Hematology Infectious Diseases & Vaccines (including COVID-19 and Emerging Pathogens) Immunology & Inflammatory Disorders Metabolic & Cardiovascular Disorders Rare & Orphan Diseases |

| By Outsourcing Model | Project-Based / Fee-for-Service Engagements Strategic / Long-Term Partnerships Full-Service Integrated Outsourcing Functional Service Provider (FSP) Models |

| By Client Geography | Domestic Clients (Within Bahrain) GCC Clients (Saudi Arabia, UAE, Kuwait, Oman, Qatar) Wider Middle East & North Africa (MENA) Europe, North America and Asia-Pacific Clients |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| CMO Service Providers | 60 | Operations Managers, Business Development Executives |

| CRO Service Providers | 50 | Clinical Project Managers, Regulatory Affairs Specialists |

| Biopharmaceutical Companies | 80 | R&D Directors, Procurement Managers |

| Healthcare Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Industry Experts and Consultants | 50 | Market Analysts, Industry Advisors |

The Bahrain Biopharmaceutical CMO CRO Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the global demand for biologics, biosimilars, and advanced therapies, alongside increasing healthcare investments in the region.