Region:Middle East

Author(s):Shubham

Product Code:KRAC4221

Pages:84

Published On:October 2025

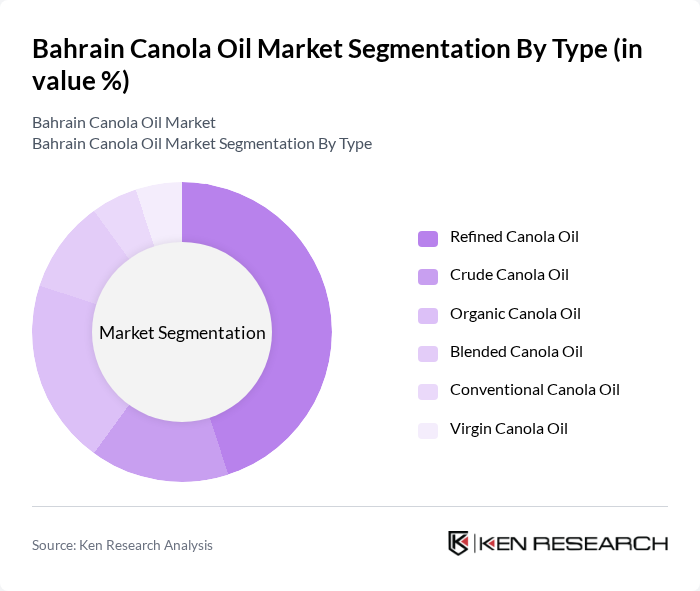

By Type:The canola oil market is segmented into refined, crude, organic, blended, conventional, and virgin canola oil. Refined canola oil remains the most widely used type, favored for its neutral flavor, high smoke point, and versatility in both home and commercial kitchens. Organic canola oil is gaining momentum as consumers increasingly seek natural and certified organic products, while blended and conventional oils address varying price sensitivities and functional requirements. Virgin and crude canola oils are used in niche applications, including specialty food and industrial segments .

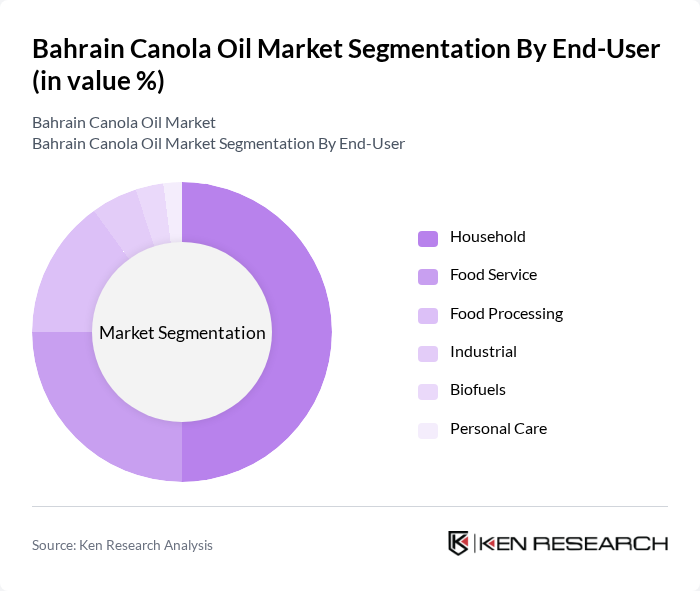

By End-User:The end-user segmentation comprises households, food service, food processing, industrial, biofuels, and personal care. The household segment leads the market, reflecting the increasing use of canola oil in home cooking due to its health benefits and suitability for a variety of culinary applications. The food service sector is also significant, as restaurants and catering services increasingly adopt canola oil for its favorable cooking properties and health profile. Food processing industries utilize canola oil in packaged foods, while industrial, biofuel, and personal care applications represent smaller but growing segments .

The Bahrain Canola Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ghurair Foods, Cargill, Inc., Bunge Limited, Archer Daniels Midland Company, Louis Dreyfus Company, Wilmar International Limited, AAK AB, Olam International, Savola Group, United Foods Company, Bahrain Flour Mills Company, Canola Harvest, Sunora Foods, The Hain Celestial Group, Nutiva, Inc., and Catania Spagna Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the canola oil market in Bahrain appears promising, driven by health trends and the expansion of the food processing sector. As consumers increasingly prioritize health-conscious choices, the demand for canola oil is expected to rise. Additionally, the food service industry is likely to adopt canola oil more widely, enhancing its market presence. Innovations in product offerings and sustainable practices will further shape the market landscape, positioning canola oil as a staple in both households and commercial kitchens.

| Segment | Sub-Segments |

|---|---|

| By Type | Refined Canola Oil Crude Canola Oil Organic Canola Oil Blended Canola Oil Conventional Canola Oil Virgin Canola Oil |

| By End-User | Household Food Service Food Processing Industrial Biofuels Personal Care |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Wholesale Store-Based Non-Store Based |

| By Packaging Type | Bottles Tetra Packs Bulk Packaging Pouches Cans |

| By Price Range | Economy Mid-Range Premium |

| By Brand Type | National Brands Private Labels |

| By Others | Specialty Oils Non-GMO Canola Oil |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Household Consumption Patterns | 120 | Household Heads, Primary Grocery Buyers |

| Food Service Industry Insights | 90 | Restaurant Owners, Chefs, Food Service Managers |

| Retail Market Dynamics | 70 | Store Managers, Category Buyers |

| Health and Nutrition Trends | 60 | Nutritionists, Dietitians, Health Coaches |

| Supply Chain and Distribution | 50 | Logistics Managers, Distribution Coordinators |

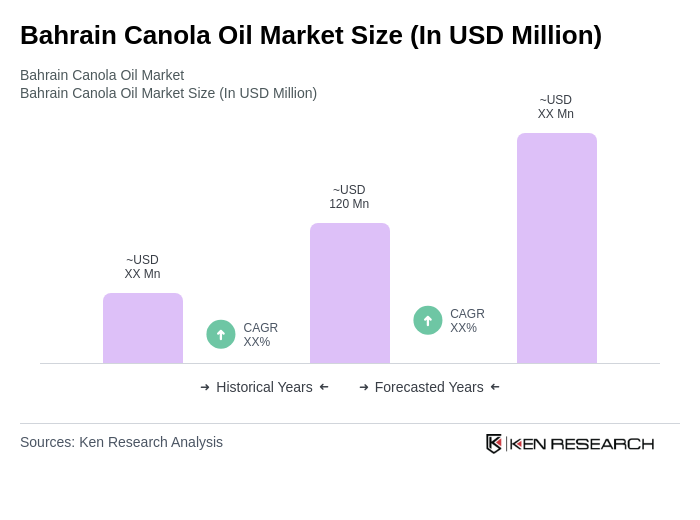

The Bahrain Canola Oil Market is valued at approximately USD 120 million, reflecting a growing trend towards healthier cooking oils among consumers, particularly due to the health benefits associated with canola oil.