Region:North America

Author(s):Shubham

Product Code:KRAD2000

Pages:98

Published On:December 2025

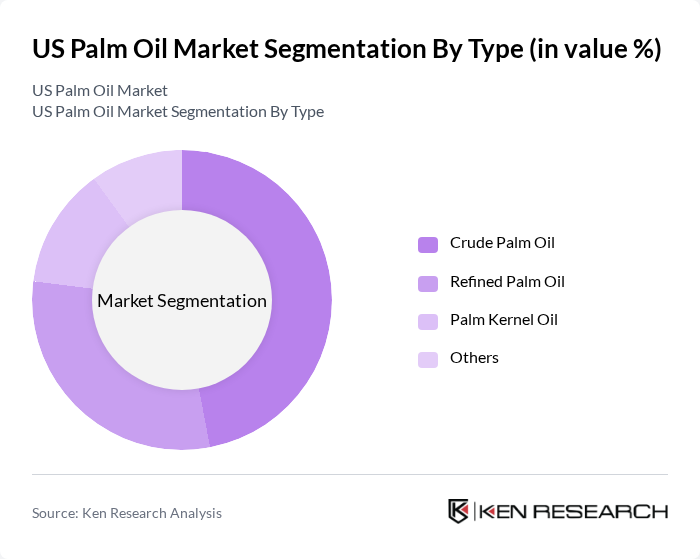

By Type:The palm oil market is segmented into various types, including Crude Palm Oil, Refined Palm Oil, Palm Kernel Oil, and Others. Among these, Crude Palm Oil is the leading subsegment due to its extensive use in food processing and cooking applications. The demand for crude palm oil is driven by its versatility, stability, and favorable pricing compared to other vegetable oils, making it a preferred choice for manufacturers and consumers alike.

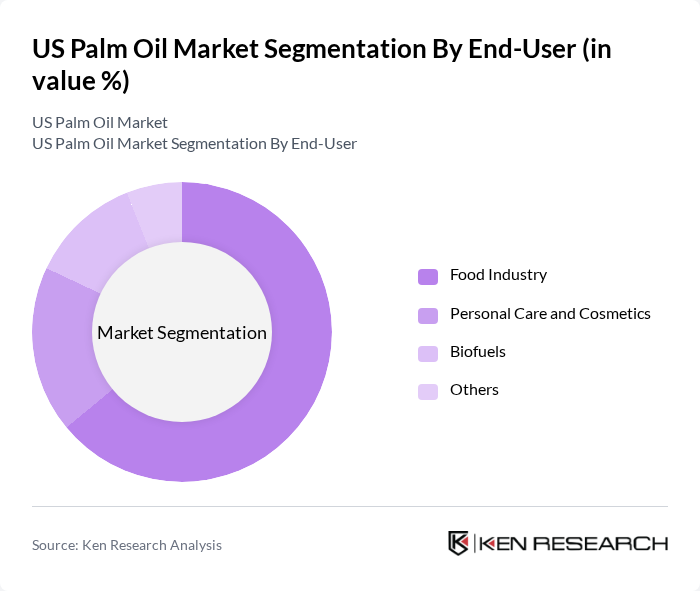

By End-User:The end-user segmentation includes the Food Industry, Personal Care and Cosmetics, Biofuels, and Others. The Food Industry dominates this segment, driven by the increasing consumption of processed foods and the growing trend of using palm oil in various culinary applications. The versatility of palm oil in cooking and food manufacturing makes it a staple ingredient, further solidifying its position in the market.

The US Palm Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Inc., Archer Daniels Midland Company, Bunge North America, Wilmar International Limited, IOI Corporation Berhad, Golden Agri-Resources Ltd., Musim Mas Holdings, Kuala Lumpur Kepong Berhad, Sime Darby Plantation Berhad, Olam International, PT SMART Tbk, AAK AB, Catania Spagna Corporation, Perdue Agribusiness, Agropalma S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The U.S. palm oil market is expected to experience steady growth, driven by increasing demand for sustainable and high-quality products. As consumer preferences shift towards plant-based diets and organic offerings, the market is likely to adapt by enhancing product quality and transparency. Additionally, technological advancements in production and processing are anticipated to improve efficiency and sustainability, further supporting market expansion. The focus on value-added products will also play a crucial role in shaping the future landscape of the palm oil industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Crude Palm Oil Refined Palm Oil Palm Kernel Oil Others |

| By End-User | Food Industry Personal Care and Cosmetics Biofuels Others |

| By Application | Cooking Oil Margarine and Shortening Bakery Products Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Others |

| By Packaging Type | Bottles Tetra Packs Bulk Packaging Others |

| By Region | Northeast Midwest South West |

| By Product Form | Liquid Solid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Sector | 120 | Production Managers, Quality Assurance Directors |

| Retail and Distribution Channels | 100 | Supply Chain Managers, Category Buyers |

| Cosmetics and Personal Care Industry | 80 | Product Development Managers, Brand Managers |

| Biofuel Production Sector | 70 | Operations Managers, Sustainability Officers |

| Environmental and Sustainability Consultants | 60 | Consultants, Policy Advisors |

The US Palm Oil Market is valued at approximately USD 2.7 billion. This valuation reflects the increasing demand from food processors and oleochemical manufacturers, driven by palm oil's stability, versatility, and expanding applications in sustainable sourcing.