Region:Middle East

Author(s):Dev

Product Code:KRAD0402

Pages:91

Published On:August 2025

By Type:The construction market in Bahrain can be segmented into various types, including Residential Construction, Commercial Construction, Industrial Construction, Infrastructure (Transport, Utilities, Energy & Water), Institutional (Education, Healthcare, Public Buildings), Oil & Gas and Petrochemicals, and Renovation, Maintenance & Facility Upgrades. Among these, Infrastructure projects are currently dominating the market due to the government's focus on enhancing transportation networks and utilities to support economic growth. The increasing demand for efficient public services and connectivity is driving investments in this segment.

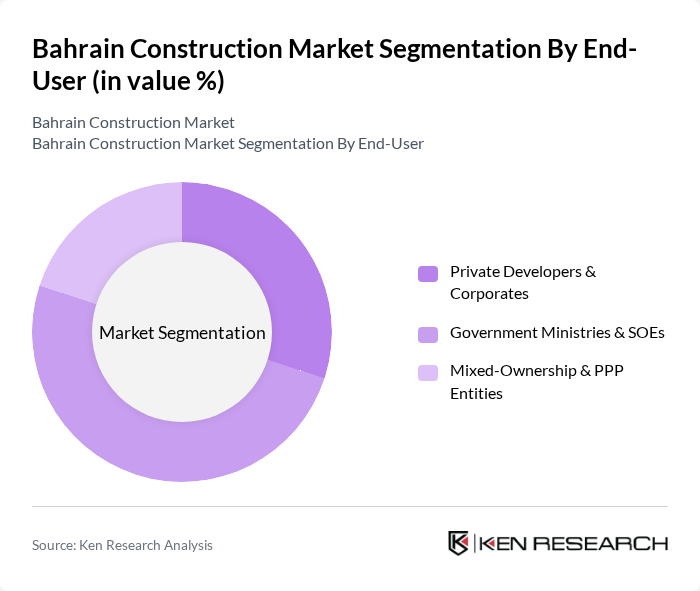

By End-User:The end-user segmentation of the construction market includes Private Developers & Corporates, Government Ministries & SOEs, and Mixed-Ownership & PPP Entities. The Government Ministries & SOEs segment is currently leading the market, driven by substantial public sector investments in infrastructure and social projects. This trend reflects the government's commitment to enhancing public services and facilities, which is crucial for the overall development of the country.

The Bahrain Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cebarco Bahrain (Cebarco WCT W.L.L.), Nass Corporation B.S.C., Kooheji Contractors, Almoayyed Contracting Group, Ahmed Mansoor Al A'ali Co. B.S.C. (AMA Group), GP Zachariades (Overseas) Ltd., Haji Hassan Group, Mohamed Abdulmohsin Al-Kharafi & Sons (Kharafi National) – Bahrain, Downton Construction Co. W.L.L., Haji Hassan Readymix (Bahrain Ready Mix Concrete Co.), Aradous Contracting & Maintenance, Al Ghanah Group, Ahmed Al Quraishi Contracting (AAQ), International Trading & Contracting Co. (ITCC) – Bahrain, RAMSIS Engineering W.L.L. (RAFCO Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain construction market appears promising, driven by ongoing government initiatives and a focus on sustainable development. The anticipated growth in infrastructure spending, coupled with urbanization trends, is expected to create a robust demand for construction services. Additionally, the integration of technology in construction processes will likely enhance efficiency and safety. As the market evolves, stakeholders must adapt to emerging trends, ensuring they remain competitive and responsive to changing consumer needs and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Construction Commercial Construction Industrial Construction Infrastructure (Transport, Utilities, Energy & Water) Institutional (Education, Healthcare, Public Buildings) Oil & Gas and Petrochemicals Renovation, Maintenance & Facility Upgrades |

| By End-User | Private Developers & Corporates Government Ministries & SOEs Mixed-Ownership & PPP Entities |

| By Application | Housing (Affordable, Mid-income, Luxury) Commercial & Hospitality (Retail, Offices, Hotels) Transport & Logistics (Roads, Bridges, Ports, Airports) Energy & Utilities (Power, Water, Sewage, Renewables) |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Project Size | Small Scale Projects Medium Scale Projects Large & Mega Projects |

| By Construction Method | Traditional Construction Modular & Prefabricated Construction Design-Build & EPC Contracts |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 110 | Project Managers, Site Supervisors |

| Commercial Building Developments | 85 | Architects, Construction Executives |

| Infrastructure Projects (Roads, Bridges) | 75 | Government Officials, Civil Engineers |

| Green Building Initiatives | 60 | Sustainability Consultants, Project Developers |

| Construction Material Suppliers | 90 | Supply Chain Managers, Procurement Officers |

The Bahrain Construction Market is valued at approximately USD 3.2 billion, driven by investments in infrastructure, residential, and commercial projects, alongside government initiatives focused on urban development and sustainability.