Region:Middle East

Author(s):Rebecca

Product Code:KRAB7381

Pages:95

Published On:October 2025

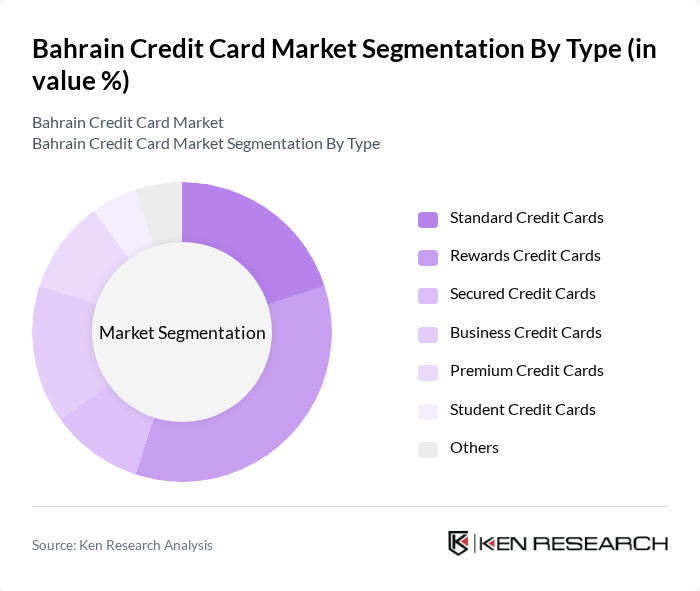

By Type:The credit card market can be segmented into various types, including Standard Credit Cards, Rewards Credit Cards, Secured Credit Cards, Business Credit Cards, Premium Credit Cards, Student Credit Cards, and Others. Among these, Rewards Credit Cards are gaining significant traction due to their attractive benefits and cashback offers, appealing to consumers who frequently use credit for purchases.

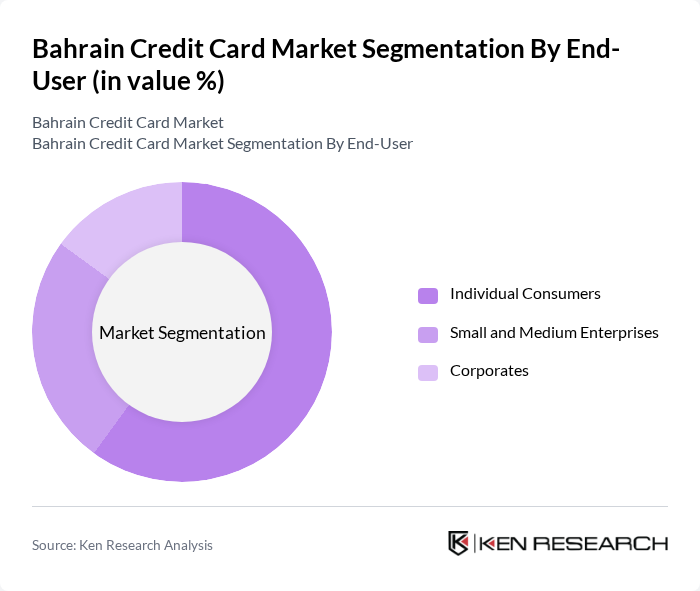

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), and Corporates. Individual Consumers dominate the market, driven by the increasing trend of personal credit usage for everyday purchases and online shopping. The convenience and rewards associated with credit cards make them a popular choice among consumers.

The Bahrain Credit Card Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Bank of Bahrain, Gulf International Bank, Bank of Bahrain and Kuwait, Ahli United Bank, Bahrain Islamic Bank, Al Baraka Banking Group, Arab Banking Corporation, Qatar National Bank, Standard Chartered Bank, HSBC Bank Middle East, Citibank Bahrain, Emirates NBD, Abu Dhabi Commercial Bank, Mashreq Bank, and Bank of America contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain credit card market appears promising, driven by technological advancements and changing consumer preferences. As digital payment solutions become more integrated into daily life, credit card usage is expected to rise significantly. Financial institutions are likely to focus on enhancing customer experience through personalized services and innovative products. Additionally, the ongoing collaboration between banks and fintech companies will further streamline payment processes, making credit cards more appealing to a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Credit Cards Rewards Credit Cards Secured Credit Cards Business Credit Cards Premium Credit Cards Student Credit Cards Others |

| By End-User | Individual Consumers Small and Medium Enterprises Corporates |

| By Application | Online Shopping Travel and Entertainment Everyday Purchases Bill Payments |

| By Pricing Strategy | Low-Interest Rate Cards High-Reward Cards No Annual Fee Cards |

| By Customer Segment | High-Income Individuals Middle-Income Individuals Students |

| By Distribution Channel | Direct Bank Sales Online Applications Third-Party Agents |

| By Geographic Distribution | Urban Areas Rural Areas Expatriate Communities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Credit Card Usage | 150 | Credit Card Holders, General Consumers |

| Banking Sector Insights | 100 | Bank Executives, Product Managers |

| Merchant Acceptance of Credit Cards | 80 | Retail Managers, Business Owners |

| Financial Advisory Perspectives | 60 | Financial Advisors, Investment Consultants |

| Consumer Attitudes Towards Credit | 120 | Young Professionals, College Students |

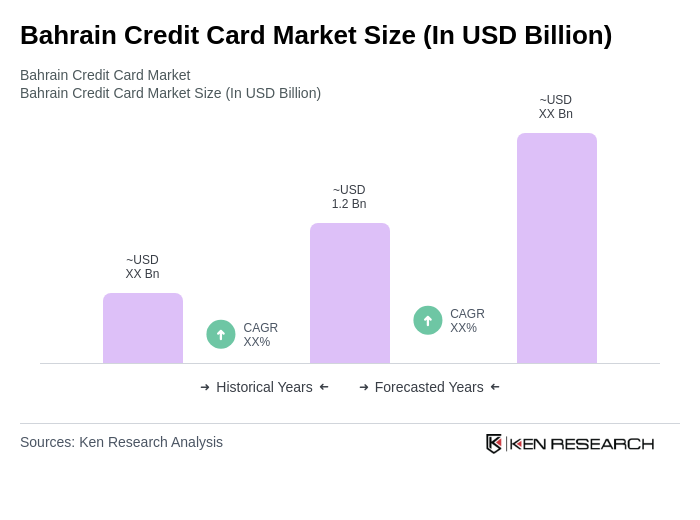

The Bahrain Credit Card Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased consumer spending, the adoption of digital payment solutions, and the expansion of e-commerce platforms.