Region:Middle East

Author(s):Shubham

Product Code:KRAB7268

Pages:94

Published On:October 2025

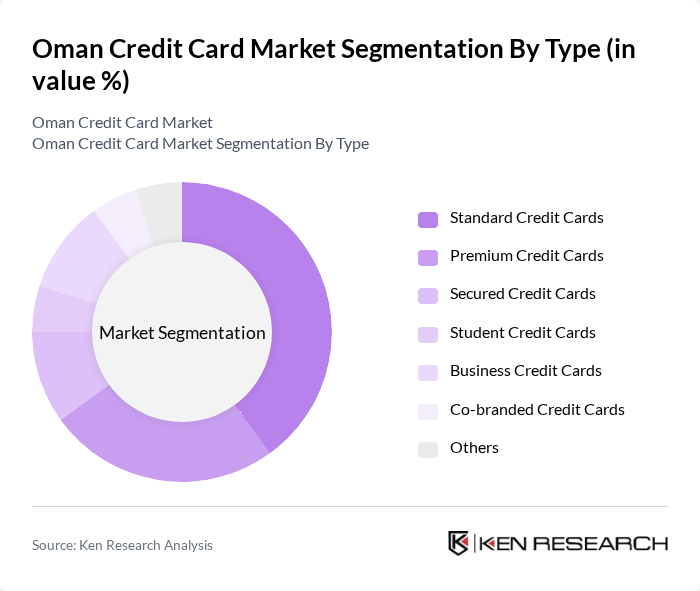

By Type:The credit card market can be segmented into various types, including Standard Credit Cards, Premium Credit Cards, Secured Credit Cards, Student Credit Cards, Business Credit Cards, Co-branded Credit Cards, and Others. Among these, Standard Credit Cards dominate the market due to their widespread acceptance and accessibility for the average consumer. Premium Credit Cards are also gaining traction, particularly among affluent individuals seeking exclusive benefits and rewards.

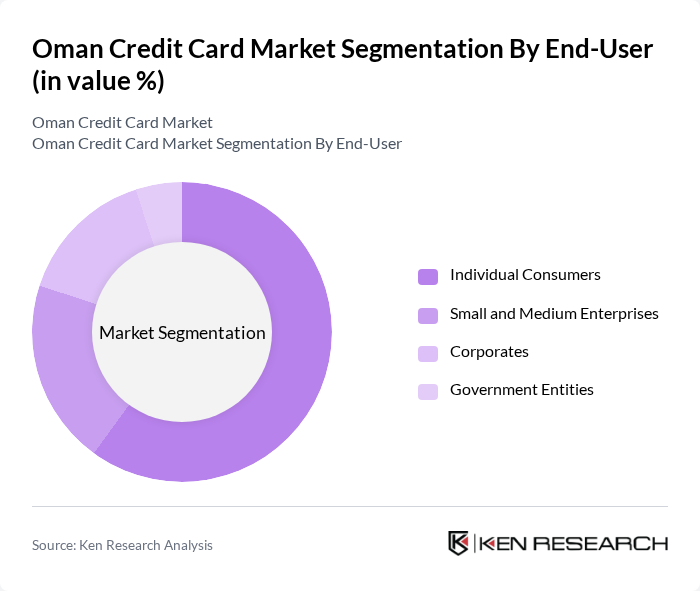

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. Individual Consumers represent the largest segment, driven by the increasing number of retail transactions and the growing trend of personal credit usage. SMEs are also significant contributors, as they seek credit facilities to manage cash flow and operational expenses.

The Oman Credit Card Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Muscat, Oman Arab Bank, National Bank of Oman, Bank Dhofar, HSBC Oman, Oman International Bank, Alizz Islamic Bank, Sohar International Bank, Dhofar International Bank, Muscat Bank, Bank of Beirut and the Arab Countries, Qatar National Bank, Abu Dhabi Commercial Bank, Emirates NBD, Standard Chartered Bank contribute to innovation, geographic expansion, and service delivery in this space.

The Oman credit card market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As mobile wallets gain traction, traditional credit card usage may evolve, necessitating adaptation from financial institutions. Additionally, the integration of artificial intelligence in fraud detection and customer service is expected to enhance user experience. Overall, the market is likely to witness a shift towards more personalized and secure financial products, aligning with global trends in digital finance.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Credit Cards Premium Credit Cards Secured Credit Cards Student Credit Cards Business Credit Cards Co-branded Credit Cards Others |

| By End-User | Individual Consumers Small and Medium Enterprises Corporates Government Entities |

| By Application | Online Shopping Travel and Hospitality Retail Purchases Bill Payments Others |

| By Pricing Strategy | Low-Interest Rate Cards High-Reward Cards Annual Fee Cards No Annual Fee Cards |

| By Customer Segment | Young Professionals Families Retirees High Net-Worth Individuals |

| By Distribution Channel | Direct Bank Sales Online Applications Third-Party Agents Retail Partnerships |

| By Loyalty Programs | Cashback Programs Points-Based Rewards Travel Benefits Exclusive Offers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Credit Card Usage | 150 | Credit Card Holders, Young Professionals |

| Banking Sector Insights | 100 | Bank Managers, Product Development Heads |

| Merchant Acceptance of Credit Cards | 80 | Retail Owners, Payment Processing Managers |

| Consumer Attitudes Towards Credit | 120 | General Consumers, Financial Literacy Advocates |

| Impact of Digital Banking on Credit Cards | 90 | Fintech Experts, Digital Banking Executives |

The Oman Credit Card Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increased consumer spending, the rise of digital payment solutions, and the expansion of e-commerce platforms.