Region:Middle East

Author(s):Geetanshi

Product Code:KRAA7047

Pages:88

Published On:January 2026

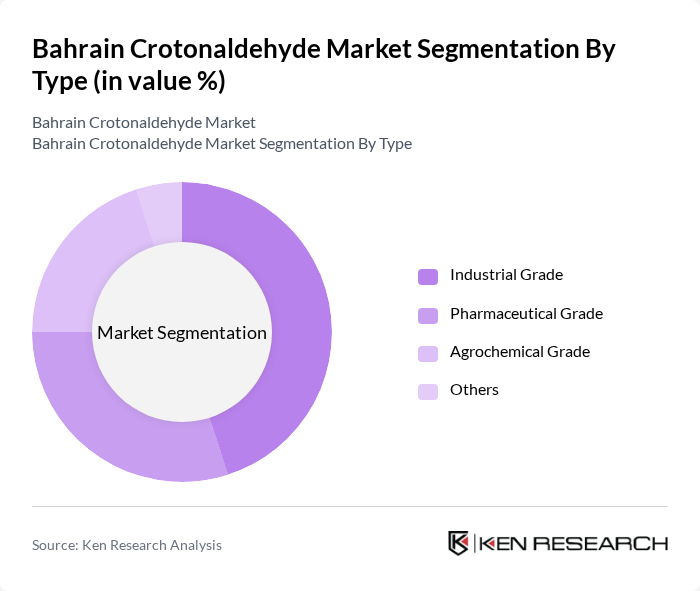

By Type:The market is segmented into four main types: Industrial Grade, Pharmaceutical Grade, Agrochemical Grade, and Others. The Industrial Grade segment is the most dominant due to its extensive use in various industrial applications, including the production of solvents and chemical intermediates. The Pharmaceutical Grade segment is also significant, driven by the increasing demand for high-purity chemicals in drug manufacturing. The Agrochemical Grade segment is growing as agricultural practices evolve, requiring more specialized chemicals for crop protection and enhancement.

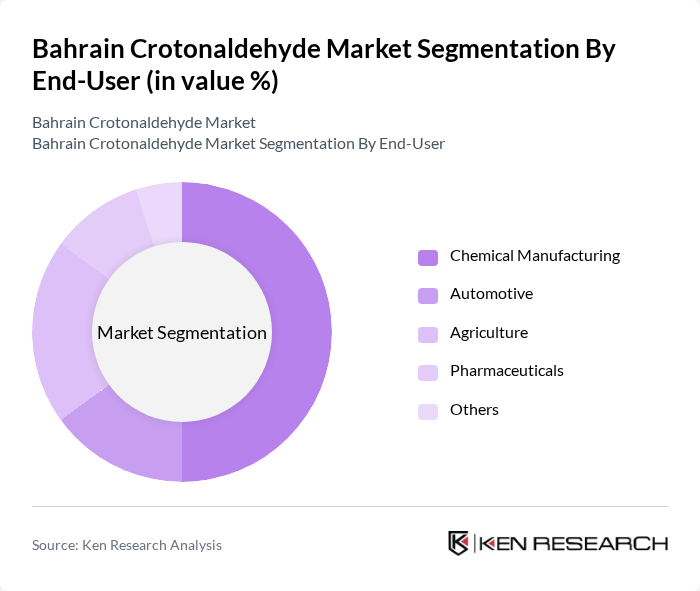

By End-User:The end-user segments include Chemical Manufacturing, Automotive, Agriculture, Pharmaceuticals, and Others. The Chemical Manufacturing sector is the largest consumer of crotonaldehyde, utilizing it as a key raw material in various chemical processes. The Pharmaceuticals sector is also significant, as the demand for high-quality chemicals for drug formulation continues to rise. The Agriculture sector is witnessing growth due to the increasing need for agrochemicals that enhance crop yield and protect against pests.

The Bahrain Crotonaldehyde Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, The Dow Chemical Company, Eastman Chemical Company, Solvay S.A., Huntsman Corporation, Oxea GmbH, Mitsubishi Chemical Corporation, Arkema S.A., SABIC, INEOS Group, LyondellBasell Industries, Chevron Phillips Chemical Company, Formosa Plastics Corporation, Kraton Corporation, and Celanese Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the crotonaldehyde market in Bahrain appears promising, driven by the increasing focus on sustainability and the shift towards green chemistry. As industries adapt to environmental regulations, there will be a growing demand for bio-based alternatives and innovative production methods. Additionally, the expansion into emerging markets presents significant growth potential, allowing local producers to tap into new customer bases and diversify their offerings, ultimately enhancing market resilience and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Pharmaceutical Grade Agrochemical Grade Others |

| By End-User | Chemical Manufacturing Automotive Agriculture Pharmaceuticals Others |

| By Application | Solvent Production Intermediate for Chemical Synthesis Flavor and Fragrance Industry Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Production Method | Aldol Condensation Dehydration of 2-Butanol Others |

| By Regulatory Compliance | ISO Certified REACH Compliant Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crotonaldehyde Production Facilities | 45 | Plant Managers, Production Supervisors |

| End-User Industries (Plastics, Chemicals) | 80 | Procurement Managers, Product Development Heads |

| Regulatory Bodies and Environmental Agencies | 50 | Policy Makers, Environmental Compliance Officers |

| Research Institutions and Universities | 40 | Academic Researchers, Chemical Engineering Professors |

| Distributors and Suppliers of Crotonaldehyde | 70 | Sales Managers, Supply Chain Coordinators |

The Bahrain Crotonaldehyde market is valued at approximately USD 3 million, based on a five-year historical analysis. This valuation reflects the increasing demand for crotonaldehyde across various applications, including chemical manufacturing and agrochemicals.