Region:North America

Author(s):Rebecca

Product Code:KRAD1878

Pages:93

Published On:January 2026

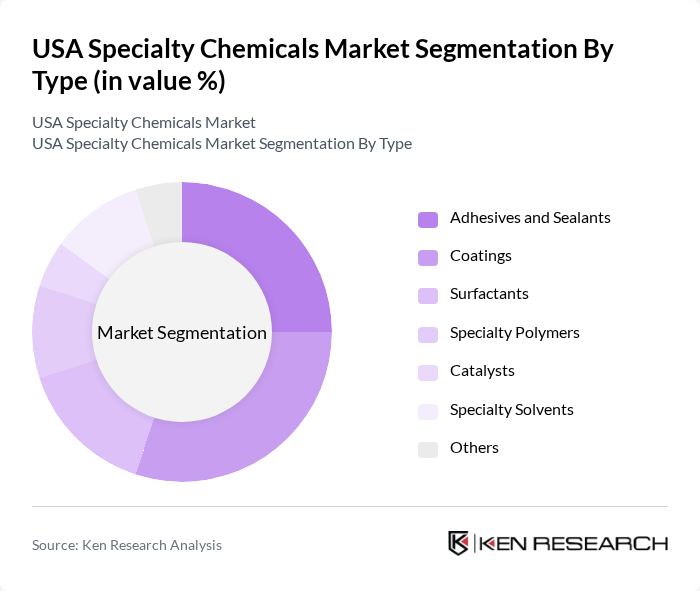

By Type:The specialty chemicals market can be segmented into various types, including adhesives and sealants, coatings, surfactants, specialty polymers, catalysts, specialty solvents, and others. Each of these subsegments plays a crucial role in different applications across industries. Among these, coatings and adhesives are particularly dominant due to their extensive use in construction and automotive sectors, driven by the need for durability and performance.

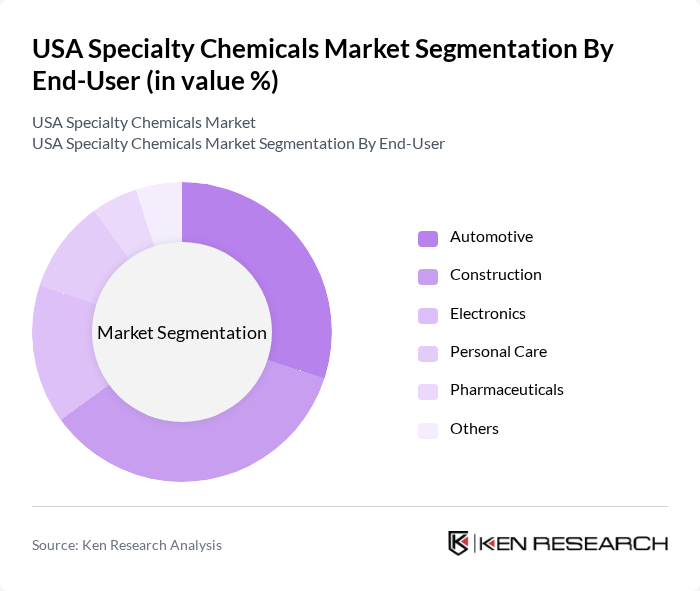

By End-User:The end-user segmentation of the specialty chemicals market includes automotive, construction, electronics, personal care, pharmaceuticals, and others. The automotive and construction sectors are the largest consumers of specialty chemicals, driven by the increasing demand for high-performance materials that enhance product durability and functionality. The trend towards sustainable and eco-friendly products is also influencing purchasing decisions in these industries.

The USA Specialty Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., Eastman Chemical Company, Huntsman Corporation, Solvay S.A., AkzoNobel N.V., Clariant AG, Lanxess AG, Covestro AG, DuPont de Nemours, Inc., Albemarle Corporation, FMC Corporation, LyondellBasell Industries N.V., INEOS Group, Mitsubishi Chemical Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The USA specialty chemicals market is poised for transformative growth, driven by the increasing emphasis on sustainability and technological innovation. As companies adapt to stringent regulations and consumer demands for eco-friendly products, the market is expected to evolve significantly. The integration of digital technologies and automation will enhance operational efficiencies, while the focus on circular economy practices will reshape product development. This dynamic environment presents both challenges and opportunities for stakeholders aiming to capitalize on emerging trends in the specialty chemicals sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Adhesives and Sealants Coatings Surfactants Specialty Polymers Catalysts Specialty Solvents Others |

| By End-User | Automotive Construction Electronics Personal Care Pharmaceuticals Others |

| By Application | Industrial Applications Consumer Products Agricultural Chemicals Food Additives Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Geography | Northeast Midwest South West Others |

| By Product Form | Liquid Solid Powder Others |

| By Innovation Level | Established Products Emerging Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Chemicals | 120 | Product Managers, Agronomists |

| Industrial Coatings | 100 | Manufacturing Engineers, Quality Control Managers |

| Personal Care Ingredients | 80 | Formulation Chemists, Brand Managers |

| Adhesives and Sealants | 70 | Procurement Specialists, Product Development Leads |

| Specialty Polymers | 90 | Research Scientists, Technical Sales Representatives |

The USA Specialty Chemicals Market is valued at approximately USD 190 billion, reflecting a five-year historical analysis. This valuation is driven by increasing demand across various industries, including automotive, construction, and electronics, alongside a growing trend for sustainable products.