Region:Middle East

Author(s):Shubham

Product Code:KRAD6635

Pages:85

Published On:December 2025

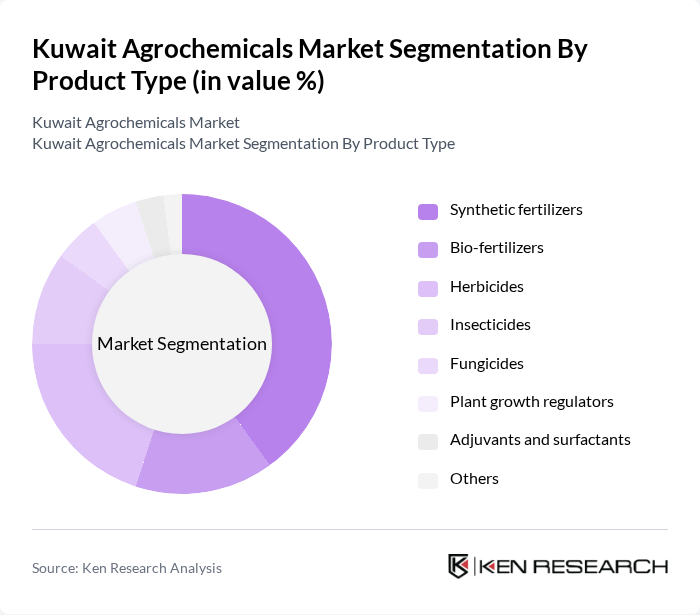

By Product Type:The product type segmentation includes various categories such as synthetic fertilizers, bio-fertilizers, herbicides, insecticides, fungicides, plant growth regulators, adjuvants and surfactants, and others. Synthetic fertilizers remain the most widely used due to their effectiveness in rapidly enhancing crop yields, compatibility with Kuwait’s intensive greenhouse and irrigated systems, and their relatively lower cost per unit of nutrient supplied compared with many organic options. The increasing focus on food production, especially vegetables and fodder crops, and the need for higher agricultural output in limited arable land drive the demand for synthetic fertilizers, making them a dominant segment in the market. At the same time, demand for adjuvants and surfactants is rising to improve spray efficiency and reduce wastage, particularly in protected cultivation and precision application.

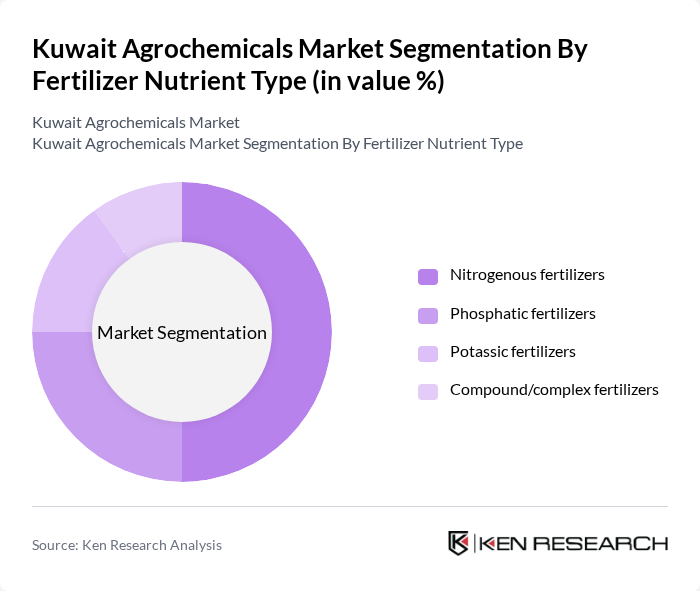

By Fertilizer Nutrient Type:This segmentation includes nitrogenous fertilizers, phosphatic fertilizers, potassic fertilizers, and compound/complex fertilizers. Nitrogenous fertilizers dominate the market due to their central role in vegetative growth and their extensive use in Kuwait’s primary crops such as leafy vegetables, cereals, and fodder under irrigated and greenhouse conditions. The increasing need for nitrogen to enhance crop productivity in nutrient?poor desert soils and ongoing efforts to optimize nutrient management under water-scarce conditions contribute to the strong demand for nitrogenous fertilizers in Kuwait, while compound and complex fertilizers are gaining traction for balanced nutrient supply and convenience of application.

The Kuwait Agrochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC Agri-Nutrients Company, Bayer AG, Syngenta AG, BASF SE, UPL Limited, ADAMA Agricultural Solutions Ltd., Nufarm Limited, United Chemicals Company (Kuwait), Al-Kout Industrial Projects Company, Kuwait Chemical Manufacturing Company (KCMC), Gulf Cryo, Dow Chemical Company, FMC Corporation, Evonik Industries AG, Croda International Plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait agrochemicals market appears promising, driven by a growing emphasis on sustainable agricultural practices and technological advancements. As farmers increasingly adopt precision agriculture techniques, the demand for innovative agrochemical solutions is expected to rise. Furthermore, the government's commitment to enhancing food security through agricultural investments will likely foster a conducive environment for market growth, encouraging local production and reducing dependency on imports.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Synthetic fertilizers Bio-fertilizers Herbicides Insecticides Fungicides Plant growth regulators Adjuvants and surfactants Others |

| By Fertilizer Nutrient Type | Nitrogenous fertilizers Phosphatic fertilizers Potassic fertilizers Compound/complex fertilizers |

| By Pesticide Type | Herbicides Insecticides Fungicides Others (rodenticides, nematicides, etc.) |

| By Crop Type | Cereals and grains (e.g., wheat, barley) Fruits and vegetables Fodder and forage crops Greenhouse and protected crops Others |

| By Application Method | Foliar spray Soil treatment Seed treatment Fertigation and chemigation Others |

| By Formulation | Liquid formulations Granular formulations Powder and wettable powder formulations Emulsifiable concentrates and suspension concentrates Others |

| By Distribution Channel | Direct sales to large farms and government entities Agrochemical distributors and dealers Retail agri-input stores and cooperatives Online and digital platforms Others |

| By Region | Central Kuwait Northern Kuwait Southern Kuwait Western and border agricultural areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agrochemical Retailers | 60 | Store Managers, Sales Representatives |

| Farmers Using Agrochemicals | 120 | Crop Farmers, Livestock Farmers |

| Agrochemical Distributors | 50 | Distribution Managers, Logistics Coordinators |

| Government Agricultural Officials | 40 | Policy Makers, Agricultural Advisors |

| Research Institutions Focused on Agriculture | 40 | Research Scientists, Agricultural Economists |

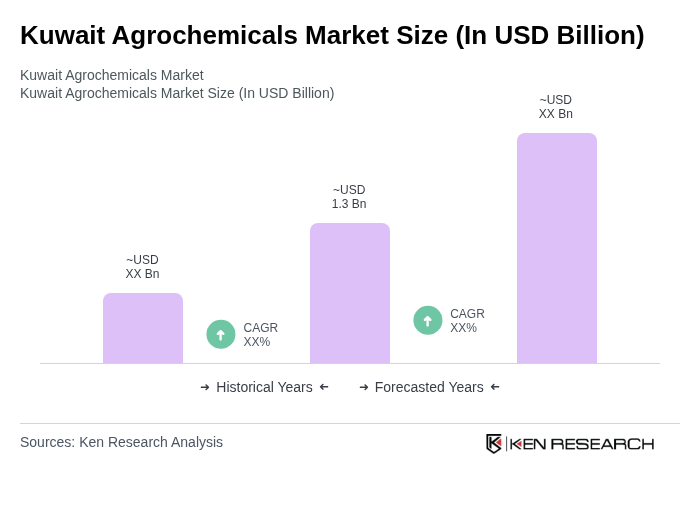

The Kuwait Agrochemicals Market is valued at approximately USD 1.3 billion, reflecting its significant role within the broader Middle East agrochemicals market and aligning with national growth expectations.