Region:Middle East

Author(s):Dev

Product Code:KRAD7730

Pages:95

Published On:December 2025

By Service Type (DSO Support Functions):

The service type segmentation includes various support functions that are essential for the effective operation of dental service organizations. The subsegments include Human Resources & Staffing Solutions, Marketing & Branding Services, Accounting & Revenue Cycle Management, Medical Supplies Procurement & Inventory Management, Compliance, Legal & Regulatory Support, IT, Digital Health & Practice Management Systems, and Others. Among these, IT, Digital Health & Practice Management Systems is increasingly important in Bahrain due to the rising adoption of electronic health records, digital imaging, online appointment systems, and practice management platforms that enhance operational efficiency, data accuracy, and patient engagement in line with global DSO trends.

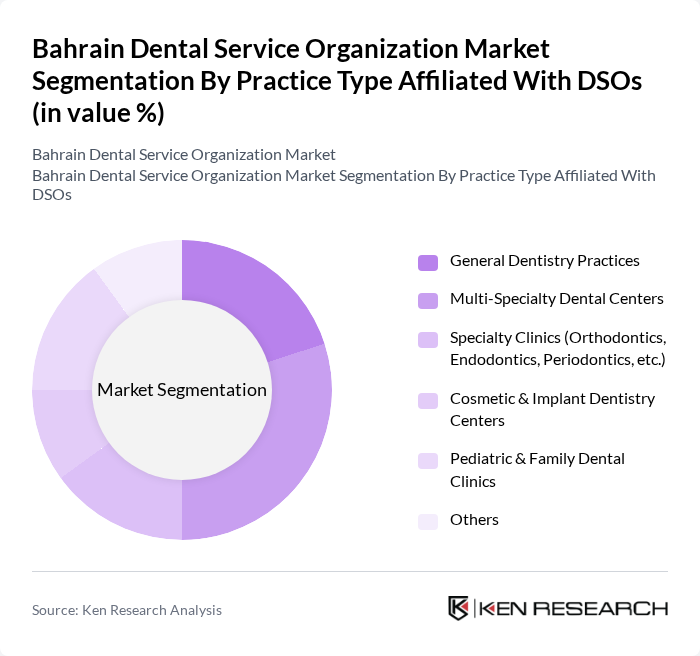

By Practice Type Affiliated With DSOs:

This segmentation focuses on the types of dental practices that are affiliated with dental service organizations. The subsegments include General Dentistry Practices, Multi-Specialty Dental Centers, Specialty Clinics (Orthodontics, Endodontics, Periodontics, etc.), Cosmetic & Implant Dentistry Centers, Pediatric & Family Dental Clinics, and Others. In line with broader DSO and dental services trends in the EMEA region, General Dentistry Practices and Multi-Specialty Dental Centers account for a substantial share of affiliations, as they provide routine preventive care, restorative services, and access to multiple specialties within consolidated settings, improving patient convenience and supporting higher throughput.

The Bahrain Dental Service Organization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Specialist Hospital – Dental Center, Bahrain Dental Center (Dr. Hasan Al Fateh Dental Center), Al Jazeera Dental Center, German Dental & Dermatology Centre, Al Kindi Specialised Hospital – Dental Department, Royal Bahrain Hospital – Dental Clinic, Orchid Dental Clinic, Gulf Dental Specialty Hospital, Al Salam Specialist Dental Center, Middle East Dental Laboratory & Clinics, Al Ahlia Dental Center, Smile Dental Clinic Bahrain, Elite Medical Center – Dental Division, Kingdom Dental Care, Dr. Hasan & Habib Medical Group – Dental Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain dental service organization market appears promising, driven by ongoing advancements in technology and a growing emphasis on preventive care. As the population becomes increasingly health-conscious, the demand for innovative dental solutions is expected to rise. Additionally, the integration of teledentistry is likely to enhance access to dental care, particularly in underserved areas, while collaborations with health organizations will further strengthen the sector's infrastructure and service delivery.

| Segment | Sub-Segments |

|---|---|

| By Service Type (DSO Support Functions) | Human Resources & Staffing Solutions Marketing & Branding Services Accounting & Revenue Cycle Management Medical Supplies Procurement & Inventory Management Compliance, Legal & Regulatory Support IT, Digital Health & Practice Management Systems Others |

| By Practice Type Affiliated With DSOs | General Dentistry Practices Multi?Specialty Dental Centers Specialty Clinics (Orthodontics, Endodontics, Periodontics, etc.) Cosmetic & Implant Dentistry Centers Pediatric & Family Dental Clinics Others |

| By Ownership & Affiliation Model | Fully DSO?Owned Clinics Affiliated / Franchise Clinics Dentist?Owned Practices Under DSO Management Contracts Hospital?Based Dental Departments Under DSO Support Others |

| By Geographic Cluster Within Bahrain | Manama & Capital Governorate Urban Cluster Muharraq Governorate Northern Governorate Southern Governorate Emerging Suburban & Industrial Zones |

| By Patient Segment Served | National Population (Bahraini Citizens) Expatriate Professionals & Families Medical & Dental Tourists Low?Income & Publicly Funded Patients Others |

| By Payment & Contracting Model | Out?of?Pocket / Self?Pay Private Insurance & TPA Contracts Government Programs & Public Funding Corporate & Occupational Dental Plans Others |

| By Treatment Mix in DSO?Affiliated Practices | Preventive & Diagnostic Services Restorative & Prosthetic Treatments Surgical & Implant Procedures Cosmetic & Aesthetic Dentistry Orthodontic Treatments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Dental Services | 120 | Dentists, Clinic Managers |

| Cosmetic Dentistry | 100 | Cosmetic Dentists, Marketing Managers |

| Pediatric Dentistry | 80 | Pediatric Dentists, Family Health Practitioners |

| Orthodontic Services | 70 | Orthodontists, Treatment Coordinators |

| Dental Hygiene Practices | 60 | Dental Hygienists, Public Health Officials |

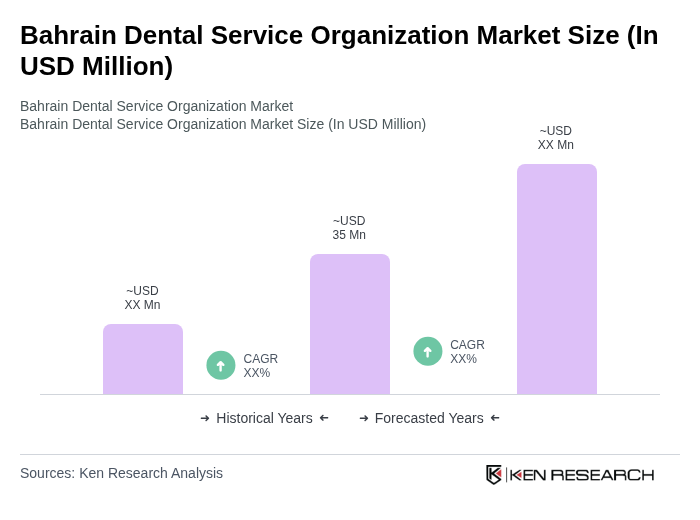

The Bahrain Dental Service Organization market is valued at approximately USD 35 million, reflecting growth driven by increased awareness of oral health, rising disposable incomes, and the expansion of dental services across the region.